Colorado State Income Tax Withholding Form 2024 – There are many reasons one might choose to fill out forms withholding. The reasons include the need for documentation including withholding exemptions and the quantity of requested withholding allowances. It doesn’t matter what reasons someone is deciding to file the Form, there are several aspects to keep in mind.

Withholding exemptions

Non-resident aliens have to file Form 1040 NR at least once per year. It is possible to file an exemption form from withholding when you meet the requirements. This page you will see the exemptions that are that you can avail.

To file Form 1040-NR the first step is to attach Form 1042S. This form details the withholdings that the agency makes. It is important to enter the correct information when filling out the form. One individual may be treated differently if this information is not provided.

Non-resident aliens are subject to 30 percent withholding tax. The tax burden of your business must not exceed 30% in order to be eligible for exemption from withholding. There are many exemptions. Some are specifically for spouses, and dependents, like children.

In general, chapter 4 withholding gives you the right to an amount of money. Refunds can be claimed under sections 1401, 1474, and 1475. Refunds are to be given by the withholding agents, which is the person who is responsible for withholding taxes at the source.

Relational status

An appropriate marital status that is withheld will make it easier for both you and your spouse to do your work. The bank could be shocked by the amount that you deposit. It isn’t easy to decide which of the many options is most attractive. There are certain actions you should not do. Making a mistake can have expensive results. If you stick to the guidelines and follow them, there shouldn’t be any issues. It is possible to make new acquaintances if fortunate. Since today is the date of your wedding anniversary. I’m hoping that they will turn it against you to help you get the elusive engagement ring. To do this correctly, you’ll need the assistance of a tax expert who is certified. This tiny amount is enough to last the life of your wealth. There is a wealth of information online. TaxSlayer is a reputable tax preparation company.

Number of withholding allowances claimed

In submitting Form W-4 you need to specify how many withholding allowances you want to claim. This is important because the tax withheld will affect the amount of tax taken from your paycheck.

There are many factors which affect the allowance amount you are able to request. If you’re married, you might be qualified for an exemption for head of household. Your income will determine how many allowances you are entitled to. If you have high income it could be possible to receive a higher allowance.

It could save you a lot of money by determining the right amount of tax deductions. If you complete your yearly income tax return, you might even be eligible for a tax refund. But be sure to choose your approach carefully.

Similar to any financial decision, it is important that you must do your research. Calculators will help you determine how many withholding amounts should be requested. If you prefer contact an expert.

Formulating specifications

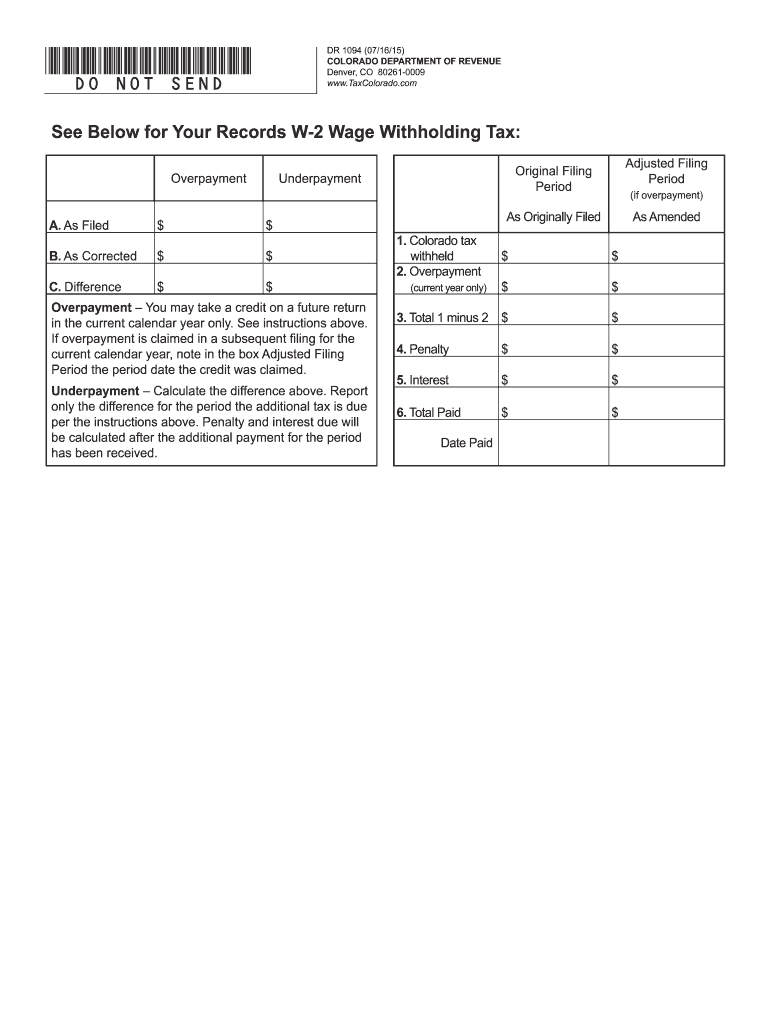

Employers are required to take withholding tax from their employees and report it. You may submit documentation to the IRS to collect a portion of these taxes. It is possible that you will require additional documents, such as an withholding tax reconciliation or a quarterly return. Here’s some information about the different forms of withholding tax categories as well as the deadlines for filing them.

