Employee’s Withholding Form – There are many reasons why someone might choose to fill out a tax form. The requirements for documentation, exemptions from withholding and the amount of withholding allowances demanded are all elements. Whatever the reason the person decides to fill out an application there are some aspects to consider.

Exemptions from withholding

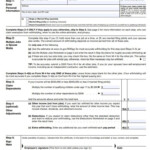

Non-resident aliens must submit Form 1040-NR once a year. If you satisfy these requirements, you may be able to claim an exemption from the withholding form. On this page, you’ll find the exclusions for you to choose from.

When submitting Form1040-NR, Attach Form 1042S. The document lists the amount withheld by the tax authorities for federal tax reporting to be used for reporting purposes. Be sure to enter the right information when filling in this form. A person could be treated if the information is not entered.

Nonresident aliens pay a 30% withholding tax. Exemption from withholding could be possible if you’ve got a the tax burden lower than 30 percent. There are a variety of exemptions. Certain are only for spouses and dependents, like children.

In general, you’re entitled to a reimbursement under chapter 4. Refunds can be made according to Sections 1400 through 1474. The refunds are made by the withholding agent. The withholding agent is the person accountable for tax withholding at the point of origin.

Relational status

A marriage certificate and withholding forms will assist your spouse and you both to make the most of your time. You’ll be amazed by how much you can transfer to the bank. The problem is deciding what option to choose. Certain aspects should be avoided. A bad decision could cause you to pay a steep price. But if you adhere to the guidelines and be alert to any possible pitfalls, you won’t have problems. If you’re lucky you might make new acquaintances on your journey. Today is your birthday. I’m hoping that you can apply it against them in order to find that elusive diamond. It is best to seek the advice of a certified tax expert to finish it properly. It’s worth it to build wealth over a lifetime. Information on the internet is easy to find. TaxSlayer, a reputable tax preparation company, is one of the most effective.

