Federal Tax Withholding Payment Due Dates On Form 1042 Withholding – There are many reasons an individual might want to complete a form for withholding form. This includes documentation requirements, withholding exemptions, and the amount of withholding allowances. Whatever the reason the person decides to fill out a form it is important to remember a few things to keep in mind.

Withholding exemptions

Nonresident aliens are required once every year to file Form1040-NR. It is possible to submit an exemption form from withholding in the event that you meet all conditions. This page lists all exemptions.

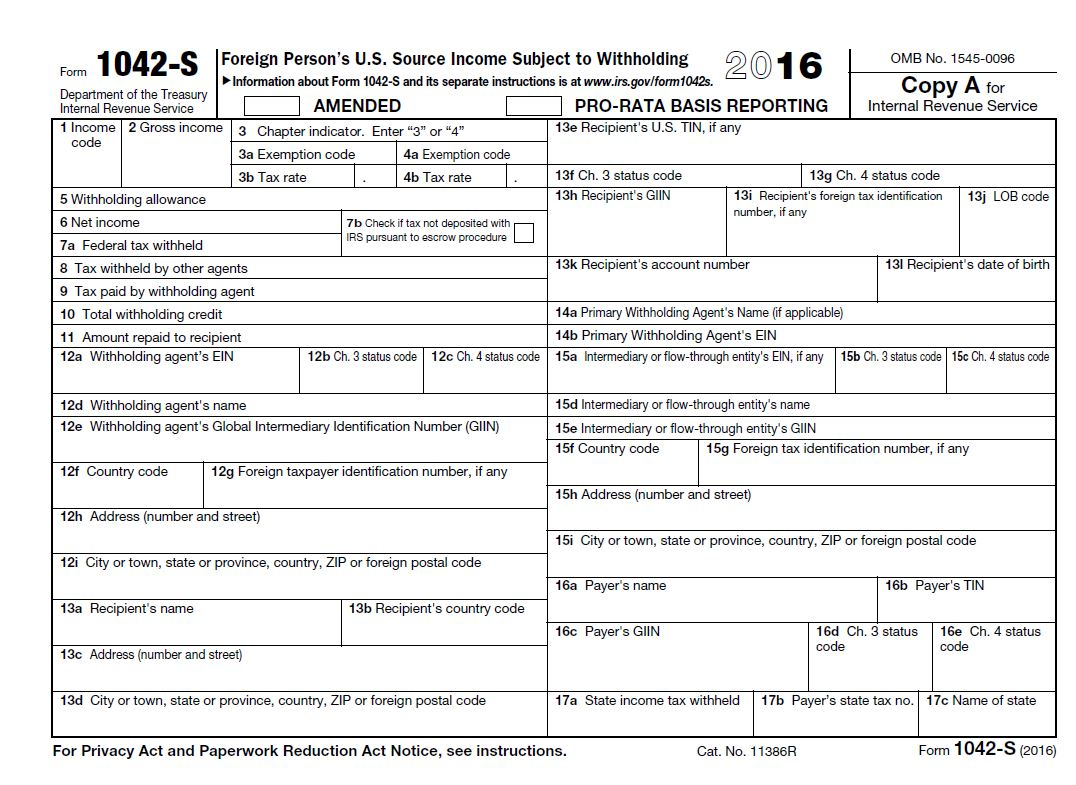

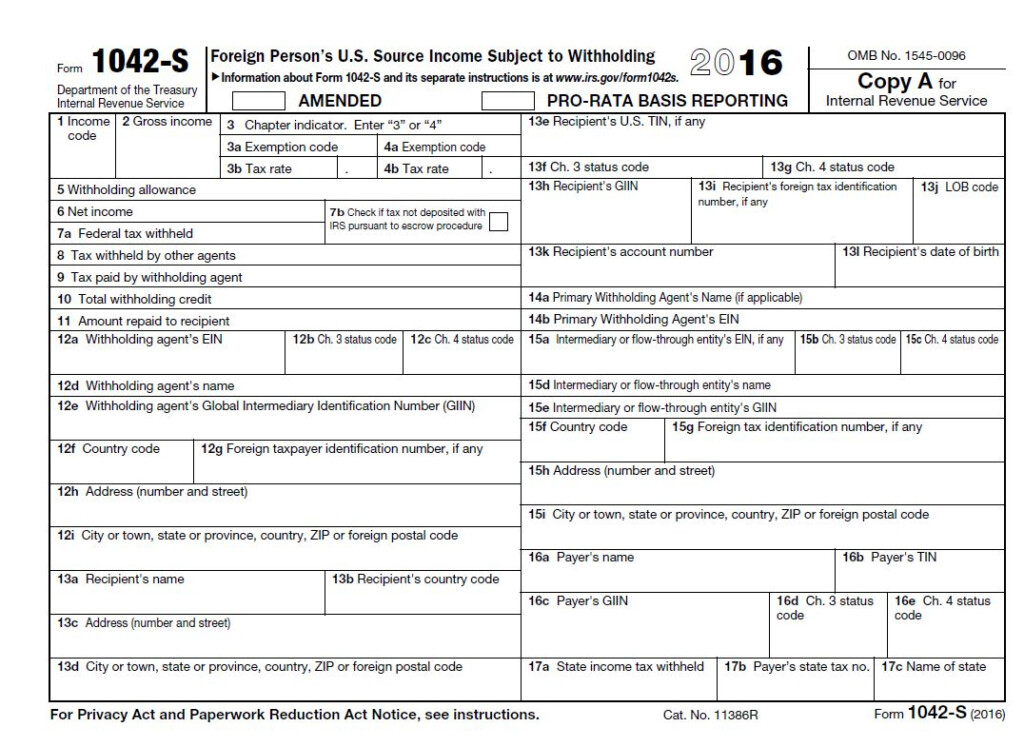

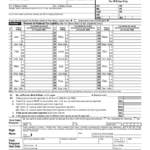

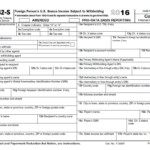

The first step in submitting Form 1040 – NR is to attach Form 1042 S. This form lists the amount withheld by the tax authorities to report federal income tax to be used for reporting purposes. Make sure you fill out the form correctly. It is possible that you will have to treat a single person if you don’t provide the correct information.

Nonresident aliens have a 30% withholding tax. A tax exemption may be available if you have an income tax burden of less than 30 percent. There are numerous exemptions. Some of them are for spouses or dependents like children.

