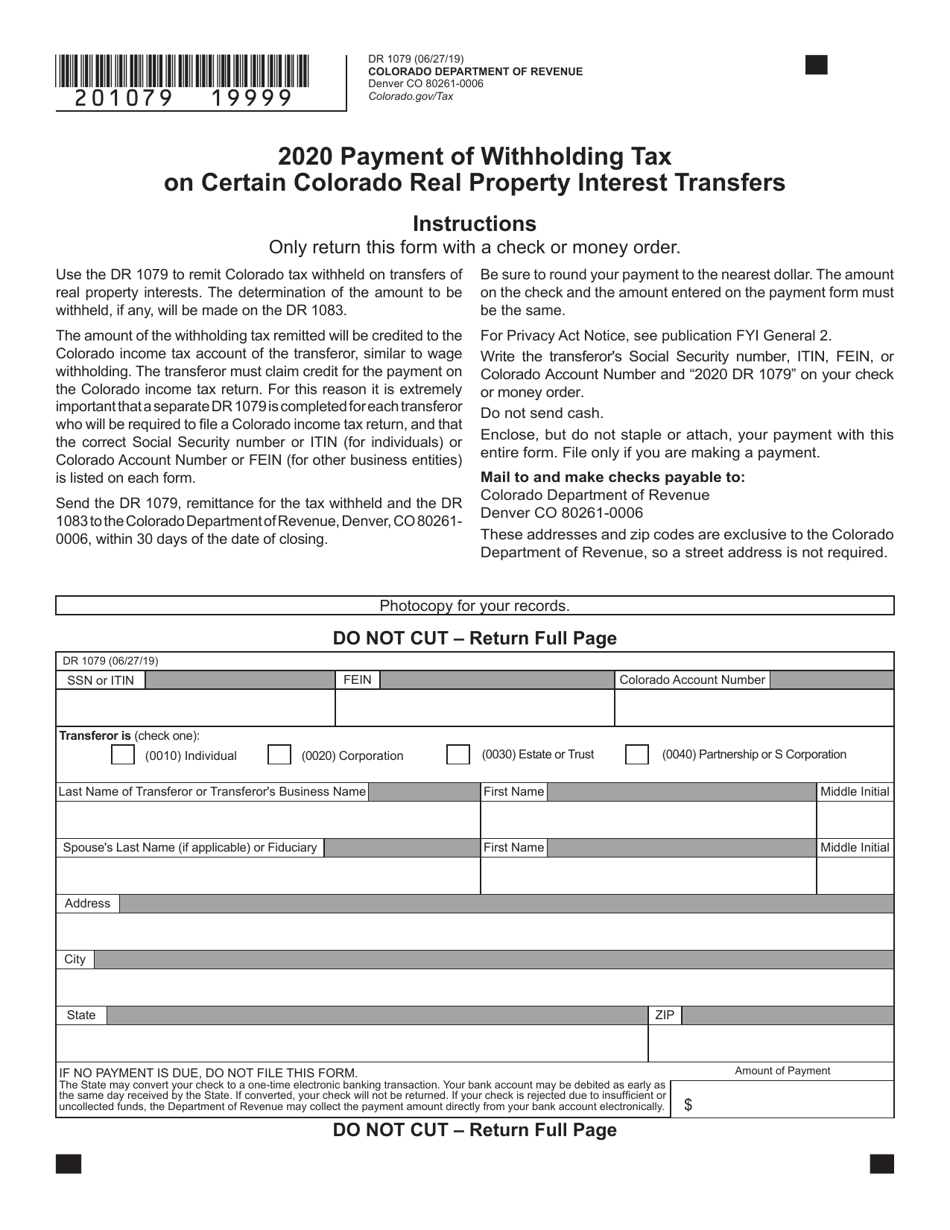

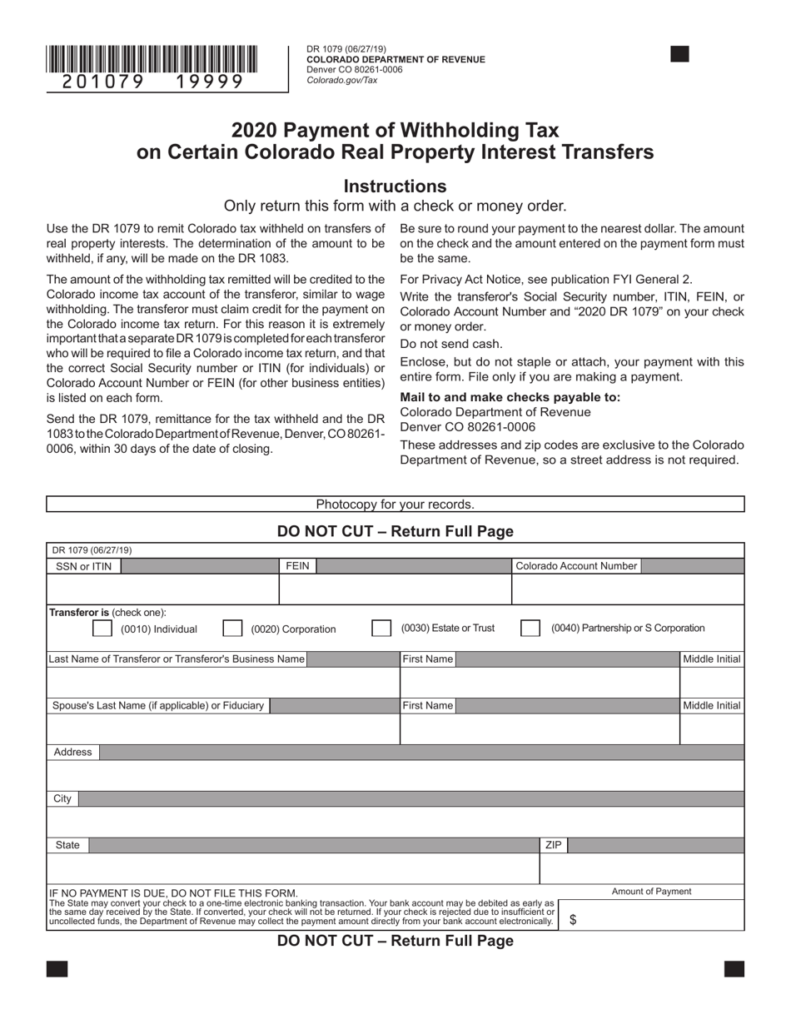

Colorado Real Estate Withholding Tax Form – There are a variety of reasons why a person could choose to submit a withholding application. These factors include the requirements for documentation, exemptions from withholding, as well as the amount of withholding allowances. However, if the person decides to fill out an application there are some aspects to consider.

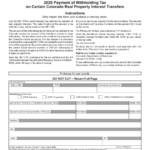

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR every calendar year. It is possible to file an exemption form from withholding in the event that you meet all criteria. The exemptions listed on this page are yours.

The application of Form 1042-S to Form 1042-S is a first step in submitting Form 1040-NR. The form contains information on the withholding process carried out by the tax agency that handles withholding for federal tax reporting for tax reporting purposes. Please ensure you are entering the correct information when filling out this form. You may have to treat one person if you don’t provide this information.

The rate of withholding for non-resident aliens is 30%. A nonresident alien may be qualified for an exemption. This applies if your tax burden is lower than 30 percent. There are many exclusions. Some of them apply to spouses or dependents like children.

Generally, withholding under Chapter 4 entitles you for an amount of money back. Refunds are granted according to Sections 1401, 1474, and 1475. Refunds are given to the withholding agent the person who withholds the tax at the source.

relational status

