Delaware Employee Withholding Form – There are many reasons for a person to decide to complete a withholding form. Documentation requirements, withholding exemptions as well as the quantity of withholding allowances required are just a few of the factors. There are some things you should remember regardless of why that a person has to fill out an application.

Withholding exemptions

Non-resident aliens must complete Form 1040-NR once a year. If you meet these conditions, you could be eligible to receive an exemption from the withholding forms. This page you will discover the exemptions that you can avail.

For submitting Form 1040-NR include Form 1042-S. This document lists the amount withheld by the withholding agencies for federal tax reporting to be used for reporting purposes. Fill out the form correctly. One person may be treated if the information is not supplied.

Non-resident aliens are subject to the option of paying a 30% tax on withholding. If the tax you pay is lower than 30 percent of your withholding you may qualify for an exemption from withholding. There are many exemptions. Some are only for spouses and dependents such as children.

The majority of the time, a refund is available for chapter 4 withholding. As per Sections 1471 to 1474, refunds can be made. These refunds are provided by the withholding agent (the person who is responsible for withholding tax at the source).

Relational status

A form for a marital withholding is an excellent way to make your life easier and aid your spouse. Additionally, the quantity of money you may deposit at the bank could delight you. It isn’t easy to determine what option you’ll pick. There are certain aspects you should be aware of. Making a mistake can have costly consequences. If you adhere to the rules and follow the directions, you shouldn’t encounter any issues. If you’re lucky, you might even make new acquaintances while traveling. Today is the anniversary. I hope you are capable of using this against them in order to acquire that elusive wedding ring. To do it right you’ll need the assistance of a certified accountant. The small amount is well worthwhile for the life-long wealth. It is a good thing that you can access many sources of information online. TaxSlayer is a trusted tax preparation firm.

the number of claims for withholding allowances

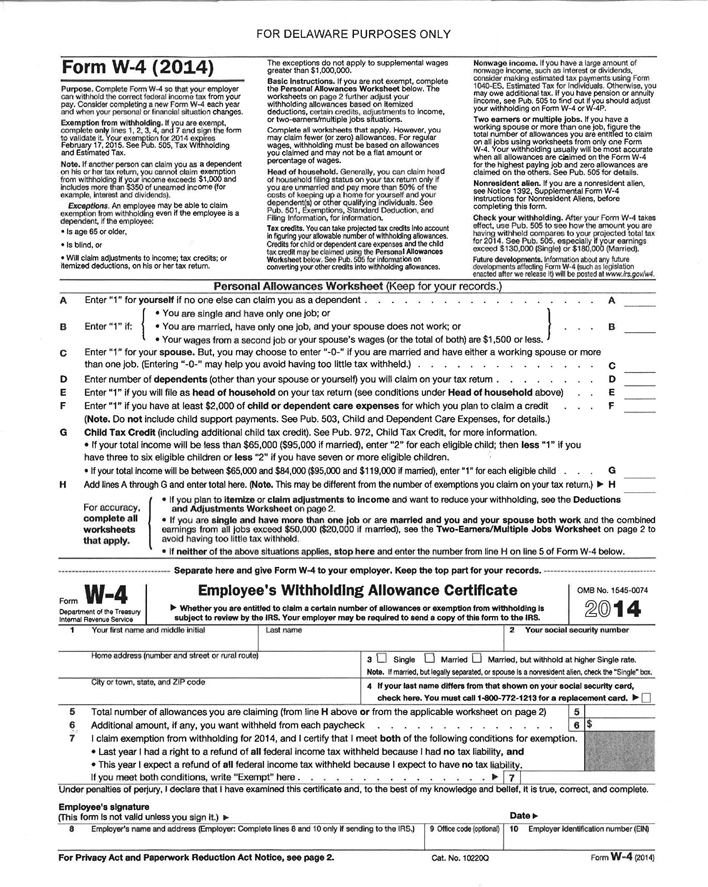

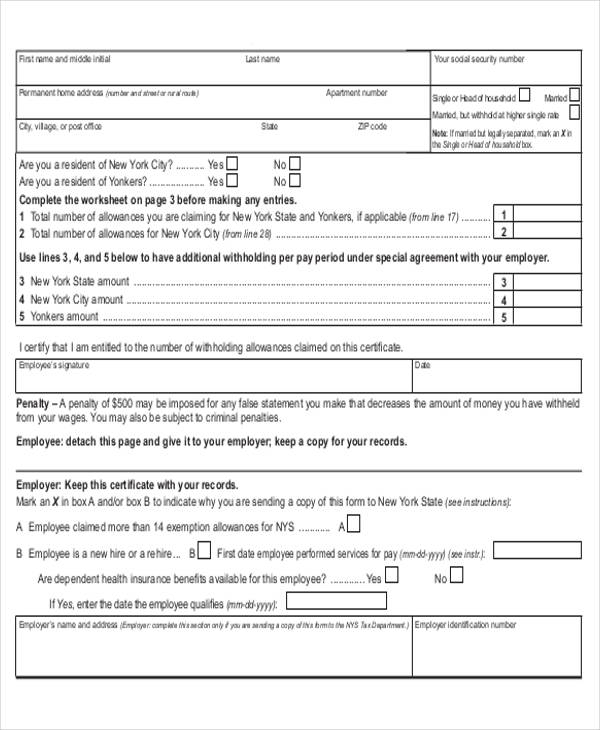

The W-4 form must be filled in with the amount of withholding allowances you wish to be able to claim. This is important because it affects how much tax you will receive from your pay checks.

Many factors determine the amount that you can claim for allowances. Your income also determines the amount of allowances you’re eligible to claim. You could be eligible to claim an increase in allowances if you have a large amount of income.

Choosing the proper amount of tax deductions might help you avoid a hefty tax payment. It is possible to receive the amount you owe if you submit your annual tax return. However, you must choose your approach wisely.

In any financial decision, you should do your research. Calculators can help determine how many withholding amounts should be demanded. Another option is to talk with a specialist.

Submission of specifications

Withholding taxes on your employees must be collected and reported if you are an employer. The IRS can accept paperwork to pay certain taxes. A tax return for the year and quarterly tax returns, or tax withholding reconciliations are just a few examples of paperwork you might need. Here’s some information about the different forms of withholding tax categories as well as the deadlines for filing them.

Tax withholding returns can be required for income such as bonuses, salary and commissions, as well as other income. In addition, if you pay your employees on time it could be possible to qualify to be reimbursed for any taxes that were not withheld. Noting that certain of these taxes are taxes imposed by the county, is important. There are also unique withholding methods that are utilized in certain circumstances.

You are required to electronically submit tax withholding forms as per IRS regulations. You must include your Federal Employer ID Number when you point at your income tax return from the national tax system. If you don’t, you risk facing consequences.

Gallery of Delaware Employee Withholding Form

State Tax Withholding Forms Template Free Download Speedy Template