Federal Withholding Form For Corporations – There are many reasons someone may decide to submit an application for withholding. This includes documentation requirements and withholding exemptions. No matter why one chooses to submit an application it is important to remember a few points to be aware of.

Withholding exemptions

Non-resident aliens have to complete Form 1040-NR once a year. If you satisfy the requirements, you could be eligible to be exempt from withholding. This page will list the exclusions.

The attachment of Form 1042-S is the first step to file Form 1040-NR. This document lists the amount withheld by the tax authorities for federal income tax reporting to be used for reporting purposes. When filling out the form, make sure you fill in the correct details. This information might not be disclosed and result in one individual being treated.

Non-resident aliens are subject to the 30% tax withholding rate. Nonresident aliens could be eligible for an exemption. This happens when your tax burden is lower than 30 percent. There are many different exemptions. Certain exclusions are only available to spouses or dependents such as children.

In general, withholding under Chapter 4 allows you to claim the right to a refund. Refunds are available under sections 1401, 1474, and 1475. Refunds are provided by the agent who withholds tax. The withholding agent is the individual accountable for tax withholding at the point of origin.

Status of the relationship

A marital withholding form is a good way to simplify your life and assist your spouse. You’ll be amazed by the amount of money you can transfer to the bank. It isn’t always easy to decide which of the many options is most attractive. Certain things are best avoided. Unwise decisions could lead to expensive consequences. However, if you adhere to the guidelines and watch out to any possible pitfalls You won’t face any issues. If you’re lucky, you might be able to make new friends as traveling. Today is your anniversary. I’m hoping that they will reverse the tide to help you get the perfect engagement ring. It is best to seek the advice of a certified tax expert to complete it correctly. It’s worthwhile to create wealth over the course of a lifetime. You can find tons of information on the internet. TaxSlayer is a reputable tax preparation company.

