Delaware Withholding Form 2024 – There are many reasons that someone could complete the form to request withholding. This includes the need for documentation, withholding exemptions and also the amount of required withholding allowances. No matter the reason for a person to file documents it is important to remember certain points to keep in mind.

Exemptions from withholding

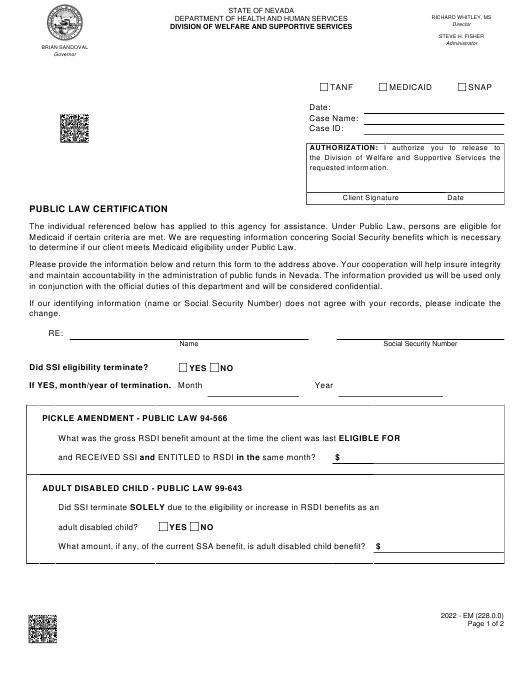

Non-resident aliens have to file Form 1040-NR at least every year. If you meet the criteria, you might be eligible to be exempt from withholding. This page you’ll see the exemptions that are that you can avail.

The application of Form 1042-S to Form 1042-S is a first step to file Form 1040-NR. For federal income tax reporting purposes, this form outlines the withholding made by the tax agency that handles withholding. Complete the form in a timely manner. There is a possibility for a individual to be treated in a manner that is not correct if the correct information is not provided.

Non-resident aliens are subjected to 30 percent withholding. Non-resident aliens may be qualified for an exemption. This is the case if your tax burden lower than 30 percent. There are many different exemptions. Some are only for spouses, dependents, or children.

In general, the chapter 4 withholding entitles you to a refund. Refunds are permitted under Sections 1471-1474. The person who is the withholding agent or the person who withholds the tax at source is the one responsible for distributing these refunds.

relational status

An official marital status form withholding form can help your spouse and you both get the most out of your time. The bank may be surprised by the amount of money you’ve deposited. The challenge is in deciding which of the numerous options to select. There are certain items you must avoid. Making the wrong decision will cost you a lot. However, if the instructions are followed and you pay attention you shouldn’t face any issues. If you’re fortunate you could even meet some new friends on your travels. Today marks the anniversary. I’m hoping they reverse the tide in order to assist you in getting that elusive engagement ring. It’s a complex job that requires the knowledge of an expert in taxation. A little amount can create a lifetime of wealth. There is a wealth of information online. TaxSlayer is one of the most trusted and respected tax preparation companies.

