Employee Withholding Form Louisiana – There are many reasons why one might decide to complete a withholding form. The reasons include the need for documentation, withholding exemptions, and the amount of requested withholding allowances. No matter what the reason is for a person to file documents, there are certain things you must keep in mind.

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once every year. However, if you satisfy the requirements, you might be eligible to submit an exemption form from withholding. On this page, you’ll see the exemptions that are that you can avail.

Attaching Form 1042-S is the first step to file Form 1040-NR. This form provides details about the withholding process carried out by the agency responsible for withholding for federal tax reporting to be used for reporting purposes. When filling out the form ensure that you have provided the correct details. A person could be treated if the information is not entered.

The tax withholding rate for non-resident aliens is 30 percent. It is possible to be exempted from withholding if your tax burden exceeds 30%. There are many exemptions. Some of them are for spouses and dependents such as children.

Generally, a refund is available for chapter 4 withholding. Refunds may be granted under Sections 1400 to 1474. These refunds are provided by the withholding agent (the person who is responsible for withholding tax at source).

Status of relationships

The marital withholding form is a good way to make your life easier and assist your spouse. Additionally, the quantity of money you may deposit at the bank could be awestruck. Knowing which of the many possibilities you’re likely choose is the challenge. You should be careful with what you choose to do. There will be a significant cost if you make a wrong choice. If you stick to the directions and keep your eyes open to any possible pitfalls and pitfalls, you’ll be fine. If you’re lucky, you could be able to make new friends during your trip. Today is the anniversary. I’m hoping you’ll be able to utilize it to secure the sought-after diamond. You’ll need the help of a tax professional certified to ensure you’re doing it right. The small amount is well enough for a lifetime of wealth. There is a wealth of information on the internet. TaxSlayer as well as other reliable tax preparation firms are some of the best.

number of claimed withholding allowances

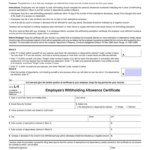

On the Form W-4 that you file, you should declare how many withholding allowances are you seeking. This is crucial because it affects how much tax you will receive from your wages.

Many factors affect the amount you are eligible for allowances. Your income will influence how many allowances your are entitled to. If you earn a higher income, you can request an increase in your allowance.

A tax deduction that is appropriate for you could help you avoid large tax bills. If you file your annual income tax returns You could be eligible for a refund. Be cautious regarding how you go about this.

As with any financial decision, you must conduct your own research. Calculators can assist you in determining the number of withholdings that need to be requested. Alternative options include speaking with an expert.

Formulating specifications

Employers must take withholding tax from their employees and then report it. A few of these taxes can be reported to the IRS through the submission of paperwork. A tax return for the year and quarterly tax returns, or tax withholding reconciliations are just a few types of documents you could need. Here are some details about the various types of withholding tax forms as well as the filing deadlines.

The compensation, bonuses commissions, bonuses, and other earnings you earn from your employees may necessitate you to file withholding tax returns. Additionally, if you paid your employees promptly, you could be eligible to receive reimbursement for taxes that were withheld. Be aware that certain taxes might be county taxes. There are certain withholding strategies that may be suitable in certain circumstances.

In accordance with IRS regulations, you have to electronically submit withholding forms. When you submit your national tax return, please provide the Federal Employer Identification number. If you don’t, you risk facing consequences.

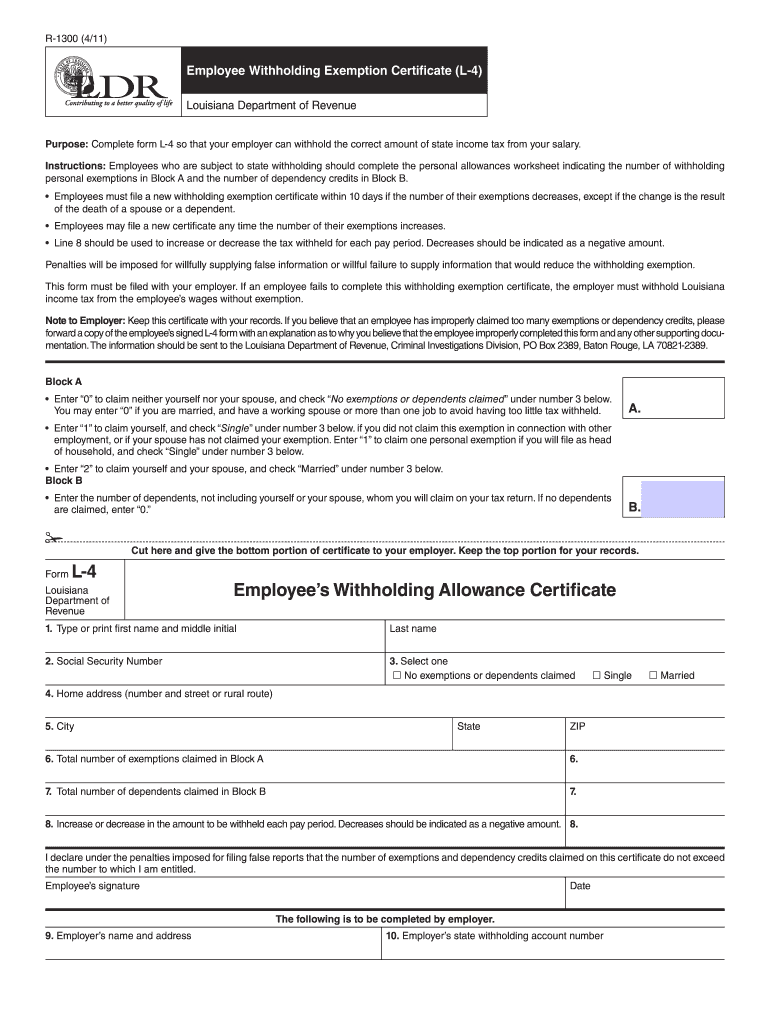

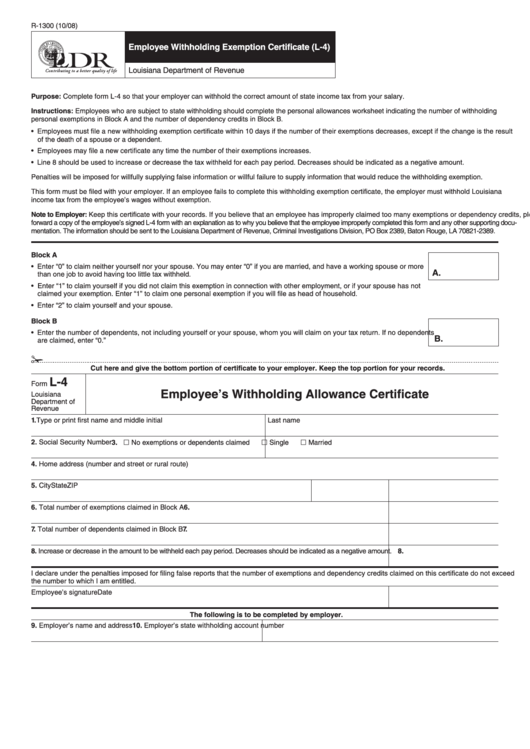

Gallery of Employee Withholding Form Louisiana

2011 Form LA R 1300 Fill Online Printable Fillable Blank PdfFiller