Federal Tax Withholding Allowances Form – There are many reasons someone might decide to file an application for withholding. This includes documentation requirements as well as exemptions from withholding, as well as the amount of requested withholding allowances. Whatever the reason behind a person to file documents it is important to remember certain points to keep in mind.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR once a calendar year. If you satisfy the requirements, you could be qualified for exemption from withholding. The exemptions you will find on this page are yours.

To complete Form 1040-NR, attach Form 1042-S. The form provides information about the withholding process carried out by the agency responsible for withholding for federal tax reporting for tax reporting purposes. When filling out the form, make sure you fill in the accurate information. This information may not be disclosed and result in one individual being treated differently.

The non-resident alien withholding rate is 30%. A tax exemption may be granted if you have a a tax burden that is less than 30 percent. There are a variety of exemptions that are available. Certain are only for spouses and dependents, like children.

You are entitled to an amount of money if you do not follow the terms of chapter 4. Refunds may be granted according to Sections 1400 through 1474. Refunds are to be given by the withholding agents who is the person who collects taxes at source.

Status of relationships

An official marital status form withholding form can help you and your spouse to make the most of your time. You’ll be amazed at the amount that you can deposit at the bank. It isn’t easy to determine which one of the options you will choose. Certain issues should be avoided. Unwise decisions could lead to costly results. But if you adhere to the guidelines and be alert for any potential pitfalls You won’t face any issues. If you’re fortunate you could even meet a few new pals on your travels. Since today is the anniversary of your wedding. I’m hoping that you can use it against them in order to find that elusive diamond. It’s a complex job that requires the knowledge of an expert in taxation. A little amount can create a lifetime of wealth. There are a myriad of online resources that can provide you with information. Tax preparation firms that are reputable, such as TaxSlayer are one of the most useful.