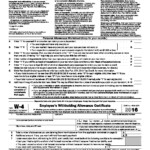

Number of claimed withholding allowances

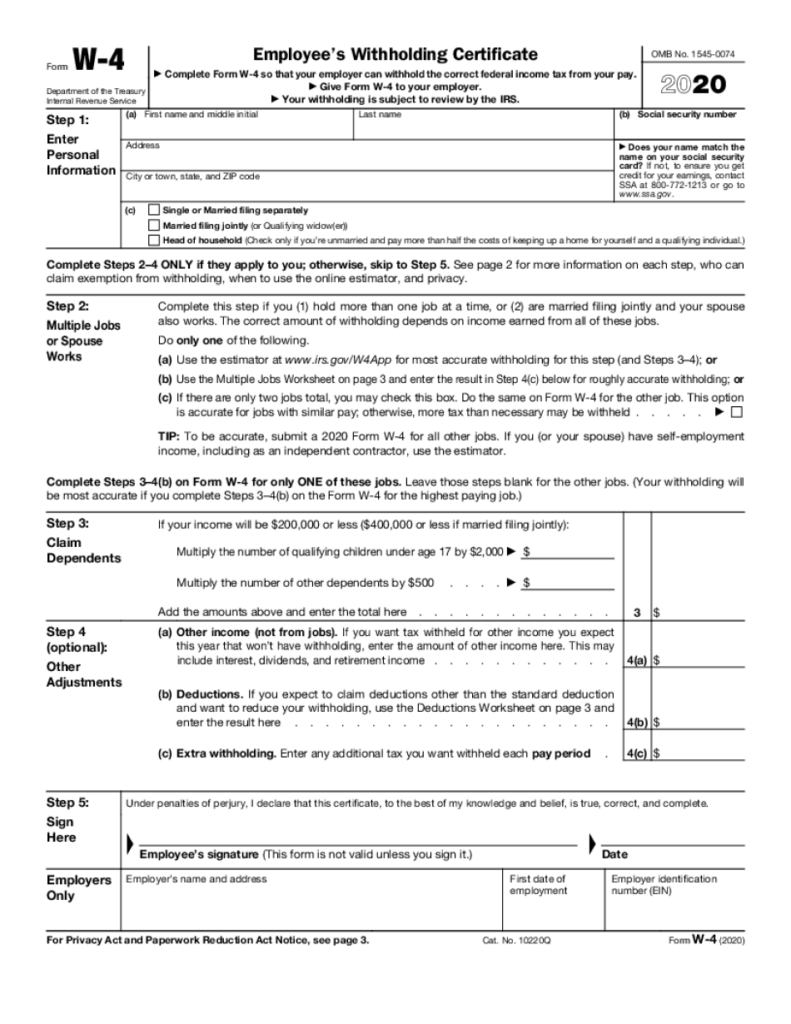

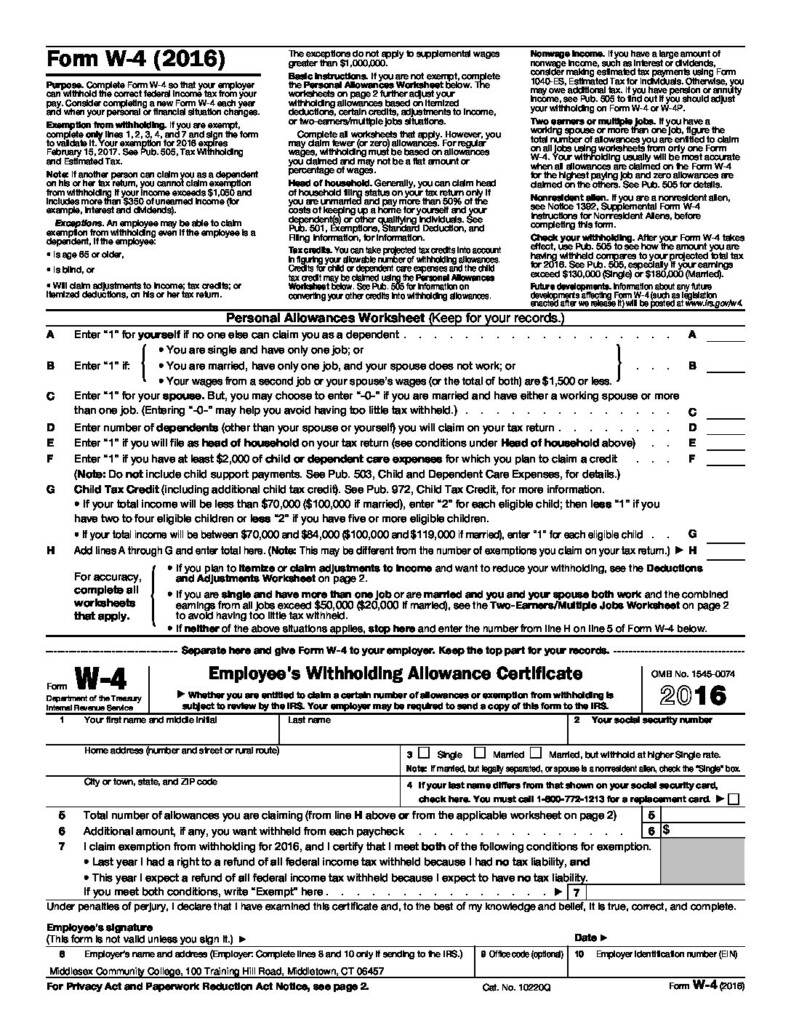

It is crucial to indicate the amount of withholding allowances which you would like to claim on the W-4 form. This is essential since the tax amount you are able to deduct from your paycheck will be affected by the you withhold.

There are a variety of factors which affect the allowance amount you are able to claim. If you’re married, you may be eligible for a head-of-household exemption. Additionally, you can claim additional allowances, based on how much you earn. If you have a higher income it could be possible to receive more allowances.

