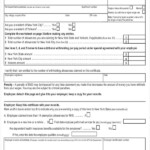

Fderal Withholding Form – There are a variety of reasons an individual might decide to fill out forms for withholding. This includes documentation requirements as well as exemptions from withholding, as well as the quantity of requested withholding allowances. No matter what the reason is for the filing of an application there are certain aspects you must keep in mind.

Exemptions from withholding

Nonresident aliens are required to submit Form 1040-NR once a year. If you satisfy the requirements, you could be eligible to be exempt from withholding. This page you will discover the exemptions for you to choose from.

For submitting Form 1040-NR add Form 1042-S. This form lists the amount that is withheld by the tax withholding authorities to report federal income tax for tax reporting purposes. Be sure to enter the correct information when filling in this form. If the correct information isn’t given, a person could be treated.

Nonresident aliens have 30 percent withholding tax. If the tax you pay is less than 30 percent of your withholding, you may be eligible to be exempt from withholding. There are many exemptions. Certain of them are applicable to spouses or dependents, like children.

In general, chapter 4 withholding allows you to receive an amount of money. Refunds are available under sections 1401, 1474 and 1475. The withholding agent or the individual who withholds the tax at source, is responsible for making these refunds.

Status of relationships

A valid marital status and withholding forms will ease your work and that of your spouse. Additionally, the quantity of money you can put at the bank could delight you. Knowing which of the many options you’re likely to decide is the biggest challenge. There are certain things you must be aware of. There will be a significant cost in the event of a poor choice. If you adhere to the rules and follow the directions, you shouldn’t run into any problems. It is possible to make new friends if you are fortunate. Today is your anniversary. I hope you are capable of using this to get that elusive wedding ring. It is best to seek the advice of a tax professional certified to ensure you’re doing it right. It’s worth it to build wealth over the course of your life. It is a good thing that you can access a ton of information online. TaxSlayer is a trusted tax preparation firm.

