Colorado Wage Withholding Tax Form Dr 1094 – There are many reasons that an individual could submit the form to request withholding. These factors include documentation requirements including withholding exemptions and the amount of withholding allowances. No matter what the reason is for an individual to file documents there are certain aspects you must keep in mind.

Withholding exemptions

Nonresident aliens are required to submit Form 1040-NR at least once per year. If the requirements are met, you may be eligible to request an exemption from withholding. This page you’ll find the exclusions for you to choose from.

To complete Form 1040-NR, attach Form 1042-S. The form provides information about the withholding process carried out by the tax agency that handles withholding for federal income tax reporting to be used for reporting purposes. Complete the form in a timely manner. It is possible that you will have to treat one individual if you do not provide this information.

The 30% tax withholding rate for non-resident aliens is 30 percent. Your tax burden should not exceed 30% to be eligible for exemption from withholding. There are many exemptions available. Some are only for spouses or dependents like children.

In general, chapter 4 withholding allows you to receive an amount of money. Refunds can be claimed under sections 1401, 1474, and 1475. Refunds are provided by the tax agent. The withholding agent is the person accountable for tax withholding at the source.

Relational status

A valid marital status withholding will make it easier for you and your spouse to complete your tasks. You’ll also be surprised by with the amount of money you can put in the bank. It isn’t easy to determine which one of the many options is most appealing. Certain aspects should be avoided. Making the wrong choice could cost you a lot. If you follow the instructions and adhere to them, there won’t be any problems. If you’re lucky, you might even make new acquaintances while you travel. Today is the day you celebrate your marriage. I’m hoping you’ll be able to utilize it to secure that elusive diamond. To complete the task correctly, you will need to get the help of a tax professional who is certified. The small amount is well worth it for a lifetime of wealth. Online information is readily available. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

The amount of withholding allowances that are claimed

It is important to specify the amount of withholding allowances you would like to claim on the form W-4. This is important because the amount of tax you are able to deduct from your paychecks will depend on how much you withhold.

There are a variety of factors that affect the allowances requested.If you’re married as an example, you could be eligible for an exemption for head of household. The amount you earn will influence how many allowances your are entitled to. If you have a high income, you can request an increase in your allowance.

Tax deductions that are appropriate for you could allow you to avoid tax bills. If you file your annual income tax return, you might even get a refund. But be sure to choose your approach carefully.

As with any financial decision it is crucial to research the subject thoroughly. Calculators are a great tool to figure out how many withholding allowances should be claimed. Alternative options include speaking with a specialist.

