Dc 2024 Withholding Form – There stand a digit of reasons for a person to decide to fill out a form for withholding. Withholding exemptions, documentation requirements as well as the quantity of allowances for withholding requested are all factors. There are certain things you should remember regardless of the reason that a person has to fill out the form.

Withholding exemptions

Non-resident aliens must file Form 1040-NR at least once a year. However, if your requirements are met, you may be eligible to apply for an exemption from withholding. This page lists all exemptions.

To complete Form 1040-NR, attach Form 1042-S. The form lists the amount that is withheld by the tax withholding authorities for federal tax reporting for tax reporting purposes. Be sure to enter the correct information as you fill in the form. It is possible that you will have to treat a single person for not providing the correct information.

Nonresident aliens have the option of paying a 30% tax on withholding. The tax burden of your business must not exceed 30% in order to be eligible for exemption from withholding. There are a variety of exemptions. Some of them apply to spouses or dependents, like children.

Generally, withholding under Chapter 4 gives you the right to an amount of money back. Refunds are allowed according to Sections 1471-1474. The person who is the withholding agent or the person who withholds the tax at source, is the one responsible for distributing these refunds.

Status of the relationship

A proper marital status withholding can help you and your spouse to complete your tasks. You will be pleasantly surprised by the amount of money you can transfer to the bank. The challenge is in deciding what option to pick. Be cautious about what you do. The wrong decision can result in a costly loss. You won’t have any issues If you simply adhere to the instructions and be attentive. If you’re fortunate you could even meet acquaintances when you travel. Today marks the anniversary. I’m hoping that they will turn it against you to help you get that elusive engagement ring. To do it right you’ll need the aid of a qualified accountant. This small payment is well enough to last the life of your wealth. There are tons of websites that offer details. TaxSlayer and other reputable tax preparation companies are some of the top.

Number of claimed withholding allowances

In submitting Form W-4 you must specify how many withholding allowances you wish to claim. This is critical as your paychecks may depend on the tax amount that you pay.

There are a variety of factors that can determine the amount that you can claim for allowances. Your income can impact how many allowances are offered to you. An additional allowance could be granted if you make an excessive amount.

A tax deduction appropriate for your situation could aid you in avoiding large tax obligations. In addition, you could be eligible for a refund when the annual tax return has been completed. However, it is crucial to choose the right approach.

Just like with any financial decision it is essential to research the subject thoroughly. Calculators are readily available to assist you in determining how much withholding allowances are required to be claimed. Alternative options include speaking with a specialist.

Submission of specifications

If you are an employer, you have to pay and report withholding tax from your employees. In the case of a small amount of these taxes, you may provide documentation to the IRS. A tax return that is annually filed and quarterly tax returns, or withholding tax reconciliation are all examples of paperwork you might require. Below are information on the different withholding tax forms and their deadlines.

The compensation, bonuses, commissions, and other income that you receive from employees might require you to file withholding tax returns. If you pay your employees on time, you may be eligible for reimbursement of any withheld taxes. Be aware that these taxes could be considered as county taxes. There are also special withholding methods which can be utilized in certain circumstances.

You are required to electronically submit withholding forms according to IRS regulations. Your Federal Employer Identification number must be noted when you file at your national tax return. If you don’t, you risk facing consequences.

