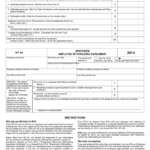

Employee Withholding Form Federal – There are a variety of reasons why someone might choose to fill out a tax form. This includes the documents required, the exclusion of withholding, and the requested withholding allowances. No matter what the reason is for an individual to file documents, there are certain things to keep in mind.

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR at least once per year. If your requirements are met, you could be eligible to request an exemption from withholding. The following page lists all exclusions.

The first step in filling out Form 1040-NR is attaching Form 1042 S. The form is used to declare federal income tax. It outlines the amount of withholding that is imposed by the tax withholding agent. It is essential to fill in the correct information when filling out the form. It is possible for one person to be treated differently if the information isn’t provided.

Non-resident aliens are subject to 30 percent withholding. It is possible to get an exemption from withholding if your tax burden exceeds 30 percent. There are a variety of exclusions. Some of them apply to spouses and dependents, such as children.

In general, you’re eligible to receive a refund in accordance with chapter 4. Refunds can be granted in accordance with Sections 471 to 474. The refunds are made by the withholding agents who is the person who is responsible for withholding taxes at the source.

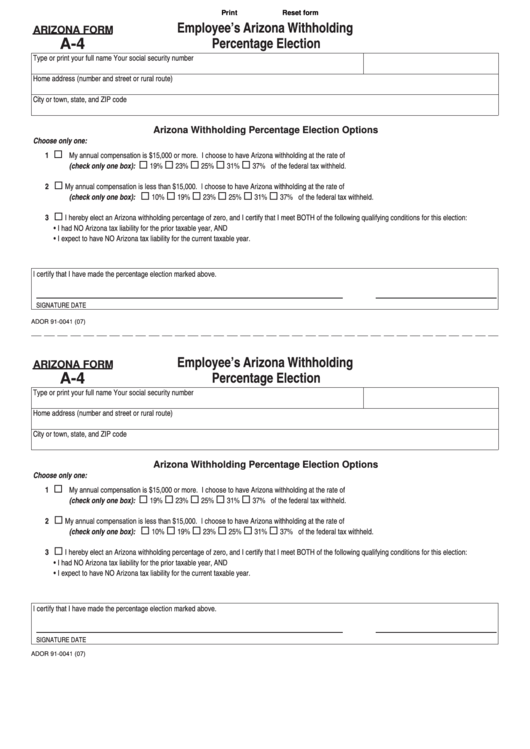

relationship status

An appropriate marital status that is withheld will make it easier for you and your spouse to accomplish your job. You’ll be amazed at how much money you could put in the bank. The problem is deciding what option to pick. There are certain actions you should avoid doing. Making the wrong choice could cost you dearly. There’s no problem when you follow the directions and pay attention. You may make new friends if you are lucky. Today is the anniversary of your wedding. I’m hoping that you can leverage it to find that perfect ring. To complete the task correctly, you will need to obtain the assistance of a certified tax expert. The accumulation of wealth over time is more than the small amount. There is a wealth of information online. TaxSlayer is one of the most trusted and respected tax preparation firms.