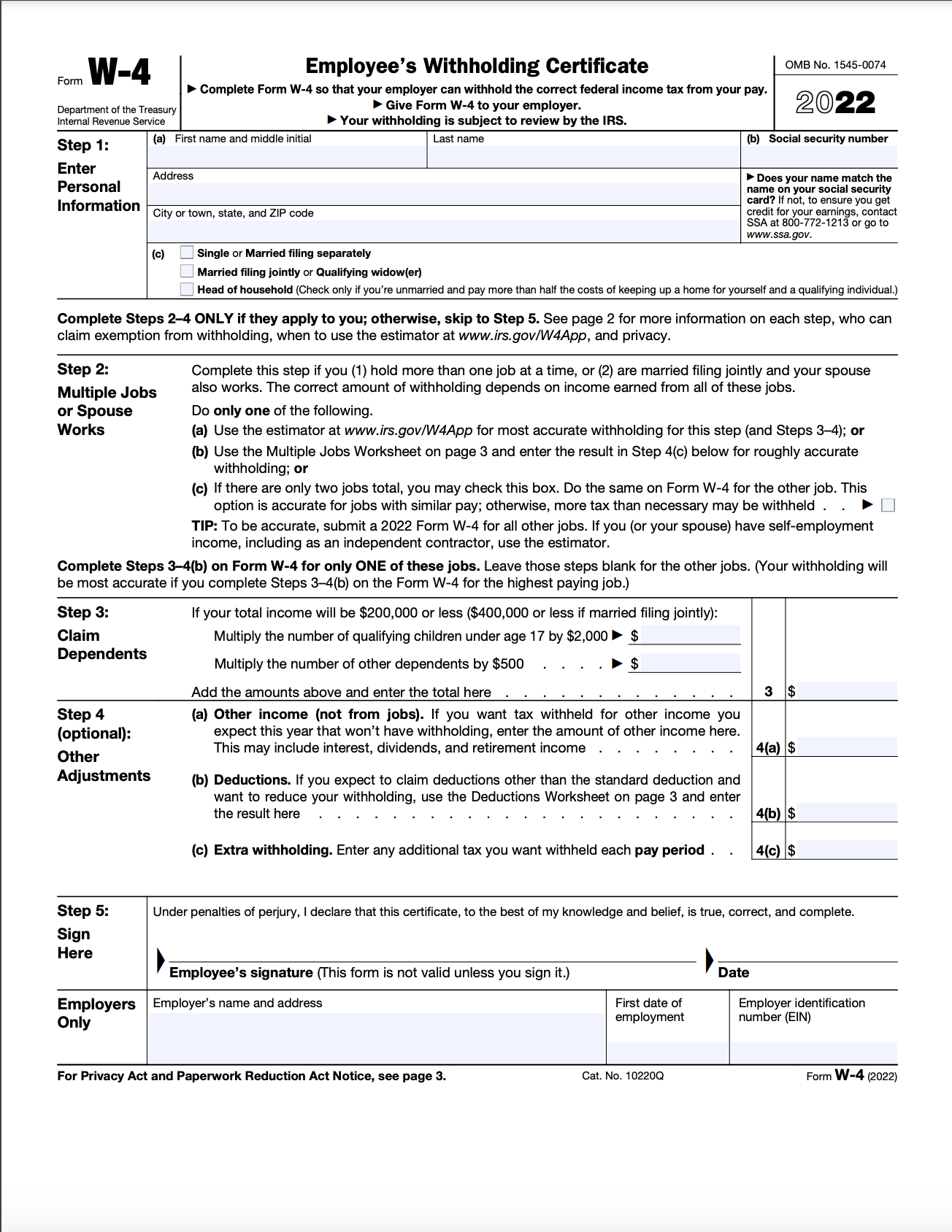

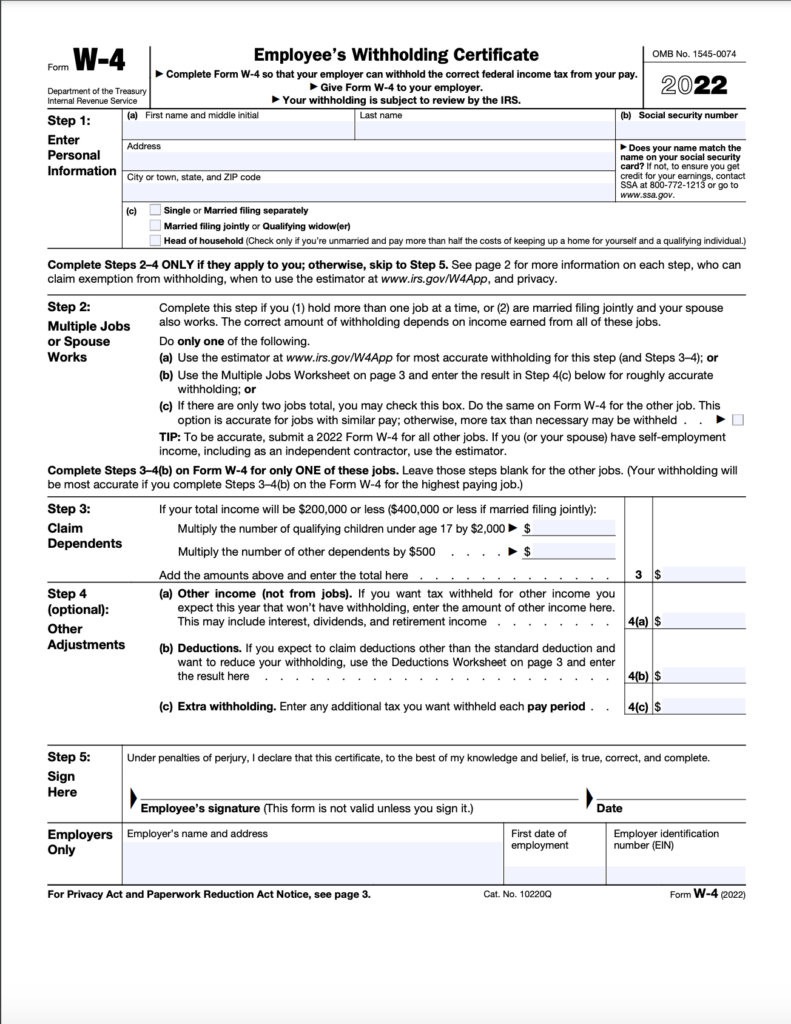

The amount of withholding allowances claimed

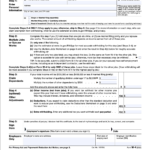

It is crucial to indicate the amount of the withholding allowance you want to claim in the form W-4. This is important because the tax withheld will affect the amount taken out of your paycheck.

You could be eligible to claim an exemption for your spouse when you’re married. Your income will determine how many allowances you can receive. A higher allowance may be available if you earn lots of money.

You could save a lot of money by determining the right amount of tax deductions. It is possible to receive an income tax refund when you file the annual tax return. However, you must choose your strategy carefully.

Similar to any financial decision, you must do your research. To determine the amount of tax withholding allowances that need to be claimed, use calculators. An expert could be a good alternative.

Formulating specifications

If you’re an employer, you must collect and report withholding taxes from your employees. You can submit paperwork to the IRS for a few of these taxation. Additional paperwork that you may need to submit include the reconciliation of your withholding tax as well as quarterly tax returns as well as the annual tax return. Here’s some details about the various tax forms and when they must be submitted.

Tax returns withholding may be required for certain incomes such as salary, bonuses and commissions, as well as other income. It is also possible to be reimbursed of taxes withheld if you’re employees received their wages promptly. Remember that these taxes may be considered to be local taxes. There are also unique withholding techniques that can be used in certain circumstances.

Electronic submission of withholding forms is required according to IRS regulations. You must include your Federal Employer ID Number when you file at your income tax return from the national tax system. If you don’t, you risk facing consequences.