There are a lot of withholding allowances that are being requested

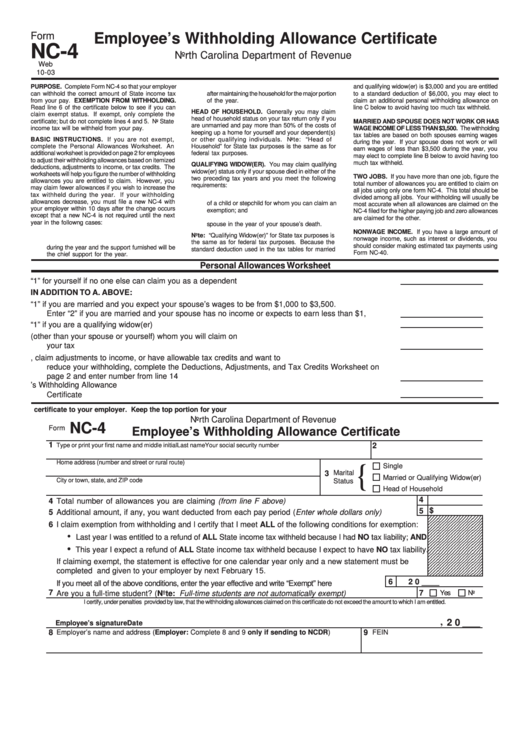

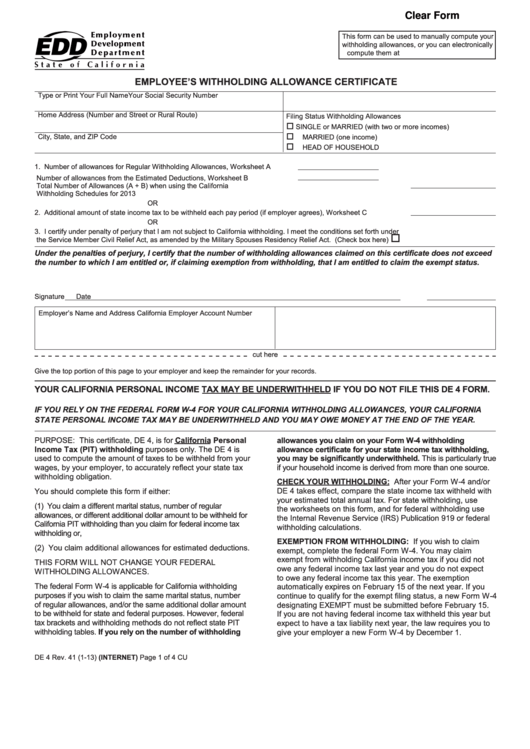

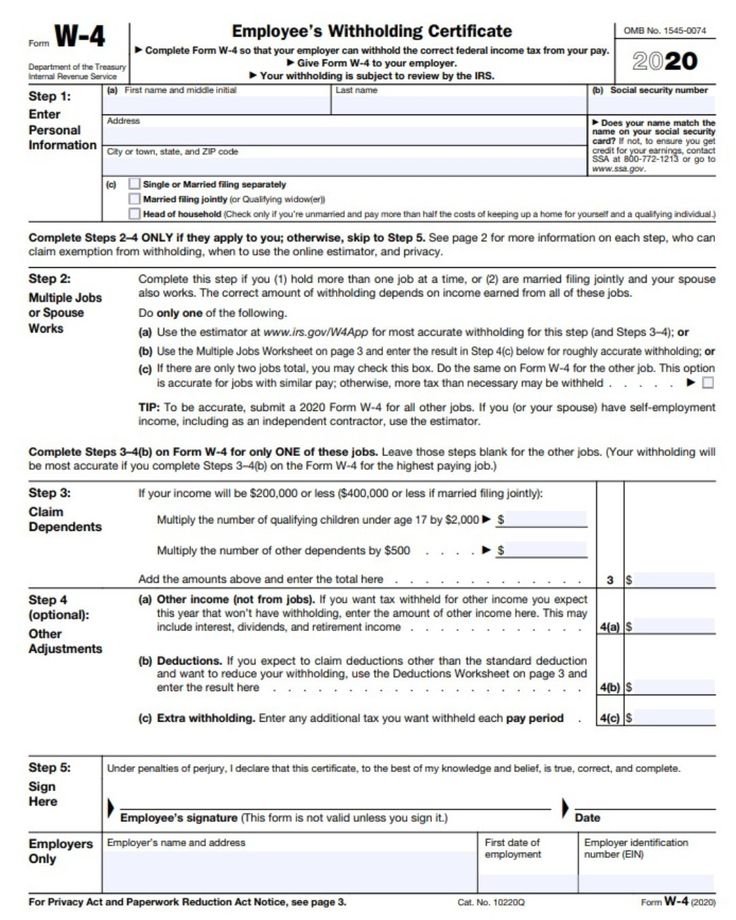

It is important to specify the number of withholding allowances you wish to be able to claim on the W-4 you submit. This is crucial because the tax amount withdrawn from your pay will depend on how you withhold.

There are many variables which affect the allowance amount that you can request. If you’re married you might be qualified for an exemption for head of household. Your income level can also determine the amount of allowances accessible to you. If you earn a high amount, you might be eligible to receive a higher allowance.

Making the right choice of tax deductions can save you from a large tax bill. You could actually receive the amount you owe if you submit your annual tax return. But it is important to pick the right method.

It is essential to do your homework the same way you would for any financial option. To figure out the amount of tax withholding allowances to be claimed, make use of calculators. An alternative is to speak with a professional.

Formulating specifications

Withholding taxes on your employees have to be collected and reported when you are an employer. The IRS can accept paperwork to pay certain taxes. A tax return that is annually filed and quarterly tax returns as well as the reconciliation of withholding tax are all kinds of documentation you may require. Here’s some details on the various withholding tax form categories, as well as the deadlines to the submission of these forms.

To be eligible to receive reimbursement for withholding tax on the compensation, bonuses, salary or other income that your employees receive it is possible to submit withholding tax return. If you paid your employees promptly, you could be eligible for reimbursement of taxes withheld. It is important to remember that some of these taxes could be considered to be local taxes. There are certain withholding strategies that may be appropriate in particular circumstances.

In accordance with IRS rules, you must electronically submit forms for withholding. When you file your tax returns for the national income tax, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.