Dc State Withholding Form 2024 – There are many reasons someone may choose to fill out withholding forms. These factors include documentation requirements and exemptions from withholding. There are a few things you should remember regardless of the reason the person fills out a form.

Exemptions from withholding

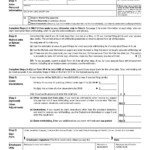

Non-resident aliens are required to complete Form 1040-NR every year. However, if you satisfy the minimum requirements, you could be able to submit an exemption form from withholding. The exclusions are that you can access on this page.

The first step in submit Form 1040 – NR is to attach the Form 1042 S. This form provides details about the withholding that is performed by the withholding agency to report federal income tax purposes. Fill out the form correctly. This information might not be given and result in one person being treated.

The tax withholding rate for non-resident aliens is 30 percent. An exemption from withholding may be available if you have an income tax burden of lower than 30%. There are many exemptions. Certain exclusions are only applicable to spouses and dependents like children.

In general, you’re eligible for a reimbursement under chapter 4. Refunds may be granted in accordance with Sections 1400 through 1474. Refunds are given to the tax agent withholding the person who withholds the tax at the source.

Relational status

The correct marital status as well as withholding forms will ease the work of you and your spouse. You’ll be surprised by the amount of money you can deposit to the bank. The problem is picking the right bank from the multitude of possibilities. There are certain actions you shouldn’t do. It will be costly to make the wrong choice. If you stick to the directions and be alert for any potential pitfalls, you won’t have problems. You might make some new acquaintances if you’re fortunate. Today is the day you celebrate your marriage. I’m hoping that you can make use of it to find that perfect ring. If you want to do this properly, you’ll require the guidance of a certified Tax Expert. A lifetime of wealth is worth that small amount. There are a myriad of online resources that provide information. TaxSlayer is among the most trusted and respected tax preparation firms.

