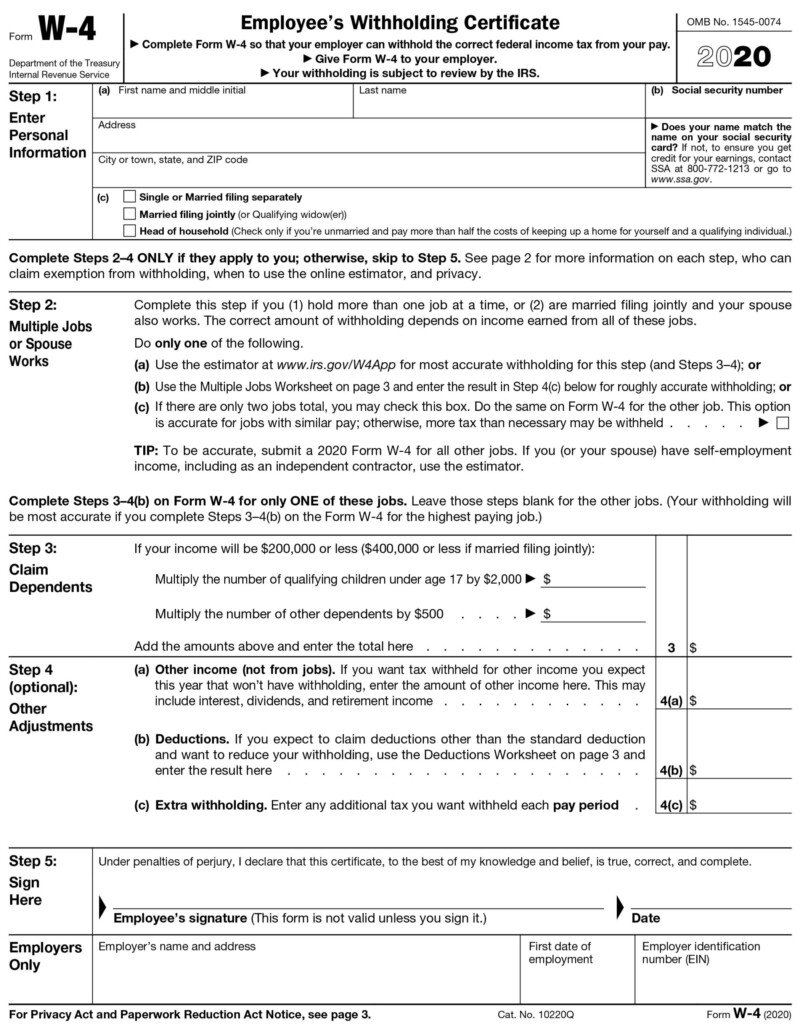

Does Pennsylvania Have A State Tax Withholding Form – There are numerous reasons one could fill out an application for withholding. These include the need for documentation and withholding exemptions. You must be aware of these things regardless of the reason you decide to submit a request form.

Withholding exemptions

Non-resident aliens must complete Form 1040-NR every year. If you satisfy these conditions, you could be eligible to receive exemptions from the form for withholding. The exemptions listed on this page are yours.

To complete Form 1040-NR, add Form 1042-S. The form is used to record federal income tax. It details the withholding by the withholding agent. Make sure that you fill in the correct information when you fill out the form. If the information you provide is not supplied, one person may be diagnosed with a medical condition.

The withholding rate for nonresident aliens is 30%. Tax burdens is not to exceed 30% in order to be eligible for exemption from withholding. There are a variety of exemptions. Some are for spouses and dependents, such as children.

The majority of the time, a refund is available for chapter 4 withholding. Refunds are available according to sections 1401, 1474 and 1475. Refunds are to be given by the tax withholding agents that is, the person who collects taxes at source.

Status of relationships

A form for a marital withholding can simplify your life and aid your spouse. You’ll be amazed at the amount that you can deposit at the bank. The difficulty lies in picking the right bank out of the many options. There are certain aspects to avoid. Making the wrong decision will result in a significant cost. It’s not a problem when you follow the directions and pay attention. If you’re lucky enough to meet some new acquaintances while on the road. Today is the anniversary day of your wedding. I’m hoping that you can use it against them to secure the elusive diamond. For this to be done properly, you’ll require guidance of a tax expert who is certified. The small amount is well enough for a lifetime of wealth. Online information is easily accessible. TaxSlayer and other reputable tax preparation firms are some of the top.

There are many withholding allowances being made available

It is important to specify the number of withholding allowances to be able to claim on the W-4 you fill out. This is critical since your wages could be affected by the amount of tax you pay.

You may be eligible to apply for an exemption on behalf of your spouse in the event that you are married. The amount of allowances you’re eligible to claim will depend on your income. If you earn a high amount you may be eligible to receive more allowances.

Selecting the appropriate amount of tax deductions can allow you to avoid a significant tax payment. It is possible to receive an income tax refund when you file your annual income tax return. However, you must choose the right method.

As with any financial decision, it is important to conduct your own research. To determine the amount of tax withholding allowances to be claimed, make use of calculators. You may also talk to an expert.

Sending specifications

Employers must inform the IRS of any withholding taxes being paid by employees. You can submit paperwork to the IRS to collect a portion of these taxes. You may also need additional forms that you may require, such as a quarterly tax return or withholding reconciliation. Here are some information regarding the various forms of withholding tax forms along with the deadlines for filing.

Employees may need the submission of withholding tax return forms to get their salary, bonuses and commissions. You could also be eligible to be reimbursed for taxes withheld if your employees received their wages on time. It is crucial to remember that some of these taxes are local taxes. There are certain withholding strategies that may be suitable in certain situations.

The IRS regulations require you to electronically submit your withholding documentation. If you are submitting your tax return for national revenue make sure you include the Federal Employer Identification number. If you don’t, you risk facing consequences.