Federal Income Tax Withholding Form Employee – There are many reasons someone might decide to file an application for withholding. This includes documentation requirements as well as exemptions from withholding, as well as the amount of requested withholding allowances. It is important to be aware of these factors regardless of your reason for choosing to fill out a form.

Exemptions from withholding

Non-resident aliens must complete Form 1040-NR once a year. If you meet the requirements, you could be eligible to receive exemptions from the withholding forms. You will discover the exclusions accessible to you on this page.

The attachment of Form 1042-S is the first step to submit Form 1040-NR. The form outlines the withholdings that the agency makes. Be sure to enter the right information when you complete the form. The information you provide may not be disclosed and result in one individual being treated.

Non-resident aliens are subject to a 30% withholding tax. The tax burden of your business should not exceed 30% in order to be exempt from withholding. There are a variety of exemptions. Certain exclusions are only available to spouses or dependents like children.

You may be entitled to refunds if you have violated the rules of chapter 4. According to Sections 1471 through 1474, refunds are given. Refunds are to be given by the agents who withhold taxes, which is the person who is responsible for withholding taxes at source.

Status of relationships

A valid marital status and withholding forms will ease the job of both you and your spouse. Additionally, the quantity of money you can put at the bank could delight you. Choosing which of the options you’re likely to decide is the biggest challenge. Undoubtedly, there are some items you must avoid. There are a lot of costs if you make a wrong choice. If you stick to the directions and be alert for any pitfalls You won’t face any issues. It is possible to make new acquaintances if lucky. Today is the anniversary. I hope you will take advantage of it to locate that perfect wedding ring. To do this correctly, you’ll need the advice of a certified Tax Expert. It’s worthwhile to accumulate wealth over the course of a lifetime. There are tons of online resources that can provide you with information. Reputable tax preparation firms like TaxSlayer are one of the most useful.

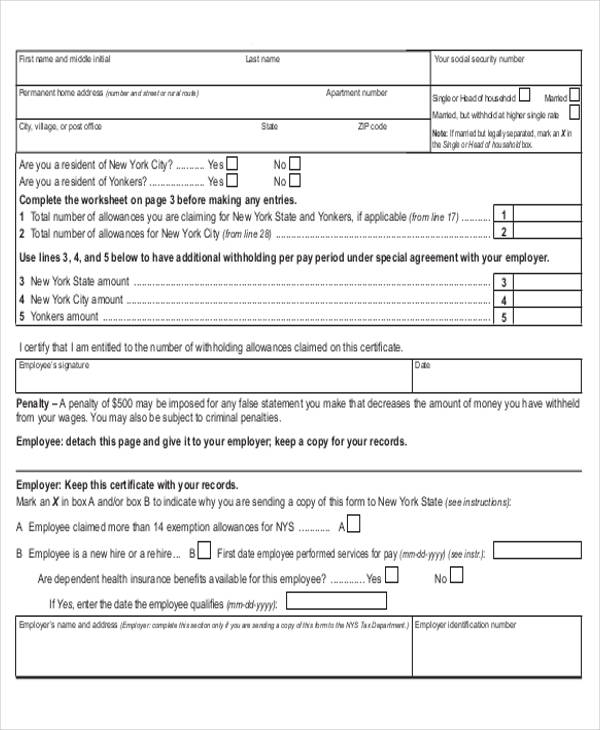

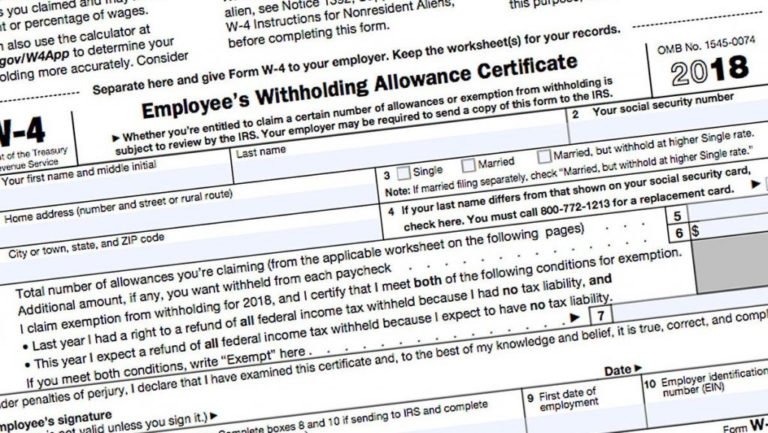

The amount of withholding allowances that are claimed

On the Form W-4 that you submit, you must declare the amount of withholding allowances you asking for. This is important because the amount of tax taken from your paycheck will depend on how you withhold.

There are a variety of factors that can determine the amount that you can claim for allowances. Your income level also affects how much allowances you’re entitled to. If you earn a substantial income, you may be eligible for an increased allowance.

It could save you lots of money by selecting the appropriate amount of tax deductions. If you submit your annual income tax returns, you may even be eligible for a refund. However, be careful about how you approach the tax return.

Research as you would in any other financial decision. To figure out the amount of tax withholding allowances that need to be claimed, you can utilize calculators. As an alternative, you may speak with an expert.

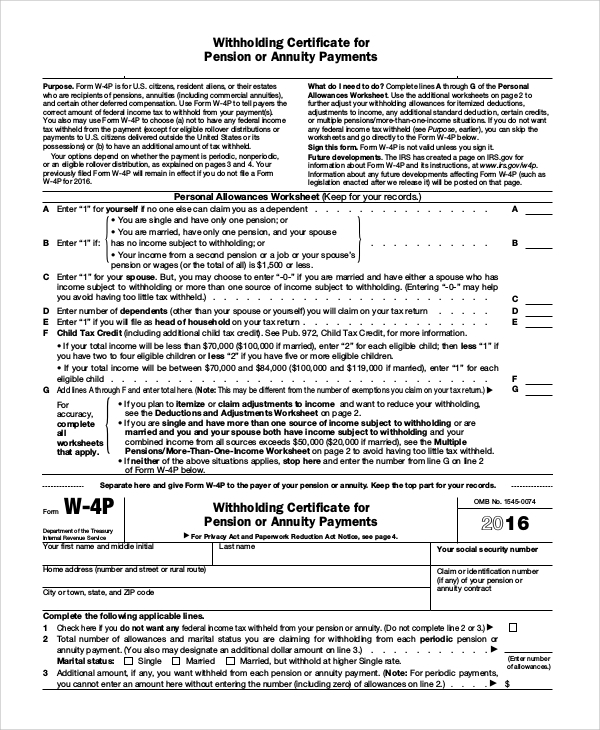

Formulating specifications

Withholding taxes on employees need to be collected and reported in the event that you’re an employer. You may submit documentation to the IRS to collect a portion of these taxation. You may also need additional forms that you might need for example, an annual tax return, or a withholding reconciliation. Here’s some details on the different forms of withholding tax categories, as well as the deadlines to filing them.

The compensation, bonuses commissions, bonuses, and other earnings you earn from your employees could require you to file withholding tax returns. In addition, if you paid your employees promptly, you could be eligible for reimbursement of taxes withheld. It is important to keep in mind that some of these taxes are local taxes. There are also specific withholding techniques that can be used in specific situations.

In accordance with IRS regulations the IRS regulations, electronic submissions of withholding forms are required. It is mandatory to include your Federal Employer ID Number when you file to your tax return for national income. If you don’t, you risk facing consequences.