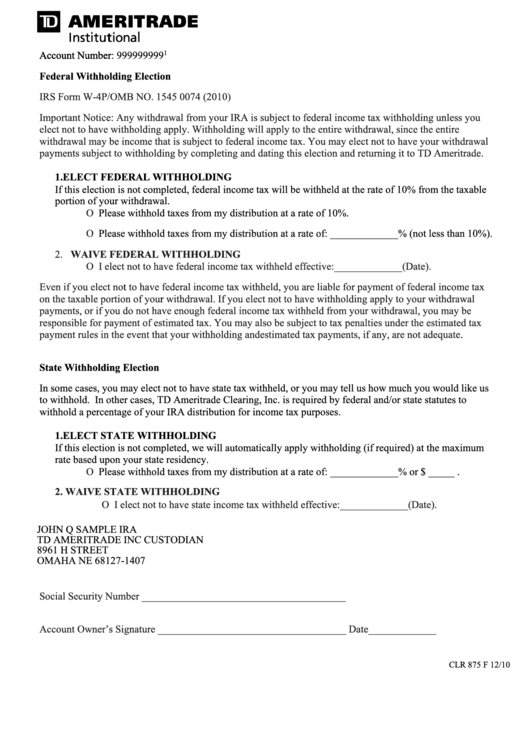

Federal Tax Withholding Election Form W-4p – There are a variety of reasons for a person to decide to complete a withholding form. This includes the documentation requirements, withholding exclusions as well as the withholding allowances. You must be aware of these aspects regardless of why you choose to file a request form.

Exemptions from withholding

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. If you meet these requirements, you could be eligible for an exemption from the withholding form. On this page, you will discover the exemptions for you to choose from.

To submit Form 1040-NR, attach Form 1042-S. For federal income tax reporting reasons, this form outlines the withholdings made by the agency responsible for withholding. It is essential to fill in the correct information when filling out the form. This information might not be disclosed and result in one person being treated differently.

The 30% non-resident alien tax withholding rate is 30 percent. A tax exemption may be available if you have the tax burden less than 30%. There are many exemptions. Some of these exclusions are only for spouses or dependents like children.

Generally, you are eligible to receive a refund under chapter 4. Refunds are available under sections 1401, 1474 and 1475. Refunds are given to the withholding agent the person who withholds the tax at the source.

Status of the relationship

The proper marital status and withholding forms will ease the job of both you and your spouse. The bank may be surprised by the amount of money that you deposit. It can be difficult to choose which one of the options you’ll choose. Certain issues should be avoided. Making a mistake can have costly results. If you stick to it and pay attention to the instructions, you won’t encounter any issues. If you’re lucky, you might be able to make new friends as you travel. After all, today marks the date of your wedding anniversary. I’m hoping you’ll be able to utilize it to secure the elusive diamond. It’s a complex job that requires the experience of an accountant. A modest amount of money can create a lifetime of wealth. It is a good thing that you can access a ton of information online. TaxSlayer, a reputable tax preparation firm, is one of the most effective.

The number of withholding allowances requested

When you fill out Form W-4, you need to specify how many withholding allowances you want to claim. This is essential since the withholdings will have an effect on the amount of tax that is taken from your paycheck.

Many factors affect the amount of allowances requested.If you’re married, as an example, you could be able to apply for an exemption for head of household. Your income level will also influence how many allowances your are entitled to. If you have a higher income, you might be eligible to receive more allowances.

You could save a lot of money by determining the right amount of tax deductions. A refund could be possible if you file your tax return on income for the current year. It is important to be cautious when it comes to preparing this.

Just like with any financial decision it is essential to research the subject thoroughly. Calculators can assist you in determining the number of withholdings that need to be demanded. Another option is to talk with a professional.

Submission of specifications

Withholding taxes from your employees must be collected and reported if you’re an employer. Some of these taxes may be reported to the IRS by submitting paperwork. Other documents you might be required to file include a withholding tax reconciliation and quarterly tax returns as well as the annual tax return. Here are some details regarding the various forms of tax forms for withholding as well as the filing deadlines.

The compensation, bonuses, commissions, and other income you get from your employees may require you to submit tax returns withholding. It is also possible to get reimbursements for tax withholding if your employees were paid in time. Remember that these taxes could also be considered local taxes. Furthermore, there are special tax withholding procedures that can be implemented in specific conditions.

The IRS regulations require that you electronically submit withholding documents. You must include your Federal Employer ID Number when you file to your tax return for national income. If you don’t, you risk facing consequences.