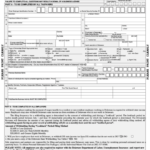

Delaware Withholding Registration Form – There are a variety of reasons why someone could complete a form for withholding. The reasons include the need for documentation including withholding exemptions and the quantity of requested withholding allowances. No matter the reason someone chooses to file the Form There are a few aspects to keep in mind.

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR at least once per year. However, if you satisfy the criteria, you may be eligible to submit an exemption from the withholding form. The following page lists all exclusions.

To submit Form 1040-NR The first step is to attach Form 1042S. The document lists the amount withheld by the withholding agencies to report federal income tax for tax reporting purposes. Make sure you enter the right information when filling out this form. One individual may be treated differently if this information is not entered.

The tax withholding rate for non-resident aliens is 30%. If the tax you pay is less than 30 percent of your withholding you may qualify for an exemption from withholding. There are numerous exemptions. Some of them are for spouses and dependents such as children.

You may be entitled to refunds if you have violated the terms of chapter 4. As per Sections 1471 to 1474, refunds are granted. Refunds will be made to the agent who withholds tax the person who withholds the tax from the source.

Status of relationships

A valid marital status and withholding forms will ease the work of you and your spouse. Furthermore, the amount of money you may deposit in the bank will pleasantly be awestruck. The problem is deciding what option to pick. There are some things you should avoid. Making the wrong decision will cost you dearly. However, if the instructions are followed and you pay attention, you should not have any problems. If you’re lucky, you may make new acquaintances on your journey. Today marks the anniversary of your wedding. I hope you are in a position to leverage this against them to obtain that wedding ring you’ve been looking for. It’s a difficult task that requires the expertise of an expert in taxation. The small amount is well enough for a life-long wealth. You can get a lot of information on the internet. TaxSlayer as well as other reliable tax preparation companies are some of the most reliable.

Number of claimed withholding allowances

In submitting Form W-4 you need to specify how many withholding allowances you wish to claim. This is important because the tax amount withdrawn from your pay will be affected by how you withhold.

The amount of allowances you are entitled to will be determined by a variety of factors. For example when you’re married, you might be qualified for an exemption for your household or head. Additionally, you can claim additional allowances depending on how much you earn. If you earn a substantial amount of income, you may be eligible for a higher allowance.

A tax deduction that is suitable for you can allow you to avoid tax obligations. In fact, if you file your annual income tax return, you might even receive a refund. However, you must choose the right method.

Research as you would in any other financial decision. Calculators are useful to determine the amount of withholding allowances that must be claimed. You can also speak to a specialist.

Filing requirements

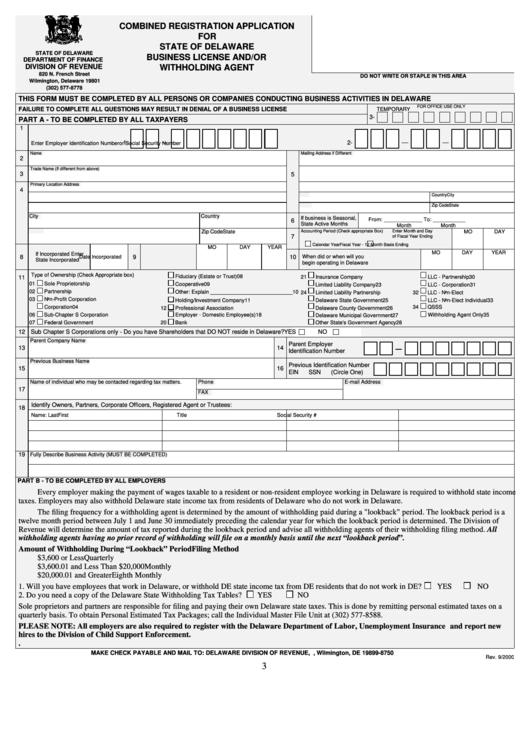

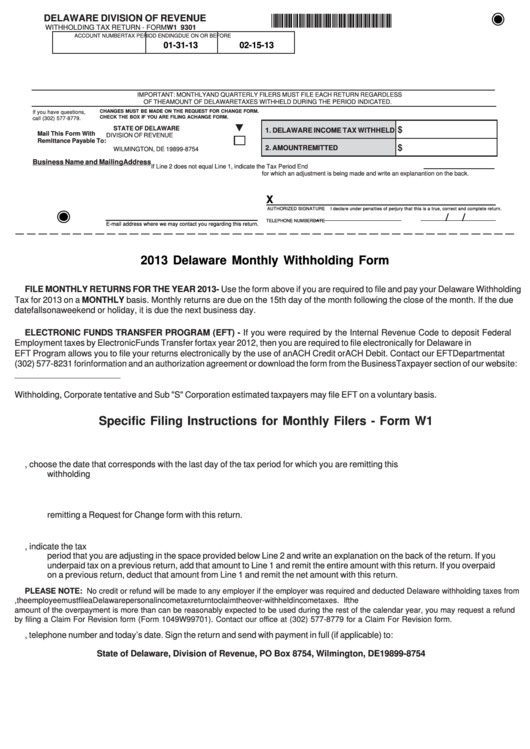

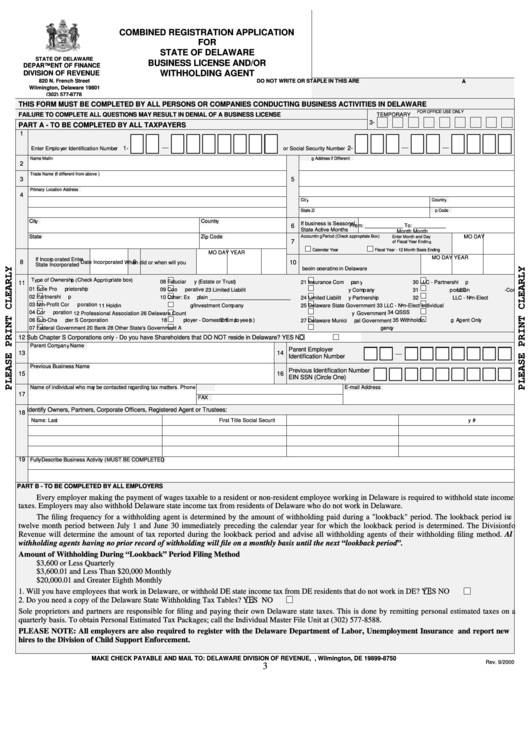

Employers must collect withholding taxes from their employees and then report the tax. If you are taxed on a specific amount you can submit paperwork to IRS. A tax return for the year and quarterly tax returns, or withholding tax reconciliation are all types of documents you could need. Here’s a brief overview of the various tax forms and when they need to be filed.

Your employees might require you to submit withholding taxes return forms to get their bonuses, salary and commissions. It is also possible to get reimbursements for tax withholding if your employees were paid promptly. It is important to note that some of these taxes are county taxes, is also crucial. There are certain tax withholding strategies that could be appropriate in particular situations.

The IRS regulations require you to electronically submit withholding documents. The Federal Employer identification number should be listed when you point your national tax return. If you don’t, you risk facing consequences.