Do You Have A Form If Filing Exemption From Withholding – There are a variety of reasons why an individual could submit an application for withholding. This includes the need for documentation, withholding exemptions and also the amount of required withholding allowances. You should be aware of these aspects regardless of your reason for choosing to fill out a form.

Exemptions from withholding

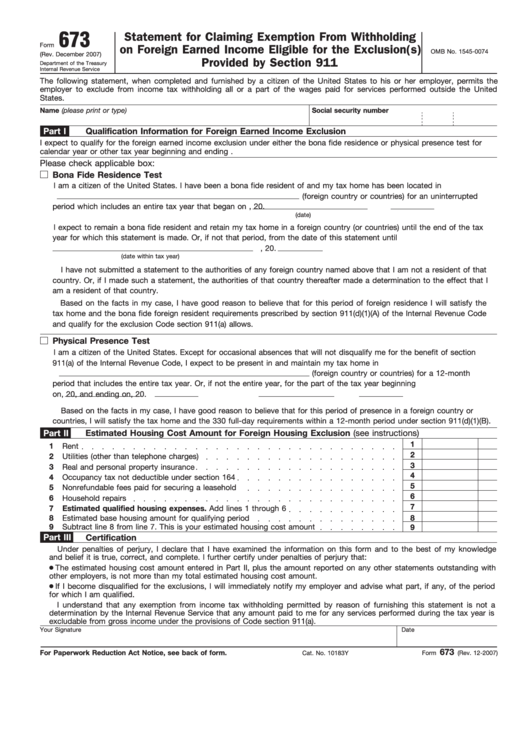

Nonresident aliens need to submit Form 1040–NR once a calendar year. If you meet the requirements you might be eligible to be exempt from withholding. The exemptions you will find here are yours.

For Form 1040-NR submission, the first step is to attach Form 1042S. This form details the withholdings that are made by the agency. Please ensure you are entering the right information when filling out this form. You could be required to treat a specific individual if you do not provide this information.

The rate of withholding for non-resident aliens is 30%. A tax exemption may be possible if you’ve got a a tax burden that is less than 30 percent. There are many exemptions. Some of them apply to spouses and dependents, such as children.

You may be entitled to an amount of money if you do not follow the provisions of chapter 4. Refunds are granted under sections 1401, 1474 and 1475. The refunds are made by the withholding agents who is the person who withholds taxes at source.

