Directory Withholding Form – There are many reasons an individual might want to complete a form for withholding form. Withholding exemptions, documentation requirements as well as the quantity of withholding allowances requested are all factors. There are a few things you should remember, regardless of the reason that a person has to fill out an application.

Exemptions from withholding

Non-resident aliens must file Form 1040-NR at least once a year. If the requirements meet, you may be eligible for an exemption from withholding. There are exemptions that you can access on this page.

To complete Form 1040-NR, add Form 1042-S. The form contains information on the withholding process carried out by the agency responsible for withholding for federal tax reporting purposes. Complete the form in a timely manner. If the information you provide is not given, a person could be diagnosed with a medical condition.

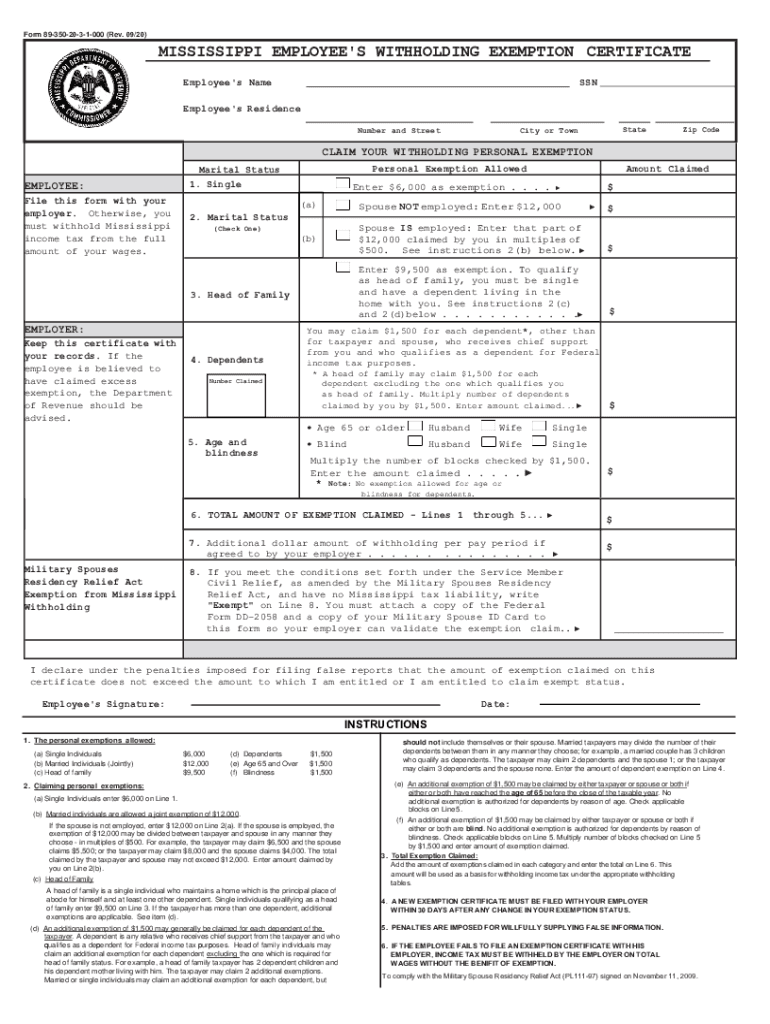

Non-resident aliens are subject to a 30% withholding rate. The tax burden of your business should not exceed 30% to be exempt from withholding. There are many exclusions. Some are specifically designed to be used by spouses, while some are designed to be used by dependents like children.

Generallyspeaking, withholding in Chapter 4 allows you to claim a return. Refunds are granted in accordance with Sections 1400 through 1474. The refunds are made by the withholding agents who is the person who is responsible for withholding taxes at source.

relational status

A valid marital status withholding can make it simpler for you and your spouse to accomplish your job. In addition, the amount of money that you can deposit at the bank can delight you. Choosing which of the possibilities you’re likely choose is the challenge. There are certain things that you should avoid doing. Making the wrong choice could result in a significant cost. However, if you adhere to the directions and be alert to any possible pitfalls, you won’t have problems. If you’re lucky enough, you could even make new acquaintances while you travel. Today marks the anniversary of your wedding. I’m hoping you’ll be able to apply it against them to secure the sought-after diamond. It’s a complex task that requires the expertise of an expert in taxation. The tiny amount is enough for a lifetime of wealth. There is a wealth of information online. TaxSlayer and other reputable tax preparation firms are a few of the top.