Formulating specifications

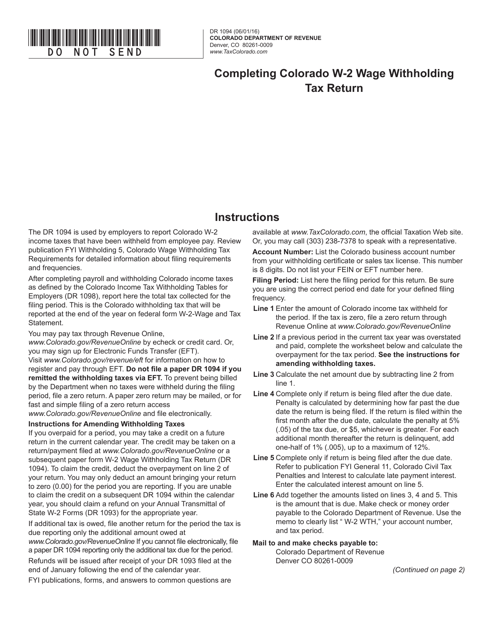

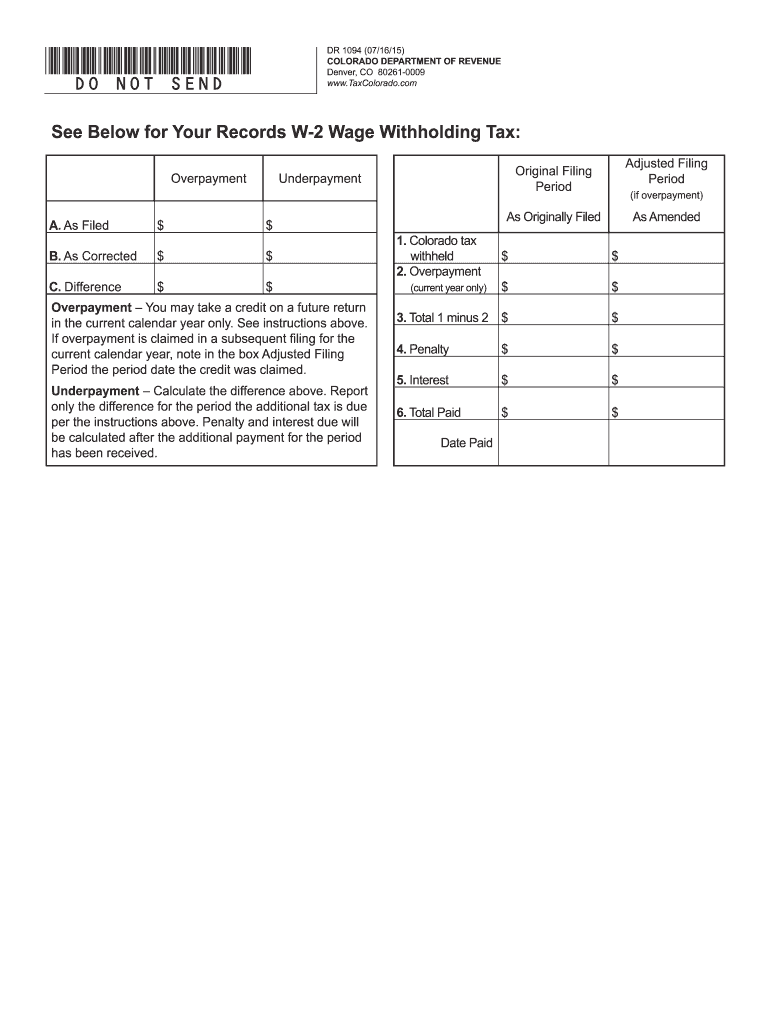

Withholding taxes on your employees must be collected and reported if you’re an employer. For certain taxes you might need to submit documentation to IRS. You might also need additional documentation , like a withholding tax reconciliation or a quarterly tax return. Here’s some information about the different tax forms, and when they need to be filed.

To be qualified for reimbursement of withholding taxes on the salary, bonus, commissions or any other earnings earned by your employees it is possible to submit withholding tax return. If you pay your employees on time, you may be eligible to receive the refund of taxes that you withheld. It is important to note that some of these taxes are taxation by county is vital. Furthermore, there are special tax withholding procedures that can be applied under particular situations.

The IRS regulations require you to electronically submit your withholding documentation. You must provide your Federal Employer Identification Number when you submit your national income tax return. If you don’t, you risk facing consequences.

Gallery of Colorado Wage Withholding Tax Form Dr 1094

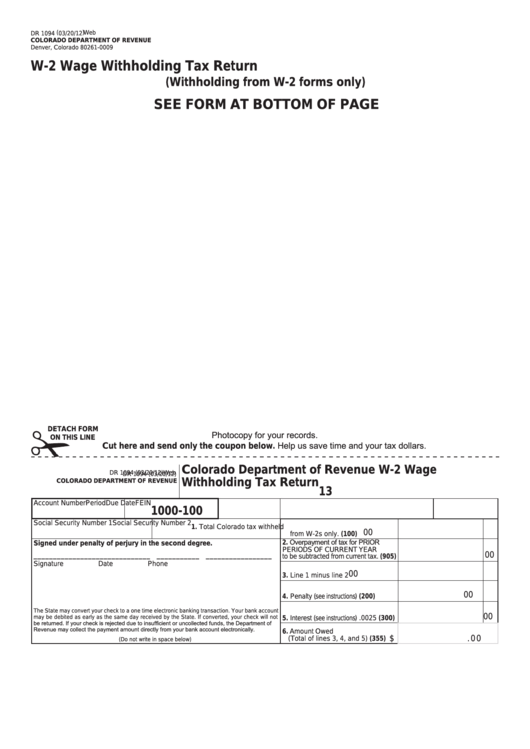

Colorado Wage Withholding Tax Form Dr 1094 WithholdingForm