A valid marital status and withholding forms will ease the work of you and your spouse. It will also surprise you how much you can put in the bank. It isn’t easy to decide which of many choices is most attractive. There are certain actions you should not do. The wrong decision can cause you to pay a steep price. If the rules are adhered to and you are attentive to the rules, you shouldn’t have any problems. If you’re lucky, you may even make new acquaintances while you travel. Since today is the date of your wedding anniversary. I’m sure you’ll take advantage of it to locate that perfect engagement ring. For this to be done properly, you’ll require the advice of a certified Tax Expert. The little amount is enough for a life-long wealth. There are a myriad of websites that offer details. TaxSlayer and other reputable tax preparation firms are a few of the best.

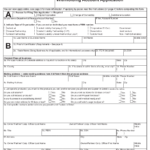

Number of claimed withholding allowances

It is crucial to indicate the amount of the withholding allowance you would like to claim on the Form W-4. This is critical since your wages could depend on the tax amount that you pay.

You may be eligible to request an exemption for your head of household if you are married. The amount you earn will influence how many allowances your are entitled to. You may be eligible for an increase in allowances if you have a large amount of income.

It is possible to avoid paying a large tax bill by deciding on the appropriate amount of tax deductions. You may even get a refund if you file the annual tax return. But it is important to pick the right method.

Do your research the same way you would with any other financial choice. Calculators are useful for determining how many allowances for withholding must be requested. An expert could be a good option.