The right amount of tax deductions can aid you in avoiding a substantial tax bill. The possibility of a refund is possible if you submit your tax return on income for the year. It is important to be cautious regarding how you go about this.

Like every financial decision, you must conduct your own research. Calculators can be utilized to determine the amount of withholding allowances should be claimed. It is also possible to speak with a specialist.

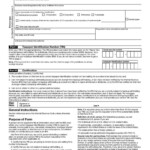

Filing specifications

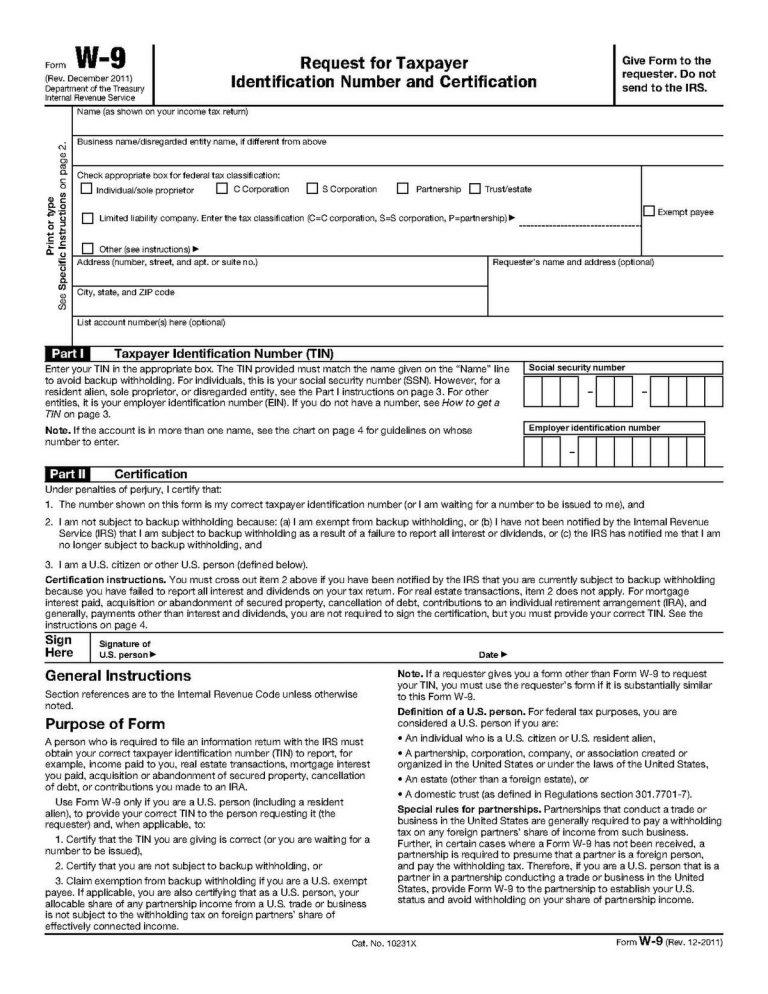

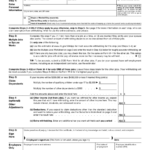

Employers must take withholding tax from their employees and report it. You can submit paperwork to the IRS for a few of these taxation. You might also need additional documents, such as an withholding tax reconciliation or a quarterly return. Below are details on the different forms of withholding tax and the deadlines for filing them.

Tax withholding returns can be required for income like bonuses, salary, commissions and other income. If you make sure that your employees are paid on time, then you could be eligible for the refund of taxes that you withheld. The fact that some of these taxes are also county taxes should be taken into consideration. Additionally, you can find specific withholding procedures that can be applied in particular situations.

As per IRS regulations the IRS regulations, electronic submissions of withholding forms are required. It is mandatory to include your Federal Employer Identification Number when you point your national income tax return. If you don’t, you risk facing consequences.