In general, you’re eligible for a reimbursement in accordance with chapter 4. Refunds are permitted under Sections 1471-1474. The refunds are made by the tax agent. This is the person responsible for withholding the tax at the source.

Status of relationships

The proper marital status and withholding form will simplify the job of both you and your spouse. Furthermore, the amount of money that you can deposit in the bank will pleasantly delight you. The problem is deciding which of the numerous options to pick. You must be cautious in when you make a decision. There will be a significant cost when you make a bad decision. If you stick to it and follow the instructions, you won’t encounter any issues. You might make some new acquaintances if you’re fortunate. Since today is the anniversary of your wedding. I’m hoping you’re in a position to leverage this against them to obtain that elusive wedding ring. It will be a complicated job that requires the knowledge of a tax professional. It’s worthwhile to accumulate wealth over a lifetime. There are numerous websites that offer details. Trustworthy tax preparation companies like TaxSlayer are one of the most useful.

the number of claims for withholding allowances

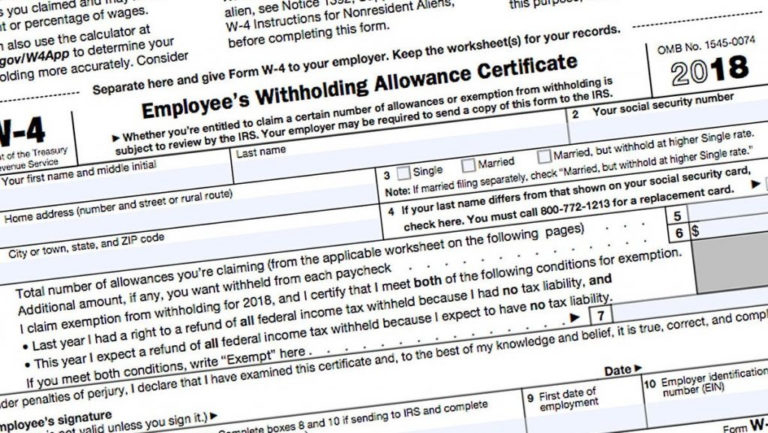

The Form W-4 must be filled out with the number of withholding allowances you wish to claim. This is important because the tax withheld can affect the amount taken out of your paycheck.