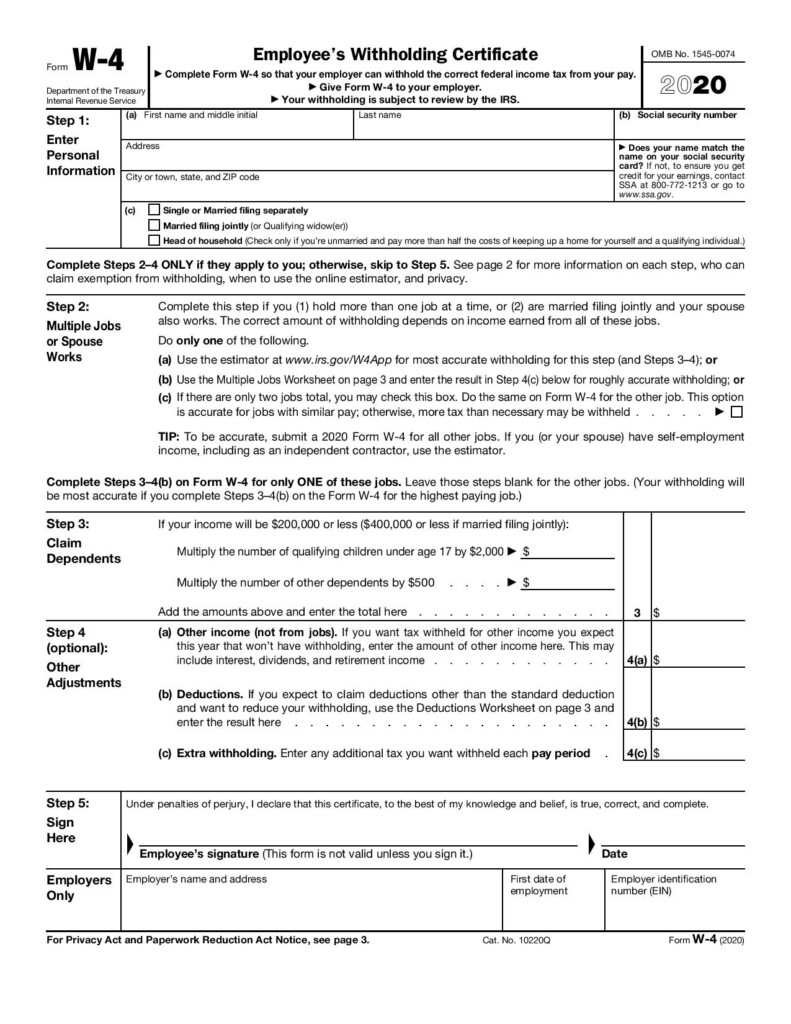

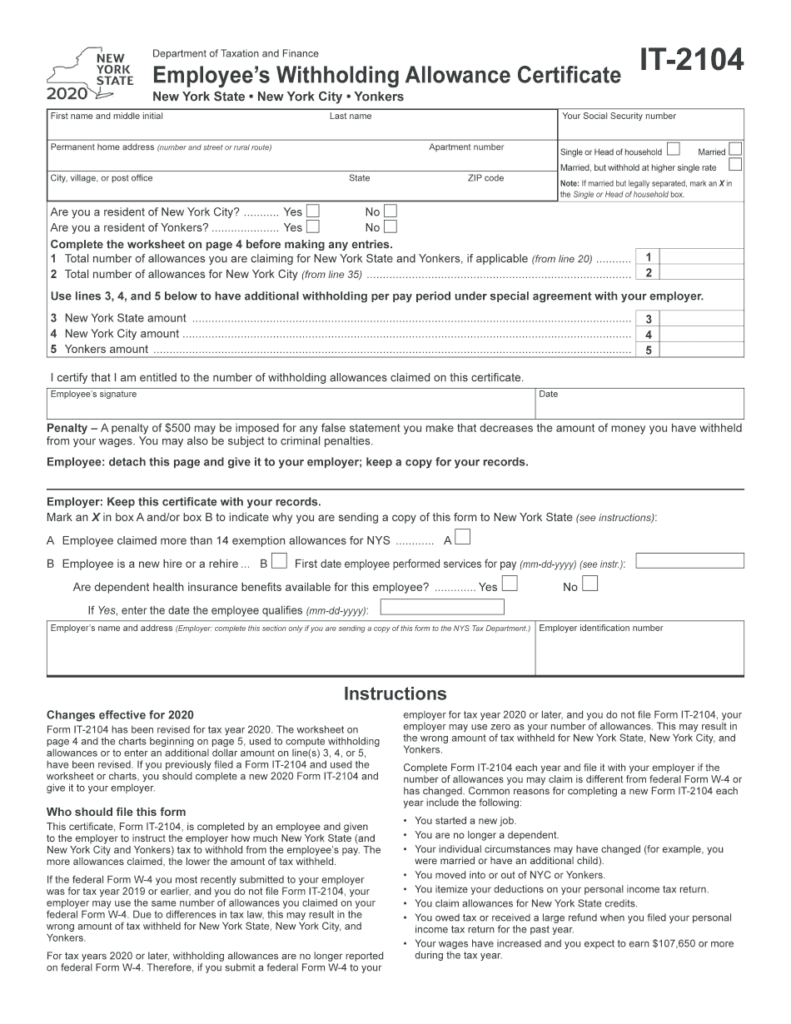

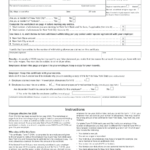

The number of withholding allowances requested

On the W-4 form you fill out, you need to indicate the amount of withholding allowances you requesting. This is crucial because it affects the amount of tax you get from your paychecks.

You may be able to apply for an exemption on behalf of your spouse when you’re married. Your income level can also affect the number of allowances offered to you. A larger allowance might be granted if you make lots of money.

It is possible to avoid paying a large tax bill by choosing the correct amount of tax deductions. In reality, if you submit your annual income tax return, you might even receive a refund. It is important to be cautious about how you approach this.

As with any financial decision it is essential to conduct your research. Calculators are readily available to aid you in determining the amount of withholding allowances are required to be claimed. You can also speak to a specialist.

Formulating specifications

Employers must report the employer who withholds tax from their employees. The IRS can accept paperwork for certain taxes. A tax reconciliation for withholding and the quarterly tax return as well as the annual tax return are examples of additional paperwork you might have to file. Here’s some details on the different forms of withholding tax categories as well as the deadlines for filing them.

Your employees might require the submission of withholding tax returns to be eligible for their salary, bonuses and commissions. If you make sure that your employees are paid on time, you may be eligible for reimbursement of any withheld taxes. You should also remember that some of these taxes might be county taxes. In addition, there are specific withholding practices that can be applied under particular circumstances.

Electronic filing of withholding forms is required according to IRS regulations. You must provide your Federal Employer ID Number when you submit your national income tax return. If you don’t, you risk facing consequences.