number of claimed withholding allowances

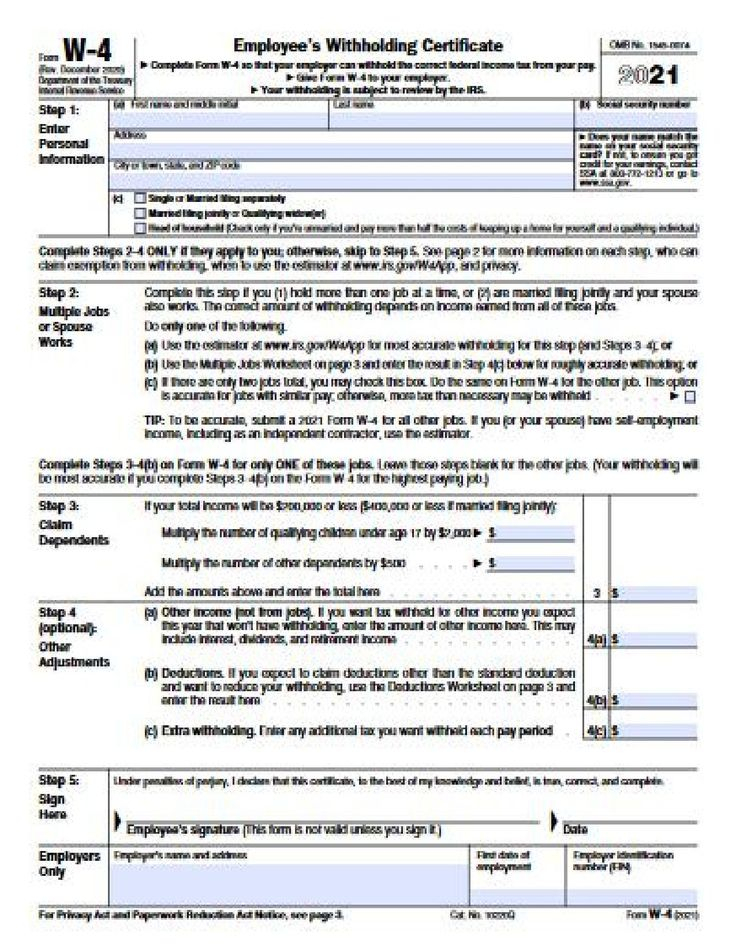

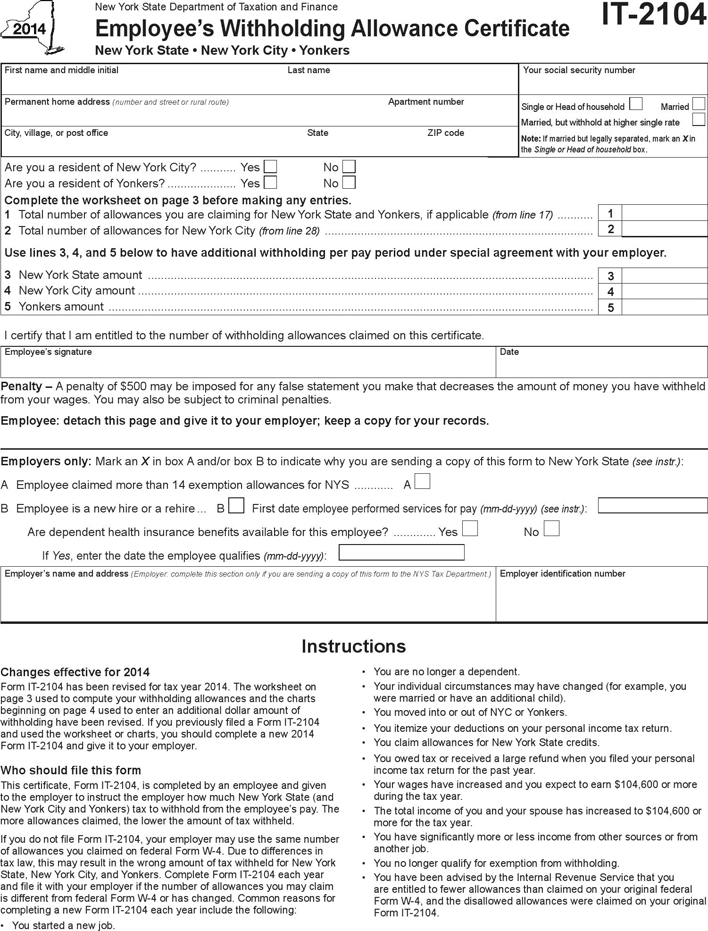

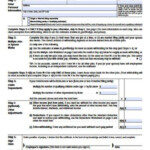

You must specify how many withholding allowances you want to be able to claim on the form W-4 you submit. This is important as it will impact how much tax you receive from your pay checks.

You may be able to apply for an exemption on behalf of the head of your household in the event that you are married. Your income can affect the number of allowances offered to you. If you earn a significant amount of money, you could be eligible for a higher allowance.

Making the right choice of tax deductions could allow you to avoid a significant tax bill. If you file your annual income tax returns and you are eligible for a refund. Be cautious when it comes to preparing this.

Conduct your own research, just as you would in any other financial decision. To figure out the amount of tax withholding allowances that need to be claimed, use calculators. You may also talk to an expert.

Specifications for filing

Employers are required to pay withholding taxes to their employees and report it. For some taxes you can submit paperwork to the IRS. There are other forms you could require for example, an annual tax return, or a withholding reconciliation. Here are some information about the various types of tax forms for withholding as well as the deadlines for filing.

In order to be qualified for reimbursement of tax withholding on compensation, bonuses, salary or other income received from your employees You may be required to submit withholding tax return. Additionally, if your employees receive their wages on time, you may be eligible for tax refunds for withheld taxes. Be aware that these taxes can be considered to be local taxes. Additionally, there are unique tax withholding procedures that can be applied under particular situations.

You have to submit electronically withholding forms in accordance with IRS regulations. Your Federal Employer Identification Number needs to be listed when you submit your tax return for national revenue. If you don’t, you risk facing consequences.

Gallery of Directory Withholding Form

2020 2022 Form MS DoR 89 350 Fill Online Printable Fillable Blank