The salary, bonuses commissions, other income that you receive from your employees may require you to file tax returns withholding. Additionally, if you pay your employees promptly, you could be eligible for reimbursement of taxes that were withheld. Remember that these taxes can be considered as taxation by the county. In some situations, withholding rules can also be unique.

The IRS regulations require that you electronically file withholding documents. When you file your national revenue tax returns ensure that you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.

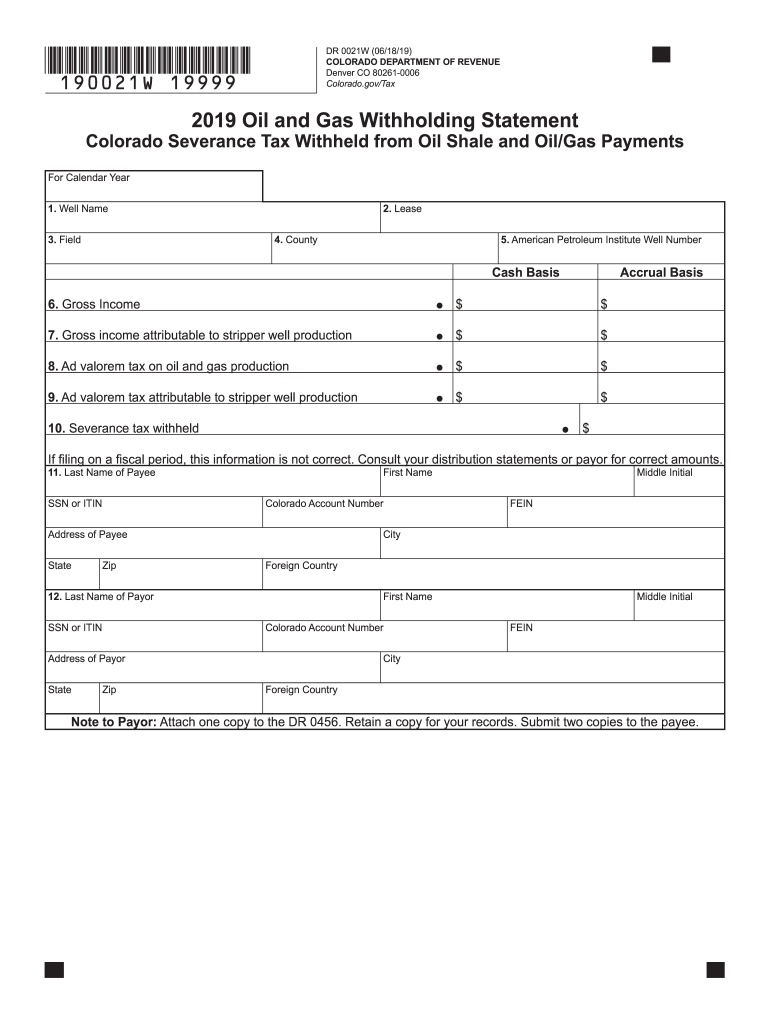

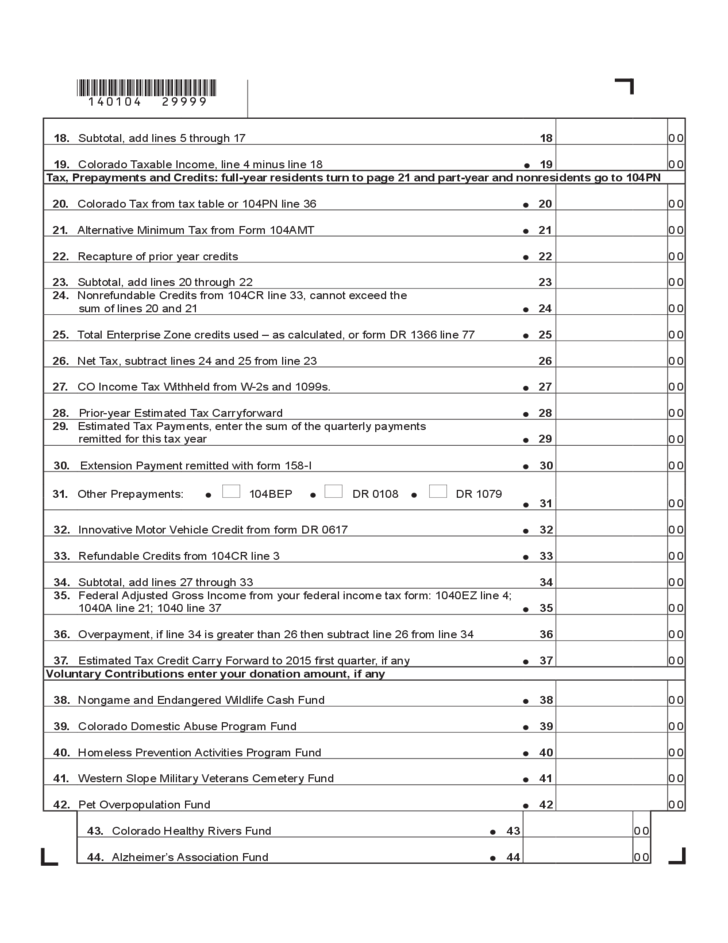

Gallery of Colorado State Income Tax Withholding Form 2024

State Income Tax Withholding Form Colorado WithholdingForm