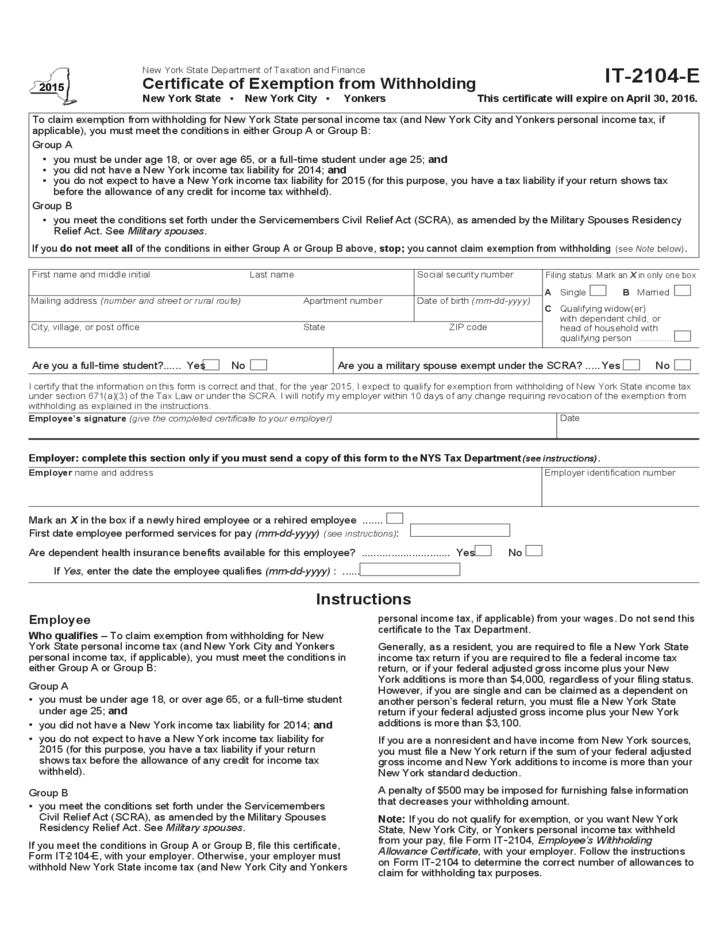

Status of relationships

A marriage certificate and withholding form can help both of you make the most of your time. You’ll be surprised by the amount of money you can put in the bank. Knowing which of the several possibilities you’re likely choose is the challenge. There are some things you shouldn’t do. It’s expensive to make the wrong choice. If you adhere to the guidelines and adhere to them, there won’t be any problems. You might make some new acquaintances if lucky. After all, today marks the date of your wedding anniversary. I’m hoping you’ll be able to apply it against them to secure the sought-after diamond. You’ll want the assistance from a certified tax expert to finish it properly. It’s worth it to build wealth over a lifetime. You can get a ton of information online. TaxSlayer and other trusted tax preparation firms are some of the most reliable.

There are numerous withholding allowances that are being claimed

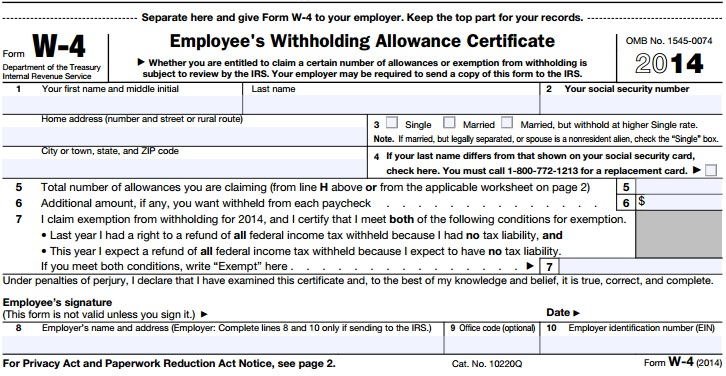

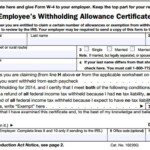

You need to indicate how many withholding allowances you wish to claim on the W-4 you submit. This is essential as the tax withheld can affect how much is taken from your paychecks.

There are a variety of factors that can influence the amount you qualify for allowances. Your income can affect the number of allowances available to you. A larger allowance might be granted if you make lots of money.

The proper amount of tax deductions can aid you in avoiding a substantial tax charge. If you file your annual income tax returns You could be eligible for a refund. Be cautious about how you approach this.

Research as you would with any financial decision. Calculators can be used to determine the amount of withholding allowances should be claimed. As an alternative to a consultation with an expert.

Submission of specifications

Employers should report the employer who withholds taxes from their employees. If you are taxed on a specific amount you can submit paperwork to IRS. Additional paperwork that you may require to submit includes a withholding tax reconciliation and quarterly tax returns as well as the annual tax return. Here’s some information about the different tax forms, and when they need to be submitted.

You may have to file tax returns withholding in order to report the income you get from your employees, such as bonuses and commissions or salaries. It is also possible to be reimbursed of taxes withheld if you’re employees were paid promptly. It is important to note that some of these taxes are county taxes ought to be taken into consideration. You may also find unique withholding methods that are utilized in certain circumstances.

You must electronically submit tax withholding forms as per IRS regulations. If you are submitting your national tax return be sure to provide the Federal Employer Identification number. If you don’t, you risk facing consequences.