Colorado Wage Withholding Form Dr 1094 – There are many reasons why an individual might want to fill out a withholding form. Withholding exemptions, documentation requirements as well as the quantity of allowances for withholding demanded are all elements. No matter the reason for the filing of a document, there are certain things that you need to remember.

Withholding exemptions

Nonresident aliens are required to submit Form 1040-NR once a year. However, if you meet the requirements, you might be eligible to submit an exemption from withholding form. The exclusions are that you can access on this page.

To submit Form 1040-NR, the first step is to attach Form 1042S. This document is required to record federal income tax. It provides the details of the withholding of the withholding agent. Make sure you fill out the form correctly. If the information you provide is not given, a person could be diagnosed with a medical condition.

The non-resident alien tax withholding tax rate is 30. You could be eligible to be exempted from withholding if the tax burden exceeds 30%. There are many different exemptions. Some are for spouses or dependents, for example, children.

The majority of the time, a refund is accessible for Chapter 4 withholding. In accordance with Section 1471 through 1474, refunds are given. Refunds are to be given by the withholding agents that is, the person who collects taxes at the source.

Status of relationships

An official marriage status withholding form will help both of you make the most of your time. You’ll be amazed by the amount you can deposit at the bank. The trick is to decide which of the numerous options to pick. There are certain things you should be aware of. Making a mistake can have expensive negative consequences. If you adhere to the rules and pay attention to instructions, you won’t have any issues. If you’re lucky you might meet some new friends on your trip. Today marks the anniversary of your wedding. I’m sure you’ll be able to leverage it to find that perfect engagement ring. It is best to seek the advice of a certified tax expert to complete it correctly. This small payment is well enough to last the life of your wealth. Information on the internet is readily available. TaxSlayer is a trusted tax preparation company.

The amount of withholding allowances claimed

It is essential to state the amount of withholding allowances which you would like to claim on the Form W-4. This is crucial because your pay will be affected by the amount of tax you pay.

You may be able to request an exemption for your head of household if you are married. Your income level can also affect the number of allowances offered to you. If you earn a high amount it could be possible to receive more allowances.

Choosing the proper amount of tax deductions could allow you to avoid a significant tax payment. Even better, you might even get a refund if your annual income tax return is filed. But be sure to choose the right method.

Research like you would with any financial decision. To figure out the amount of withholding allowances that need to be claimed, you can utilize calculators. As an alternative to a consultation with an expert.

Filing specifications

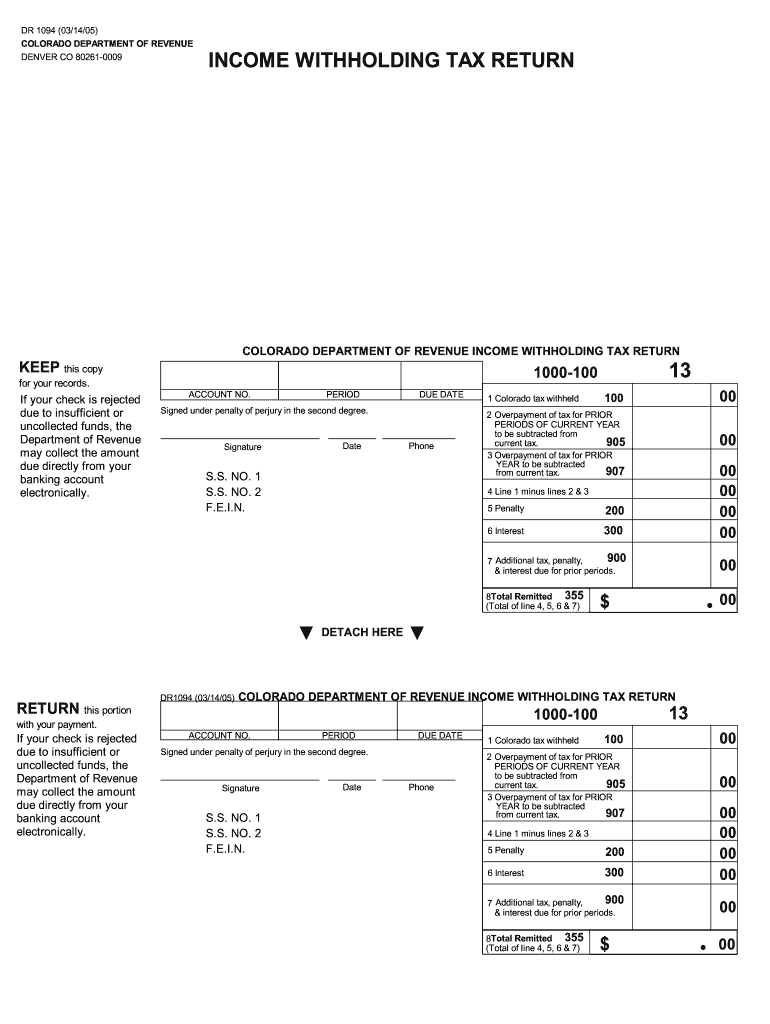

Employers should report the employer who withholds taxes from employees. For some taxes, you may submit paperwork to IRS. A reconciliation of withholding tax, a quarterly tax return, or an annual tax return are examples of additional paperwork you might be required to submit. Here is some information on the different forms of withholding tax categories and the deadlines for filling them out.

Tax returns withholding may be required for certain incomes such as bonuses, salary or commissions as well as other earnings. Additionally, if you pay your employees on-time you may be eligible to receive reimbursement for taxes that were taken out of your paycheck. It is important to note that not all of these taxes are local taxes. Additionally, there are unique methods of withholding that are used in certain circumstances.

The IRS regulations require that you electronically submit withholding documents. When you file your tax returns for national revenue, be sure to provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.