Delaware Employer Withholding Tax Form – There are many reasons one might decide to fill out a form for withholding form. These factors include documentation requirements, withholding exemptions, and the amount of withholding allowances. You should be aware of these things regardless of your reason for choosing to submit a request form.

Withholding exemptions

Nonresident aliens are required once a year to submit Form1040-NR. If you meet the criteria, you could be qualified for exemption from withholding. The exclusions you can find on this page are yours.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The form provides information about the withholding that is performed by the agency responsible for withholding to report federal income tax purposes. Please ensure you are entering the correct information when filling out this form. If this information is not supplied, one person may be diagnosed with a medical condition.

The non-resident alien withholding tax is 30 percent. The tax burden of your business should not exceed 30% in order to be exempt from withholding. There are many exemptions offered. Certain of them are designed for spouses, whereas others are meant for use by dependents such as children.

In general, withholding under Chapter 4 entitles you for the right to a refund. As per Sections 1471 to 1474, refunds can be made. The refunds are made by the withholding agents, which is the person who is responsible for withholding taxes at source.

Relationship status

Your and your spouse’s job can be made easier by a proper marriage-related status withholding document. Additionally, the quantity of money you can put at the bank could delight you. Knowing which of the several possibilities you’re most likely to decide is the biggest challenge. Certain, there are things you should avoid doing. It’s expensive to make the wrong choice. However, if you adhere to the directions and keep your eyes open to any possible pitfalls You won’t face any issues. If you’re lucky you might meet some new friends on your trip. Today is the anniversary of your marriage. I’m sure you’ll utilize it against them to search for that one-of-a-kind wedding ring. To do it right you’ll require the assistance of a certified accountant. It’s worth it to build wealth over the course of a lifetime. There are numerous online resources that can provide you with information. TaxSlayer is a trusted tax preparation company.

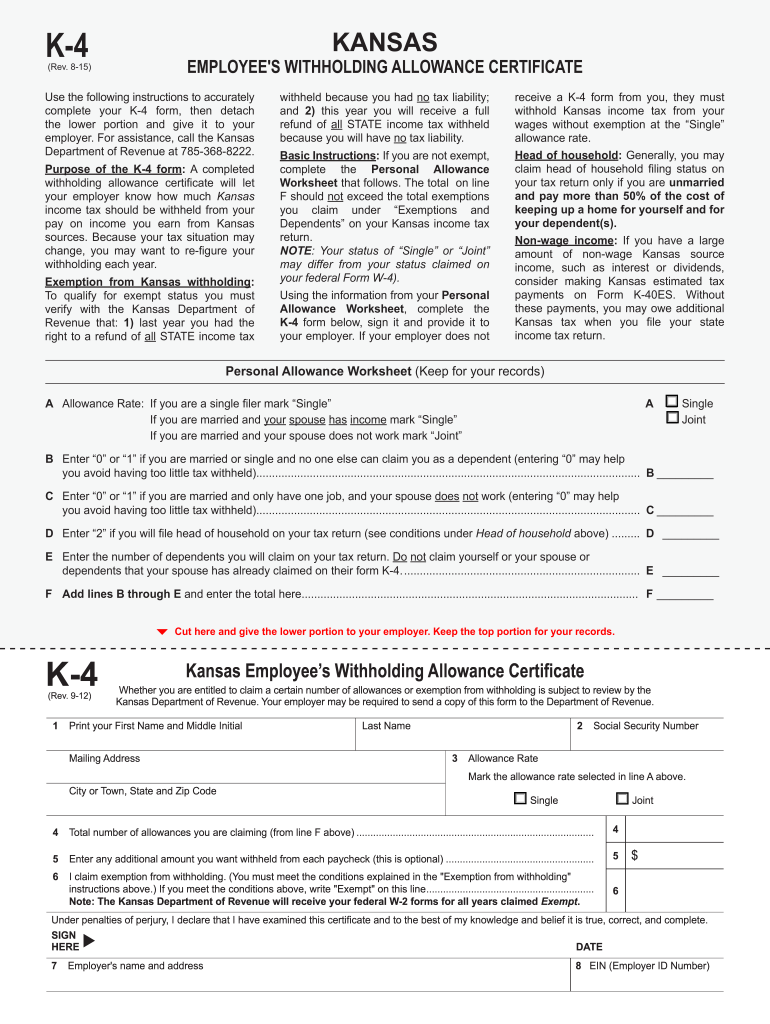

number of claimed withholding allowances

When you fill out Form W-4, you should specify the number of withholdings allowances you would like to claim. This is essential since the withholdings can have an effect on the amount of tax is taken out of your paycheck.

There are a variety of factors that can determine the amount that you can claim for allowances. Your income also determines the amount of allowances you’re entitled to. You could be eligible to claim an increase in allowances if you have a large amount of income.

Choosing the proper amount of tax deductions might help you avoid a hefty tax payment. The possibility of a refund is possible if you submit your income tax return for the current year. However, be careful about how you approach the tax return.

Similar to any other financial decision, you should conduct your homework. Calculators are a great tool to determine how many withholding allowances are required to be claimed. In addition to a consultation with a specialist.

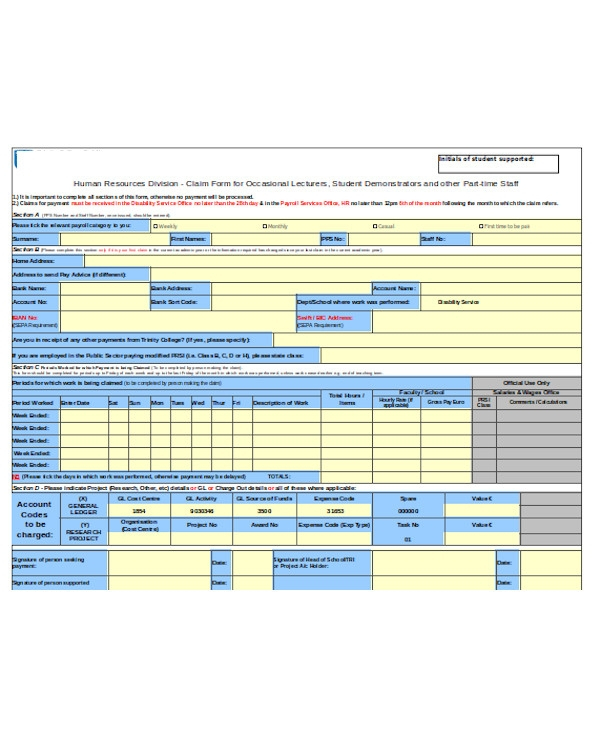

Formulating specifications

Employers should report the employer who withholds tax from their employees. The IRS may accept forms to pay certain taxes. A withholding tax reconciliation, the quarterly tax return or an annual tax return are examples of additional paperwork you might be required to submit. Here’s a brief overview of the different tax forms, and when they must be submitted.

To be eligible to receive reimbursement for withholding taxes on the pay, bonuses, commissions or any other earnings received from your employees, you may need to file a tax return for withholding. It is also possible to be reimbursed for taxes withheld if your employees were paid in time. Remember that these taxes could also be considered county taxes. There are specific methods of withholding that are suitable in certain circumstances.

In accordance with IRS regulations Electronic submissions of withholding forms are required. The Federal Employer Identification number must be included when you submit at your national tax return. If you don’t, you risk facing consequences.