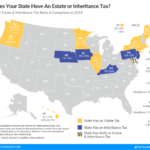

Does Maryland Have A State Withholding Form – There are many reasons why someone might choose to fill out a withholding form. This includes the documents required, the exclusion of withholding, and the requested withholding allowances. No matter the reasons someone is deciding to file a Form, there are several points to be aware of.

Exemptions from withholding

Non-resident aliens are required to submit Form1040-NR once a year to submit Form1040-NR. If you meet the requirements, you could be eligible for exemptions from the form for withholding. This page will list the exclusions.

To submit Form 1040-NR the first step is to attach Form 1042S. The form lists the amount that is withheld by the tax withholding authorities for federal tax reporting to be used for reporting purposes. Complete the form in a timely manner. If the information you provide is not given, a person could be treated.

Non-resident aliens are subject to a 30% withholding rate. Nonresident aliens could be eligible for an exemption. This is when your tax burden is less than 30%. There are many exemptions. Certain are only for spouses and dependents, like children.

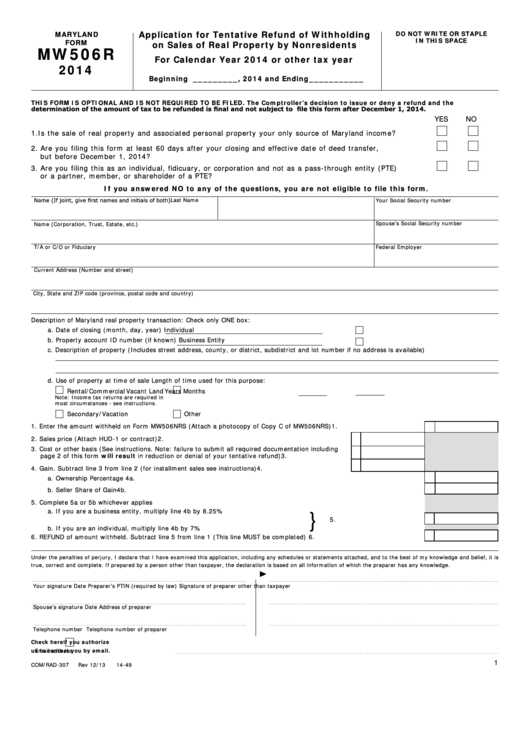

Generally, withholding under Chapter 4 gives you the right to the right to a refund. Refunds are permitted under Sections 1471-1474. These refunds are provided by the agent who withholds tax (the person who withholds tax at the source).

Status of relationships

An official marriage status withholding forms will assist your spouse and you both get the most out of your time. It will also surprise you how much you can make a deposit to the bank. The trick is to decide which of the numerous options to choose. Certain aspects should be avoided. It’s costly to make a wrong choice. There’s no problem if you just follow the directions and pay attention. If you’re lucky, you may be able to make new friends as you travel. Today is the anniversary date of your wedding. I’m hoping that you can make use of it to get that elusive ring. It’s a difficult task that requires the expertise of a tax professional. This tiny amount is enough to last the life of your wealth. Information on the internet is readily available. Reputable tax preparation firms like TaxSlayer are among the most helpful.

There are a lot of withholding allowances being claimed

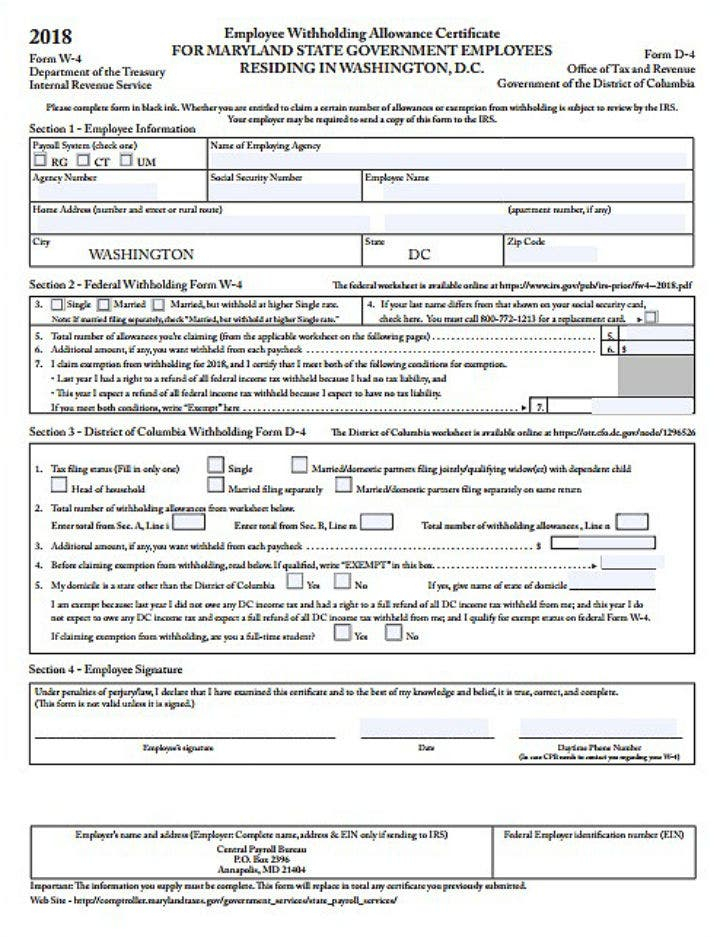

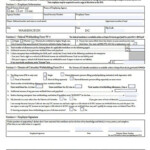

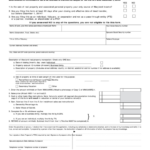

You must specify how many withholding allowances to claim on the Form W-4 that you file. This is essential since the withholdings will effect on the amount of tax is taken from your pay checks.

The amount of allowances that you receive will depend on the various aspects. For example, if you are married, you might be qualified for a head or household exemption. The amount you earn will also impact how many allowances you are entitled to. You can apply for more allowances if earn a significant amount of money.

Making the right choice of tax deductions can allow you to avoid a significant tax bill. In reality, if you file your annual income tax return, you may even receive a refund. But you need to pick your approach wisely.

Like any financial decision it is crucial to conduct your research. Calculators are a great tool to figure out how many withholding allowances are required to be claimed. In addition to a consultation with a specialist.

Filing specifications

Withholding taxes from employees need to be reported and collected when you’re an employer. Some of these taxes may be submitted to the IRS by submitting forms. There are other forms you might need, such as an annual tax return, or a withholding reconciliation. Here’s some details on the different forms of withholding tax categories, as well as the deadlines to filling them out.

To be qualified for reimbursement of tax withholding on compensation, bonuses, salary or other income that your employees receive You may be required to submit withholding tax return. In addition, if you pay your employees on-time you may be eligible to be reimbursed for any taxes withheld. Noting that certain of these taxes are taxes imposed by the county, is crucial. There are also special withholding techniques that are applicable under certain conditions.

Electronic submission of forms for withholding is mandatory according to IRS regulations. You must provide your Federal Employer ID Number when you point at your income tax return from the national tax system. If you don’t, you risk facing consequences.