Current Date Sales Use And Withholding Tax Forms – There are many reasons that one could fill out the form to request withholding. These factors include the documents required, the exclusion of withholding as well as the withholding allowances. You should be aware of these factors regardless of why you choose to submit a request form.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR at least once every year. If you fulfill the criteria, you may be eligible to submit an exemption form from withholding. There are exemptions that you can access on this page.

The attachment of Form 1042-S is the first step to file Form 1040-NR. To report federal income tax purposes, this form details the withholdings made by the tax agency that handles withholding. When you fill out the form, ensure that you provide the correct information. A person could be treated differently if this information is not supplied.

Nonresident aliens have 30 percent withholding tax. Nonresident aliens could be qualified for an exemption. This applies if your tax burden is lower than 30%. There are many different exemptions. Certain of them are applicable to spouses or dependents, like children.

In general, you’re eligible to receive a refund in accordance with chapter 4. According to Sections 1471 through 1474, refunds are given. Refunds are to be given by the agents who withhold taxes who is the person who withholds taxes at the source.

Status of relationships

A valid marital status and withholding forms can simplify the work of you and your spouse. The bank could be shocked by the amount that you deposit. It isn’t easy to determine what option you’ll choose. Be cautious about when you make a decision. It can be expensive to make the wrong choice. If you adhere to the rules and follow the instructions, you won’t encounter any issues. If you’re lucky, you might even make new acquaintances while you travel. Today marks the anniversary. I’m hoping you can make use of it to find that perfect wedding ring. It will be a complicated job that requires the experience of an expert in taxation. The accumulation of wealth over time is more than the modest payment. Fortunately, you can find a ton of information online. TaxSlayer is a reputable tax preparation firm.

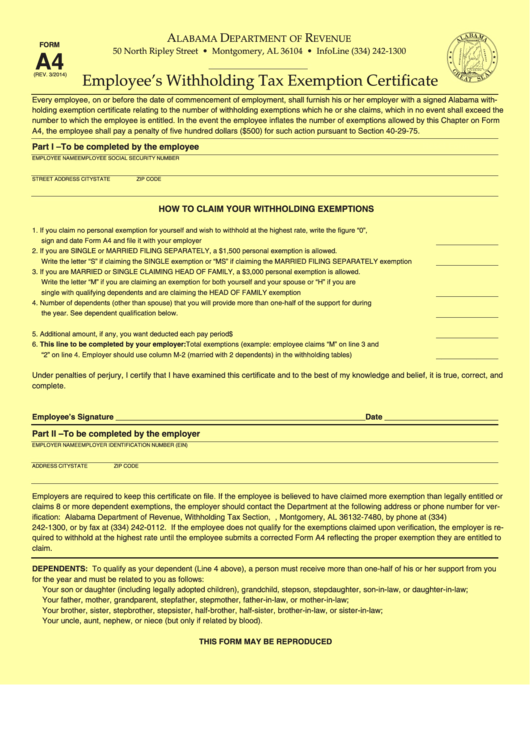

Amount of withholding allowances claimed

When you fill out Form W-4, you must specify how many withholding allowances you want to claim. This is important because the tax withheld can affect the amount of tax taken from your pay check.

You may be eligible to apply for an exemption on behalf of the head of your household if you are married. The amount of allowances you are eligible for will be contingent on the income you earn. A higher allowance may be available if you earn a lot.

Selecting the appropriate amount of tax deductions might allow you to avoid a significant tax payment. If you submit the annual tax return for income and you are entitled to a refund. However, it is crucial to select the correct method.

Research like you would with any other financial decision. Calculators are readily available to help you determine how much withholding allowances are required to be claimed. A better option is to consult to a professional.

Specifications for filing

Employers must pay withholding taxes to their employees and then report the tax. For some taxes, you may submit paperwork to IRS. A withholding tax reconciliation, a quarterly tax return, or the annual tax return are some examples of additional documents you could have to file. Here’s some details on the different forms of withholding tax categories as well as the deadlines for filling them out.

Your employees may require you to file withholding tax returns to be eligible for their salary, bonuses and commissions. Additionally, if you pay your employees on time you may be eligible to be reimbursed for any taxes not withheld. It is important to note that some of these taxes may be taxes imposed by the county, is vital. In certain circumstances the rules for withholding can be different.

According to IRS rules, you must electronically submit withholding forms. When you submit your national revenue tax return make sure you provide the Federal Employer Identification number. If you don’t, you risk facing consequences.