There are many withholding allowances that are being claimed

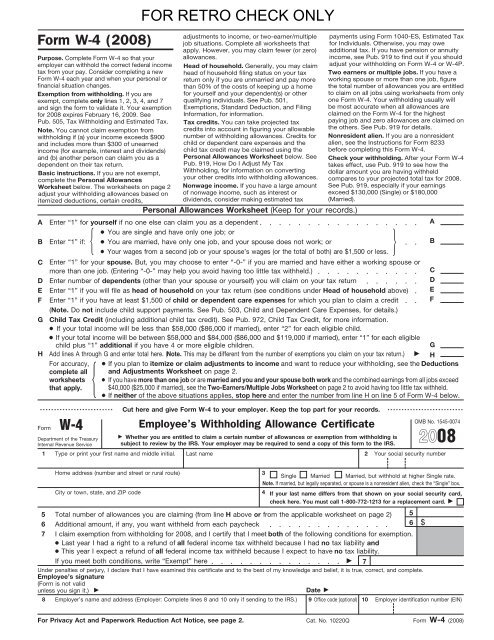

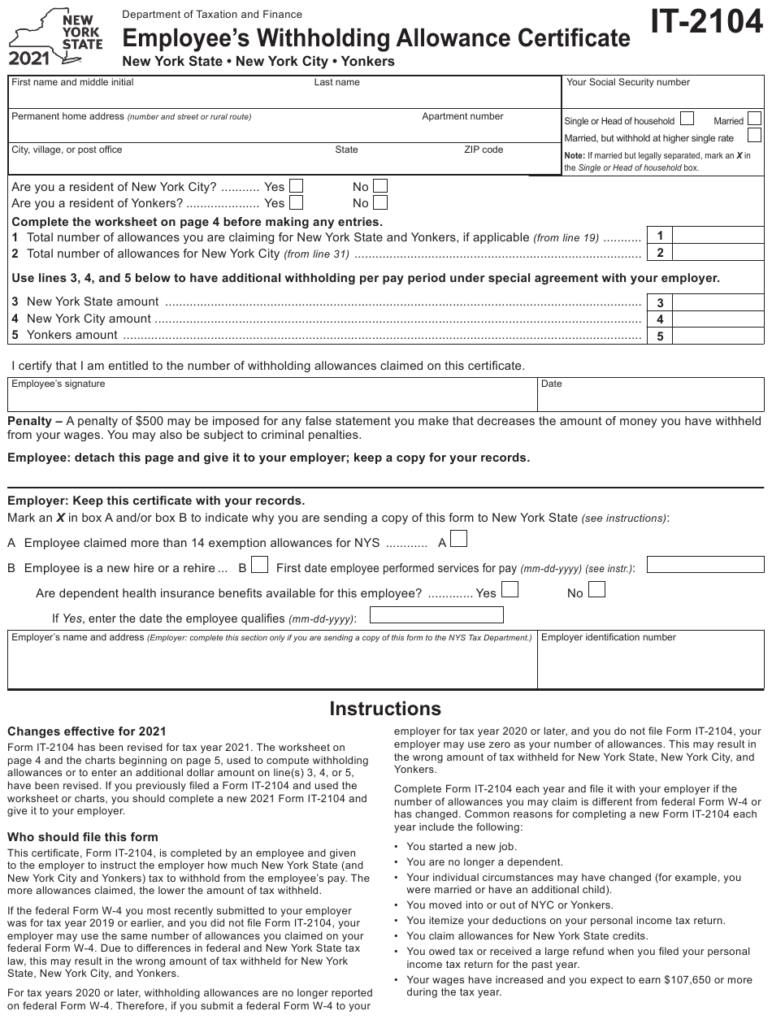

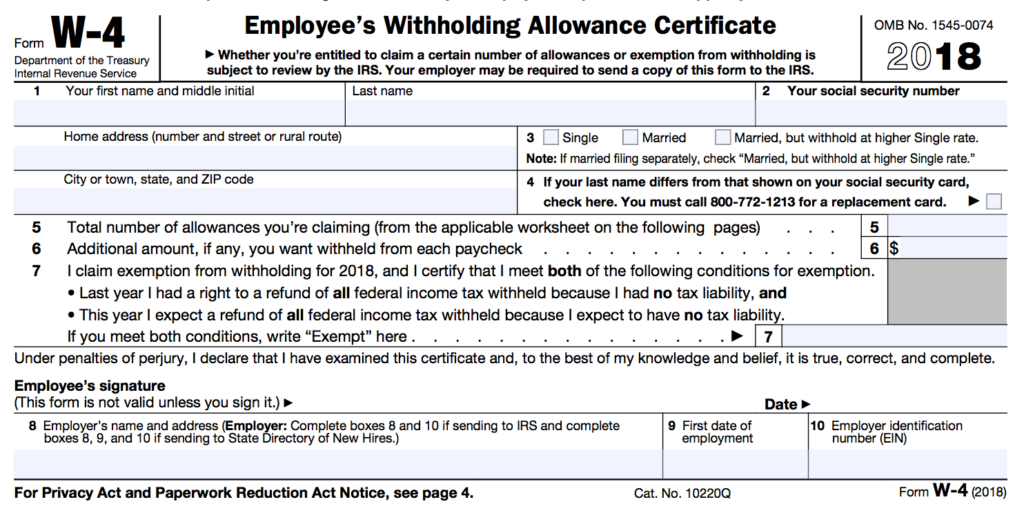

You need to indicate how many withholding allowances to be able to claim on the form W-4 you submit. This is essential as the tax withheld will impact the amount taken out of your paycheck.

There are a variety of factors that affect the amount of allowances requested.If you’re married for instance, you might be eligible to claim an exemption for head of household. Your income level can also affect the number of allowances offered to you. A larger allowance might be available if you earn a lot.

A tax deduction that is appropriate for you could aid you in avoiding large tax payments. If you file your annual tax returns You could be entitled to a refund. But you need to pick your approach wisely.

Do your research, like you would with any financial decision. Calculators are a great tool to determine how many withholding allowances should be claimed. A professional might be a viable option.

Sending specifications

Employers must report any withholding taxes being collected from employees. The IRS may accept forms for certain taxes. An annual tax return and quarterly tax returns, or the reconciliation of withholding tax are all kinds of documentation you may require. Here is more information on the various forms of withholding tax and the deadlines for filing them.

The compensation, bonuses commissions, other income you get from your employees may require you to file tax returns withholding. Also, if your employees receive their wages on time, you may be eligible to get tax refunds for withheld taxes. It is important to note that some of these taxes are local taxes. In addition, there are specific withholding practices that can be applied under particular situations.

The IRS regulations require you to electronically file withholding documents. Your Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.