The amount of withholding allowances requested

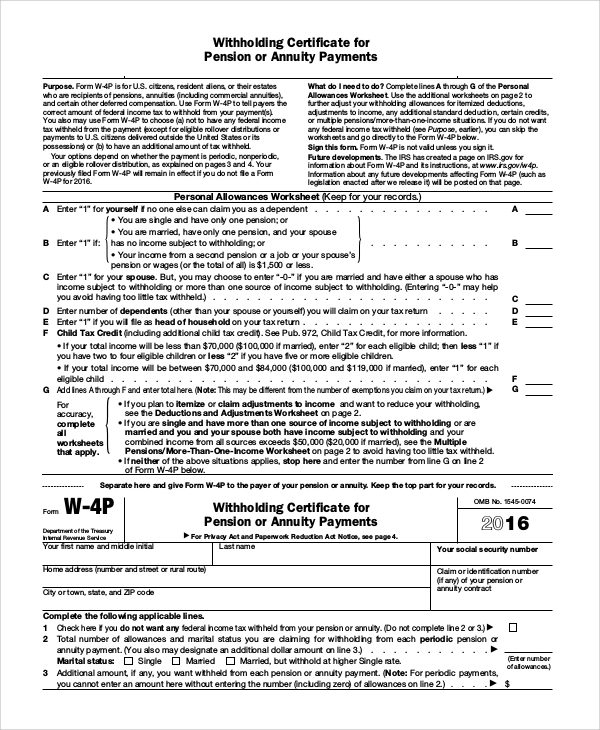

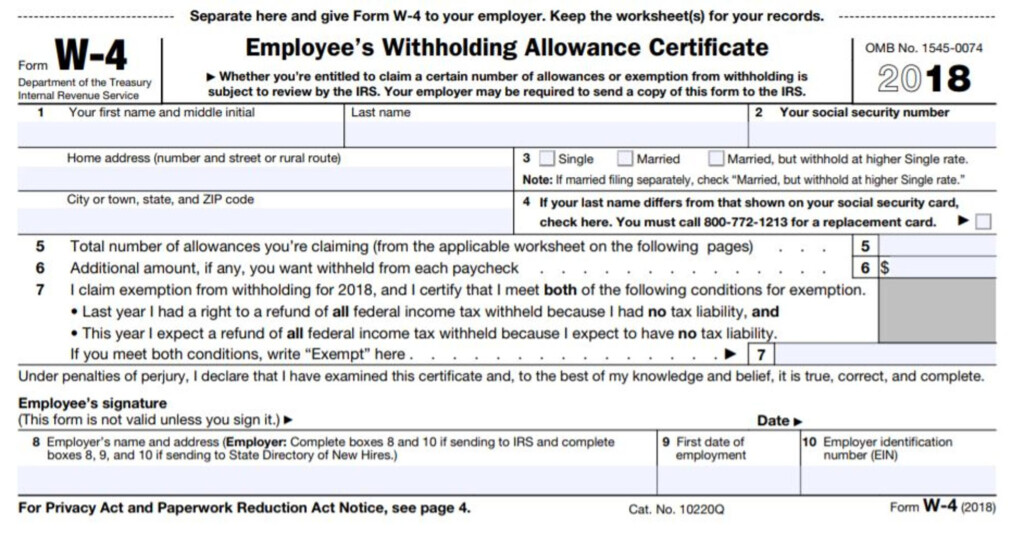

On the Form W-4 that you fill out, you need to specify the amount of withholding allowances you requesting. This is essential since the withholdings can have an effect on the amount of tax that is taken out of your pay checks.

A number of factors can influence the amount you qualify for allowances. Your income will influence how many allowances your are eligible for. If you earn a high amount it could be possible to receive more allowances.

The right amount of tax deductions can help you avoid a significant tax charge. It is possible to receive a refund if you file your annual income tax return. But be sure to choose your approach carefully.

Like any financial decision, you must conduct your own research. Calculators can help determine how many withholding amounts should be requested. It is also possible to speak with an expert.

Formulating specifications

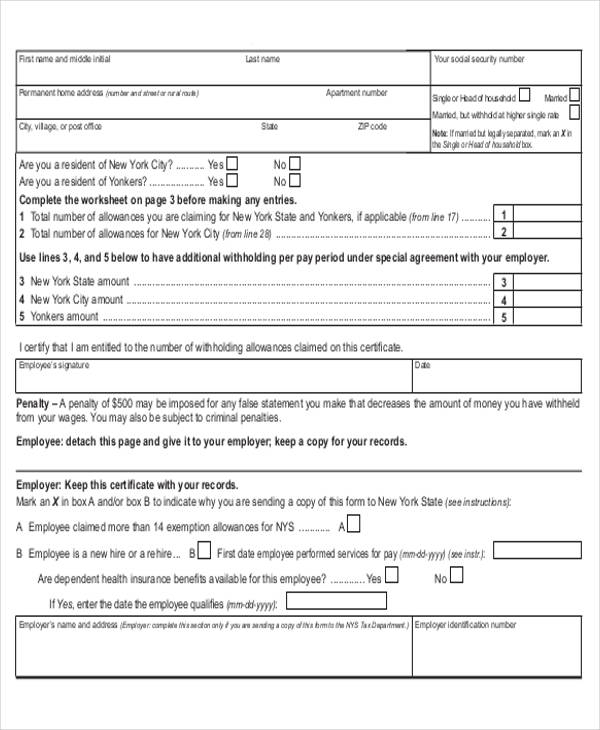

Withholding tax from your employees have to be reported and collected if you’re an employer. A few of these taxes may be reported to the IRS by submitting paperwork. A tax reconciliation for withholding and an annual tax return for quarterly filing, or an annual tax return are some examples of additional paperwork you might be required to submit. Here is more information on the different types of withholding taxes as well as the deadlines for filing them.

Employees may need you to file withholding tax return forms to get their bonuses, salary and commissions. It is also possible to receive reimbursement for tax withholding if your employees received their wages on time. The fact that certain taxes are also county taxes must be considered. There are specific methods of withholding that are appropriate in particular situations.

In accordance with IRS regulations the IRS regulations, electronic filing of forms for withholding are required. When filing your tax returns for national revenue ensure that you include your Federal Employee Identification Number. If you don’t, you risk facing consequences.