Employee Federal Withholding Form 2024 – There are a variety of reasons someone may choose to fill out forms withholding. Withholding exemptions, documentation requirements as well as the quantity of allowances for withholding demanded are all elements. No matter the reason for an individual to file documents, there are certain things that you need to remember.

Withholding exemptions

Non-resident aliens are required to file Form 1040–NR at least once per calendar year. If you satisfy the requirements, you may be eligible for an exemption to withholding. This page will provide the exclusions.

When submitting Form1040-NR, Attach Form 1042S. The form outlines the withholdings made by the agency. Make sure you enter the right information when filling in this form. One person may be treated differently if this information is not provided.

The 30% non-resident alien tax withholding rate is 30 percent. Nonresident aliens could be eligible for an exemption. This is when your tax burden is less than 30%. There are several different exclusions that are available. Some of them are for spouses, dependents, or children.

Generally, withholding under Chapter 4 allows you to claim the right to a refund. Refunds can be claimed in accordance with Sections 1401, 1474 and 1475. These refunds are provided by the tax agent (the person who is responsible for withholding tax at source).

Relational status

An official marriage status withholding form can help you and your spouse get the most out of your time. You’ll be amazed by the amount you can deposit at the bank. Knowing which of the several possibilities you’re likely choose is the challenge. There are certain things you must avoid. Making a mistake can have costly consequences. If you stick to the guidelines and adhere to them, there won’t be any issues. If you’re lucky enough to meet some new acquaintances while traveling. Today marks the anniversary. I’m hoping you’ll be able to take advantage of it to locate that perfect wedding ring. It’s a complex task that requires the expertise of an accountant. It’s worthwhile to accumulate wealth over the course of a lifetime. You can find tons of information online. TaxSlayer and other reputable tax preparation firms are some of the most reliable.