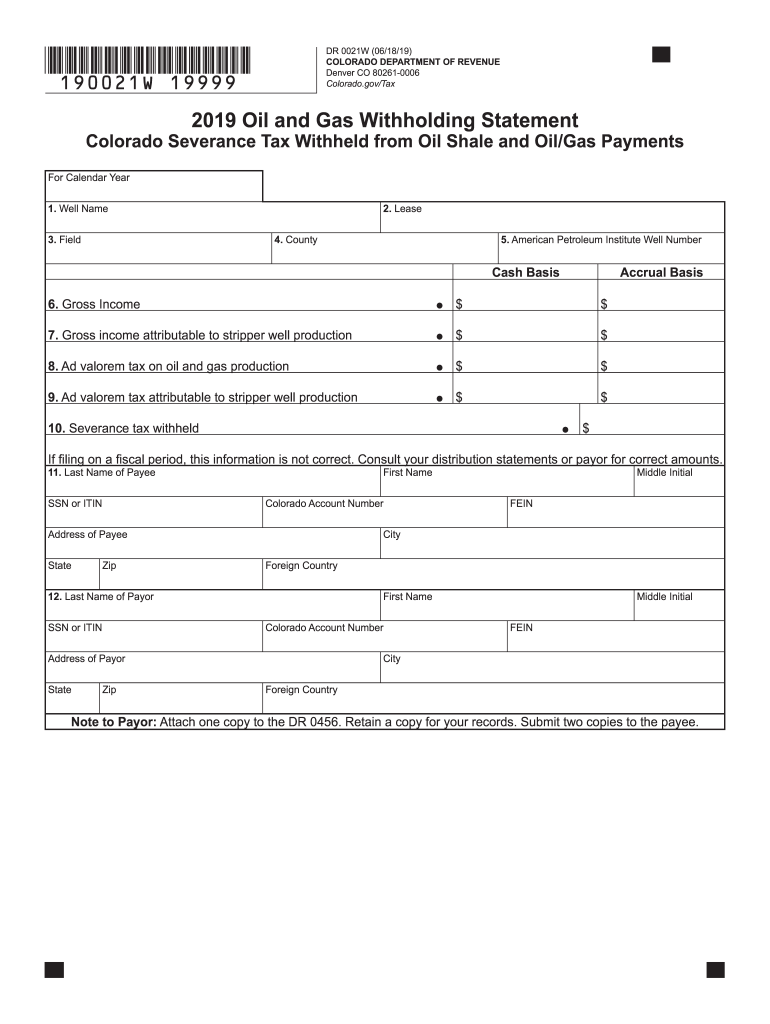

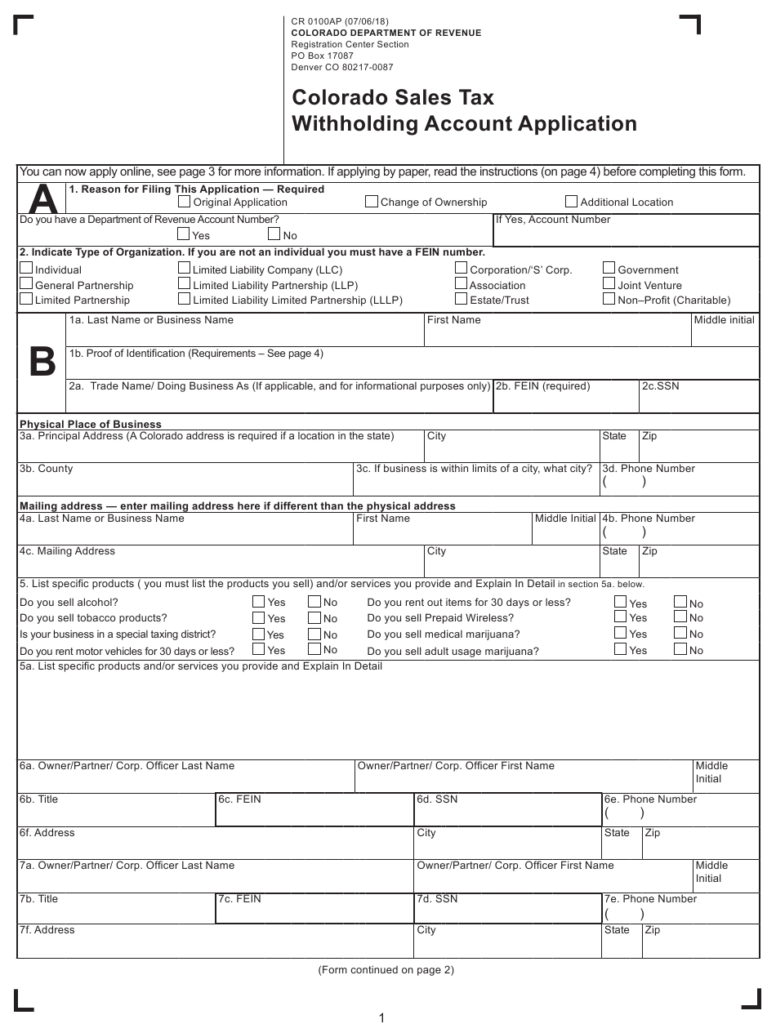

Formulating specifications

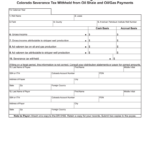

If you are an employer, you have to be able to collect and report withholding taxes on your employees. The IRS will accept documents for certain taxes. A reconciliation of withholding tax, the quarterly tax return or an annual tax return are all examples of other paperwork you may need to submit. Below is information about the various forms of withholding taxes as well as the deadlines to file them.

The salary, bonuses commissions, other income you get from your employees could require you to file tax returns withholding. Additionally, if your employees are paid punctually, you might be eligible to get tax refunds for withheld taxes. It is important to remember that some of these taxes could be considered to be local taxes. There are also special withholding methods that are applicable under certain conditions.

You have to submit electronically withholding forms in accordance with IRS regulations. When you submit your national revenue tax return, please provide the Federal Employer Identification number. If you don’t, you risk facing consequences.