The amount of allowances that you get will be contingent on various factors. For instance If you’re married, you might be eligible for a head or household exemption. You can also claim more allowances, based on how much you earn. You may be eligible for a greater allowance if you have a large amount of income.

It could save you a lot of money by selecting the appropriate amount of tax deductions. Even better, you might even get a refund if your annual income tax return is completed. It is essential to pick the right method.

In every financial decision, you should be aware of the facts. Calculators can aid you in determining the amount of withholding allowances must be claimed. An expert could be a good alternative.

filing specifications

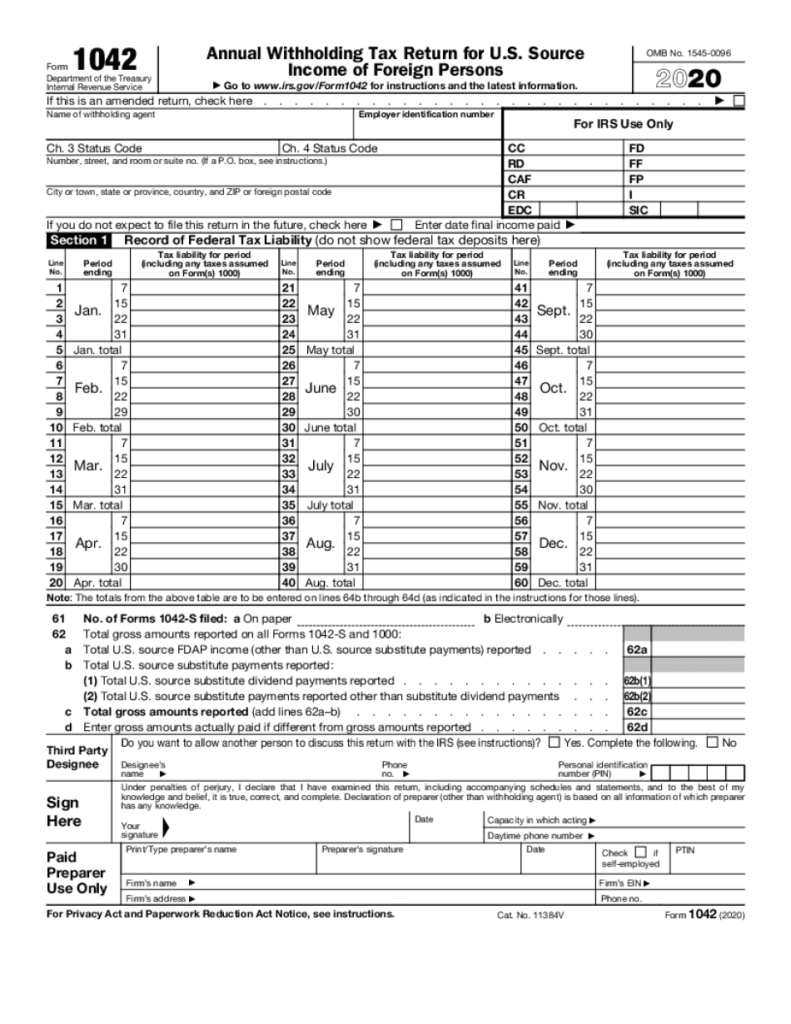

Employers should report the employer who withholds tax from employees. The IRS may accept forms to pay certain taxes. You may also need additional forms that you might need like a quarterly tax return or withholding reconciliation. Here’s some information about the different tax forms for withholding categories, as well as the deadlines to the submission of these forms.

You may have to file tax returns withholding in order to report the income you get from your employees, such as bonuses, commissions, or salary. Additionally, if employees are paid on time, you may be eligible for reimbursement of withheld taxes. It is important to note that certain taxes are also county taxes must be taken into consideration. In certain circumstances there are rules regarding withholding that can be unique.

In accordance with IRS regulations the IRS regulations, electronic submissions of withholding forms are required. It is mandatory to provide your Federal Employer Identification Number when you submit to your tax return for national income. If you don’t, you risk facing consequences.