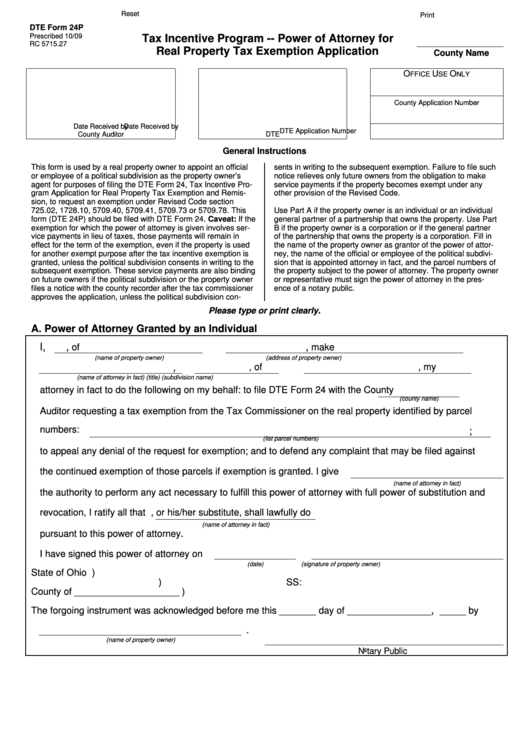

Federal Tax Withholding Form 24p – There are many reasons an individual might decide to fill out forms for withholding. These factors include documentation requirements, withholding exemptions, and the amount of requested withholding allowances. No matter the motive someone has to fill out an Application, there are several aspects to keep in mind.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040 NR at least once every year. You may be eligible to submit an exemption form for withholding, if you meet all the criteria. The exclusions are accessible to you on this page.

The first step in filling out Form 1040-NR is attaching the Form 1042 S. The form is used to declare federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. It is essential to fill in exact information when you fill out the form. It is possible that you will have to treat a single person for not providing this information.

The non-resident alien withholding tax is 30%. The tax burden of your business must not exceed 30% to be exempt from withholding. There are many exemptions. Some are for spouses and dependents, such as children.

In general, the chapter 4 withholding gives you the right to a refund. According to Sections 1471 through 1474, refunds are granted. These refunds are provided by the withholding agent (the person who collects tax at source).

Status of the relationship

The work of your spouse and you is made simpler by a proper marriage-related status withholding document. The bank might be shocked by the amount of money you’ve deposited. The problem is picking the right bank from the multitude of options. Undoubtedly, there are some items you must avoid. A bad decision could result in a costly loss. If the rules are followed and you pay attention, you should not have any problems. If you’re fortunate you could even meet a few new pals while traveling. Today is the anniversary. I hope you are in a position to leverage this against them to obtain that wedding ring you’ve been looking for. It’s a difficult task that requires the expertise of an expert in taxation. The accumulation of wealth over time is more than that small amount. Information on the internet is easy to find. TaxSlayer is a reputable tax preparation firm.

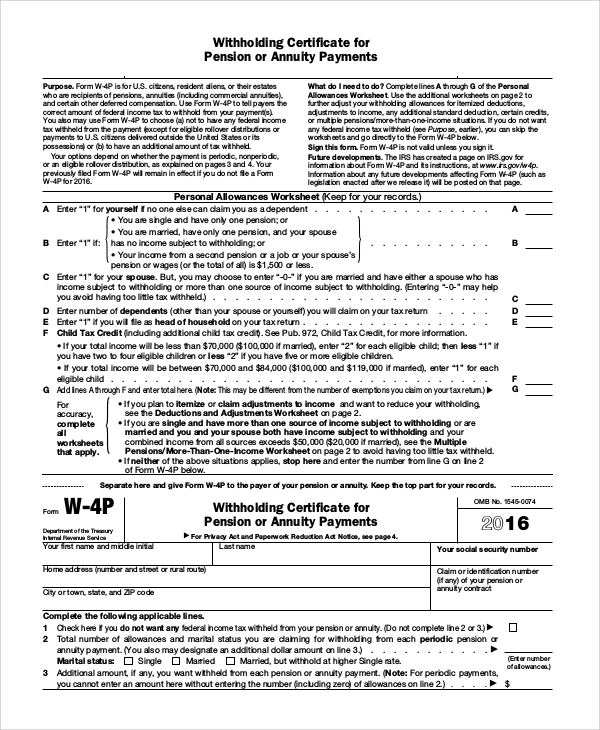

Amount of withholding allowances claimed

It is essential to state the amount of withholding allowances which you want to claim in the Form W-4. This is important as your paychecks may depend on the tax amount that you pay.

Many factors influence the amount you qualify for allowances. Additionally, you can claim additional allowances depending on how much you earn. If you earn a significant amount of income, you may be eligible for a higher allowance.

Selecting the appropriate amount of tax deductions might allow you to avoid a significant tax bill. The possibility of a refund is possible if you submit your income tax return for the previous year. Be cautious about how you approach this.

As with any other financial decision, you should conduct your homework. To figure out the amount of withholding allowances to be claimed, you can utilize calculators. An alternative is to speak to a professional.

Submitting specifications

Employers must pay withholding taxes to their employees and report the amount. The IRS may accept forms to pay certain taxes. A withholding tax reconciliation or a quarterly tax return, as well as the annual tax return are some examples of additional documents you could need to submit. Here’s some details on the various withholding tax form categories as well as the deadlines for the submission of these forms.

To be eligible for reimbursement of withholding taxes on the compensation, bonuses, salary or any other earnings received from your employees You may be required to submit a tax return withholding. If you pay your employees on time, then you may be eligible to receive the reimbursement of taxes withheld. You should also remember that some of these taxes may be county taxes. In certain circumstances the rules for withholding can be unique.

As per IRS regulations the IRS regulations, electronic filing of forms for withholding are required. When filing your national revenue tax returns make sure you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.