the number of claims for withholding allowances

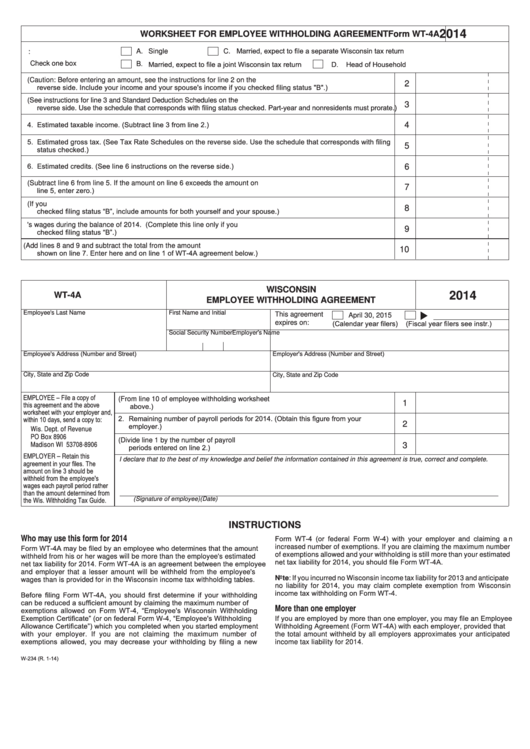

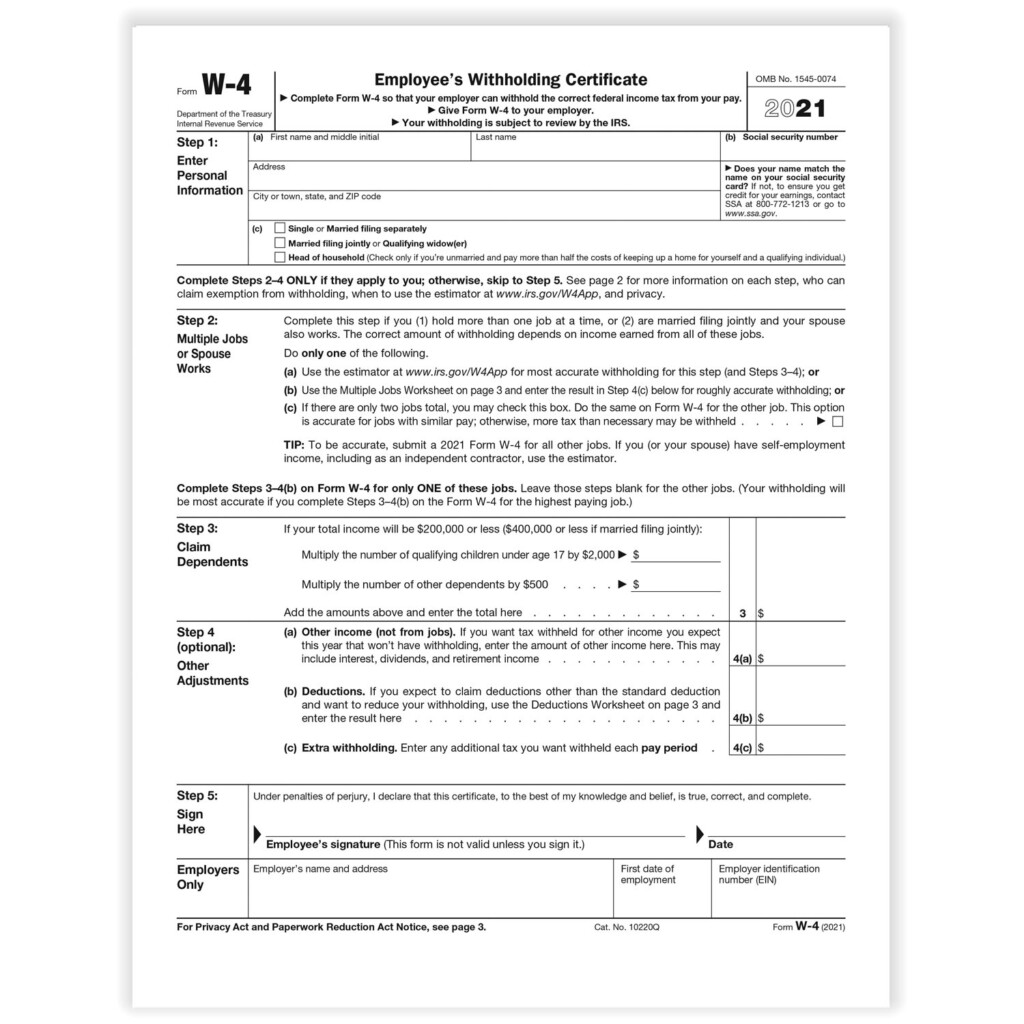

It is crucial to indicate the amount of the withholding allowance you wish to claim on the Form W-4. This is crucial as it will impact how much tax you receive from your pay checks.

The amount of allowances you get will be contingent on various factors. For instance when you’re married, you might be entitled to an exemption for your household or head. The amount you earn will influence how many allowances your are eligible for. If you earn a significant amount of money, you could be eligible for a larger allowance.

A tax deduction that is suitable for you can aid you in avoiding large tax payments. A refund could be possible if you submit your income tax return for the year. Be sure to select your method carefully.

Like any financial decision you make it is crucial to research the subject thoroughly. Calculators can be utilized to figure out how many allowances for withholding must be made. You can also speak to an expert.

Specifications for filing

If you’re an employer, you have to pay and report withholding tax on your employees. The IRS may accept forms for some of these taxes. A tax return that is annually filed and quarterly tax returns, or tax withholding reconciliations are just a few types of documents you could need. Here are some specifics regarding the various forms of tax withholding forms and the filing deadlines.

The salary, bonuses commissions, bonuses, and other income that you receive from employees might require you to file tax returns withholding. You could also be eligible to be reimbursed for taxes withheld if your employees received their wages on time. Be aware that these taxes can be considered to be local taxes. Additionally, there are unique methods of withholding that are implemented in specific circumstances.

You are required to electronically submit withholding forms according to IRS regulations. Your Federal Employer identification number should be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.