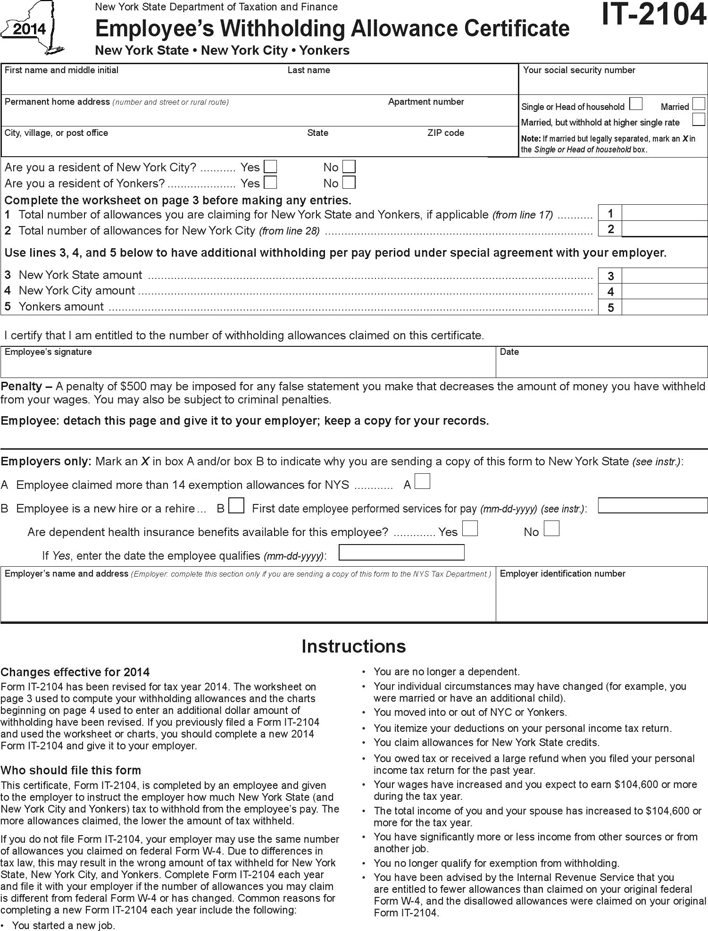

Number of withholding allowances that are claimed

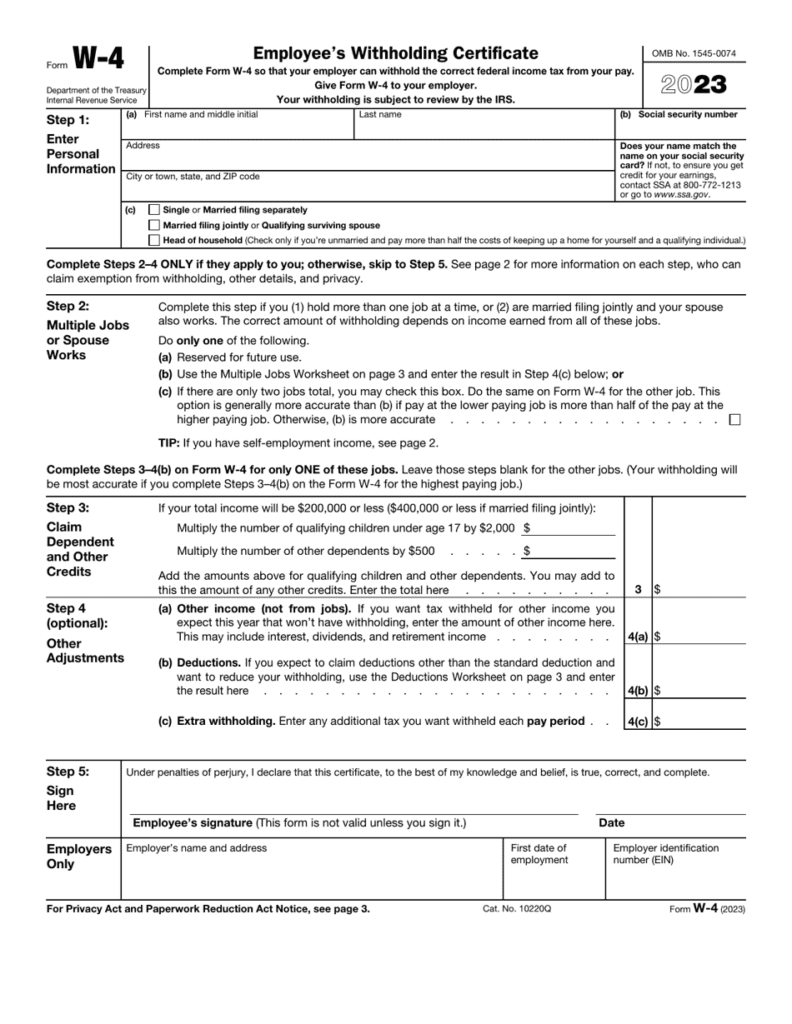

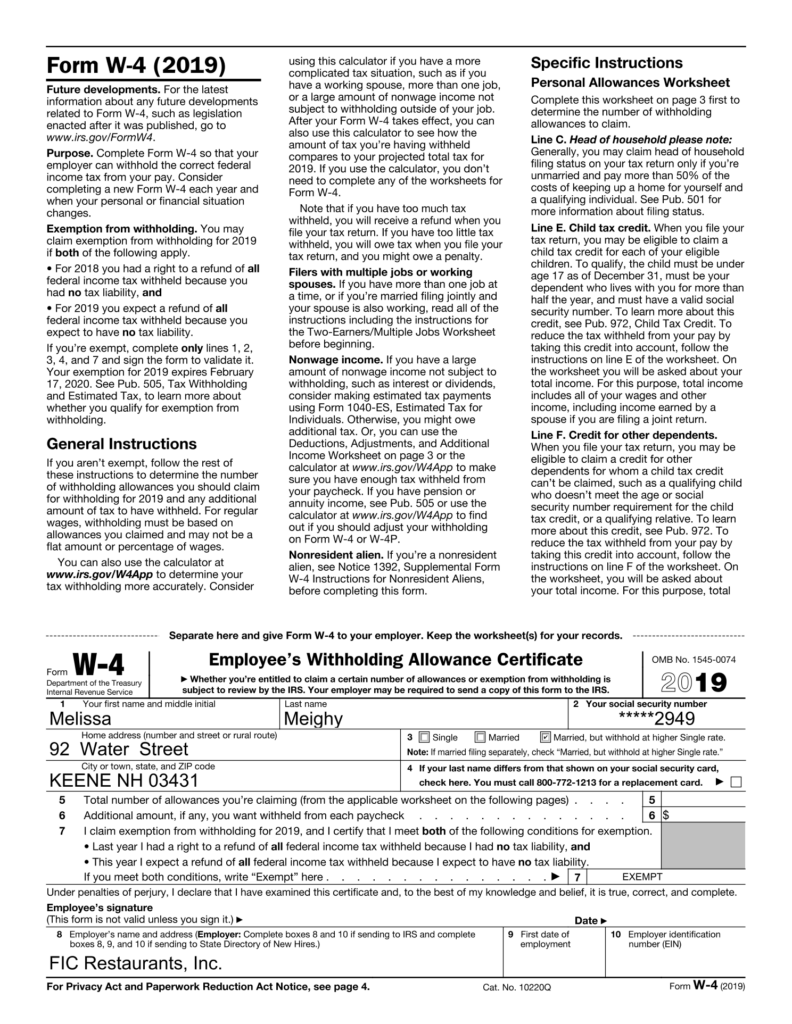

You must specify how many withholding allowances to claim on the W-4 that you file. This is vital since it will affect the amount of tax you get from your paychecks.

There are a variety of factors that influence the amount of allowances you can request. If you’re married, you could be qualified for an exemption for head of household. Your income level can also affect the number of allowances available to you. If you make a lot of income, you may be eligible for a larger allowance.

The right amount of tax deductions can save you from a large tax cost. In reality, if you submit your annual income tax return, you might even receive a refund. However, you must choose your strategy carefully.

In any financial decision, you should conduct your own research. Calculators are a great tool to determine the amount of withholding allowances are required to be claimed. As an alternative to a consultation with a specialist.

Formulating specifications

Employers should report the employer who withholds taxes from their employees. If you are taxed on a specific amount, you may submit paperwork to the IRS. You may also need additional forms that you might need for example, an annual tax return, or a withholding reconciliation. Below are details on the different forms of withholding taxes and the deadlines for filing them.

The compensation, bonuses, commissions, and other earnings you earn from your employees could require you to file tax returns withholding. You could also be eligible to get reimbursements for tax withholding if your employees received their wages promptly. The fact that some of these taxes are also county taxes should be considered. There are certain tax withholding strategies that could be appropriate in particular circumstances.

You have to submit electronically tax withholding forms as per IRS regulations. If you are filing your national revenue tax returns ensure that you include the Federal Employee Identification Number. If you don’t, you risk facing consequences.