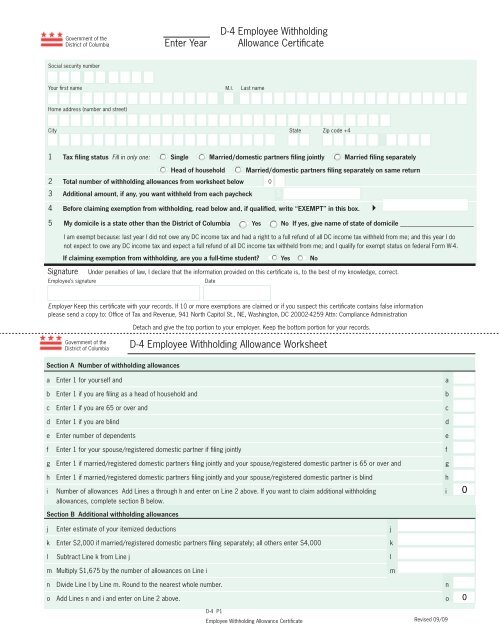

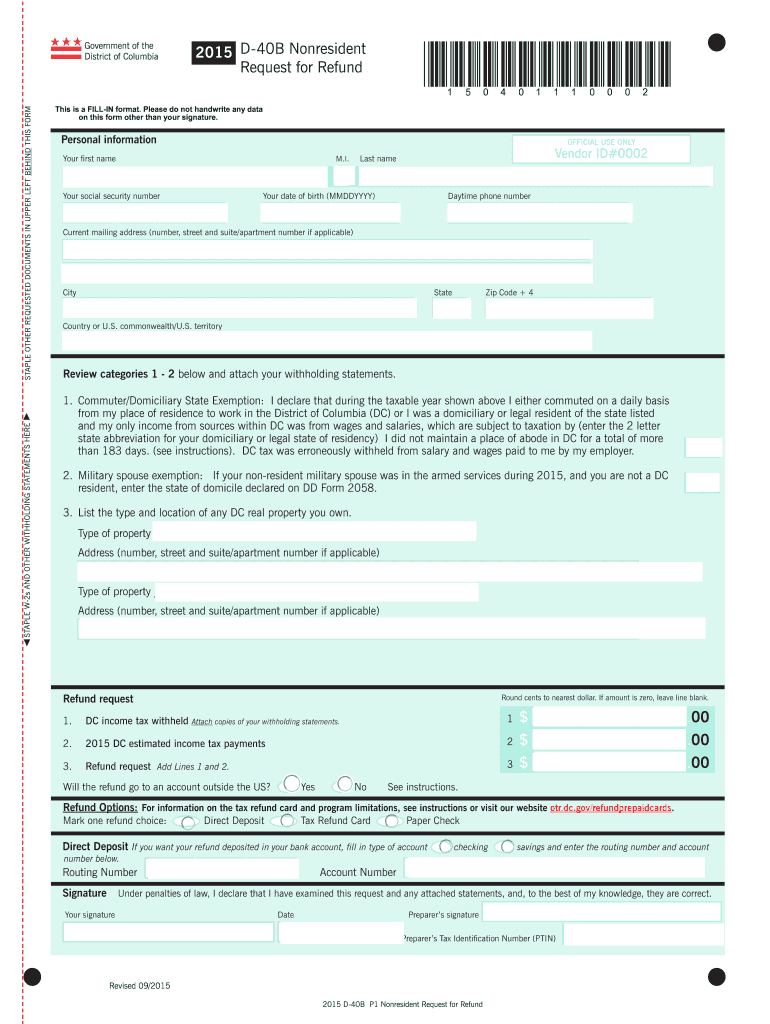

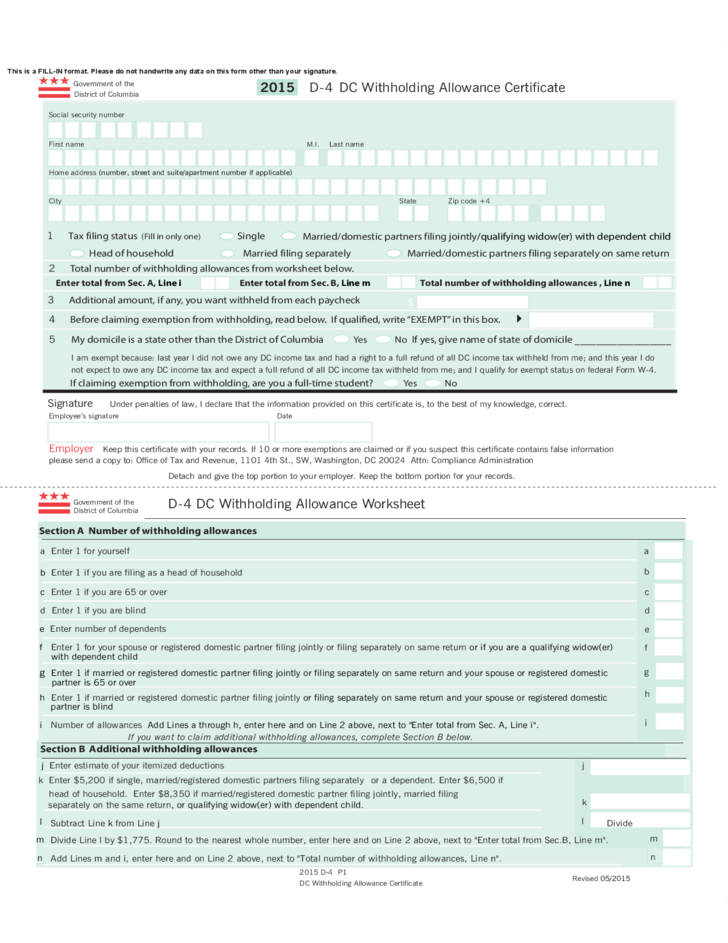

Gallery of Dc 2024 Withholding Form

Washington Dc Income Tax Withholding Form WithholdingForm