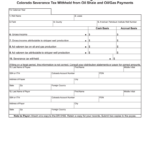

Colorado Employers Withholding Tax Forms – There are many reasons that an individual could submit a form for withholding. This includes documentation requirements and exemptions for withholding. It is important to be aware of these factors regardless of your reason for choosing to file a request form.

Exemptions from withholding

Non-resident aliens must submit Form 1040NR once each year. However, if your requirements meet, you may be eligible to request an exemption from withholding. The exemptions you will find here are yours.

To file Form 1040-NR, the first step is attaching Form 1042S. The form lists the amount that is withheld by the tax authorities for federal income tax reporting to be used for reporting purposes. Make sure that you fill in the correct information as you fill out the form. If the correct information isn’t provided, one individual could be diagnosed with a medical condition.

The non-resident alien tax withholding rate is 30. You could be eligible to receive an exemption from withholding if the tax burden is higher than 30%. There are a variety of exemptions available. Some of them are only available to spouses or dependents like children.

Generally, you are eligible to receive a refund in accordance with chapter 4. Refunds can be granted in accordance with Sections 471 to 474. Refunds will be made to the withholding agent the person who withholds taxes from the source.

Status of relationships

An official marital status form withholding forms will assist both of you get the most out of your time. The bank may be surprised by the amount you’ve deposited. It can be difficult to choose which one of the options you’ll choose. You must be cautious in with what you choose to do. The wrong decision can cause you to pay a steep price. However, if you adhere to the instructions and watch out to any possible pitfalls, you won’t have problems. If you’re lucky you might be able to make new friends during your trip. Today is your birthday. I’m sure you’ll be able to use this to get that elusive wedding ring. It will be a complicated job that requires the experience of an accountant. This small payment is well enough to last the life of your wealth. You can get a lot of details online. Reputable tax preparation firms like TaxSlayer are among the most efficient.

the number of claims for withholding allowances

The Form W-4 must be filled out with the number of withholding allowances that you want to be able to claim. This is important as it will impact how much tax you will receive from your paychecks.

There are a variety of factors that can determine the amount that you can claim for allowances. The amount you earn can impact how many allowances are accessible to you. If you have high income it could be possible to receive more allowances.

A tax deduction appropriate for your situation could allow you to avoid tax payments. If you file the annual tax return for income You could be entitled to a refund. However, you must choose your method carefully.

Just like with any financial decision you make it is essential to conduct your research. Calculators are a great tool to determine how many withholding allowances are required to be claimed. A better option is to consult with a professional.

filing specifications

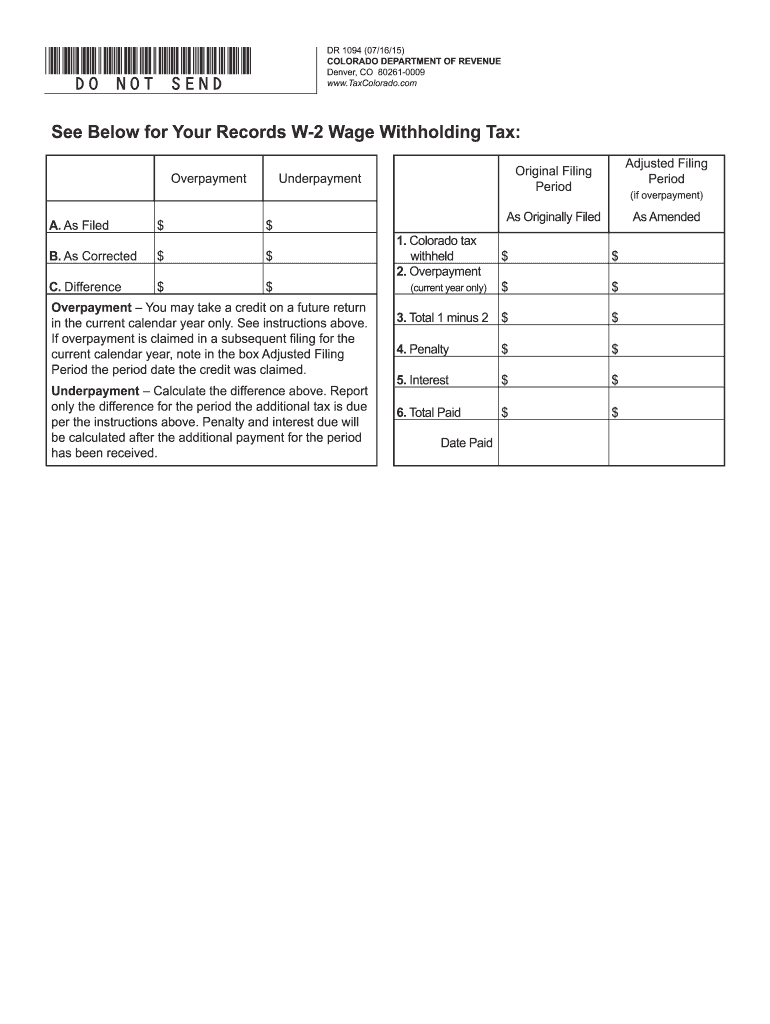

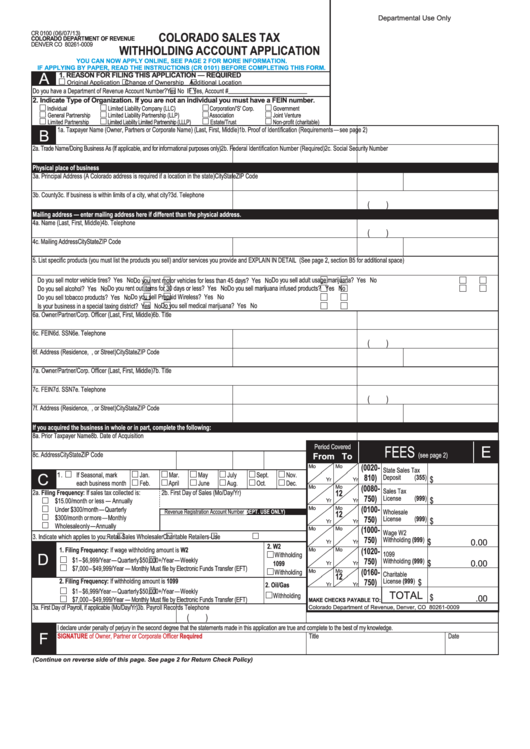

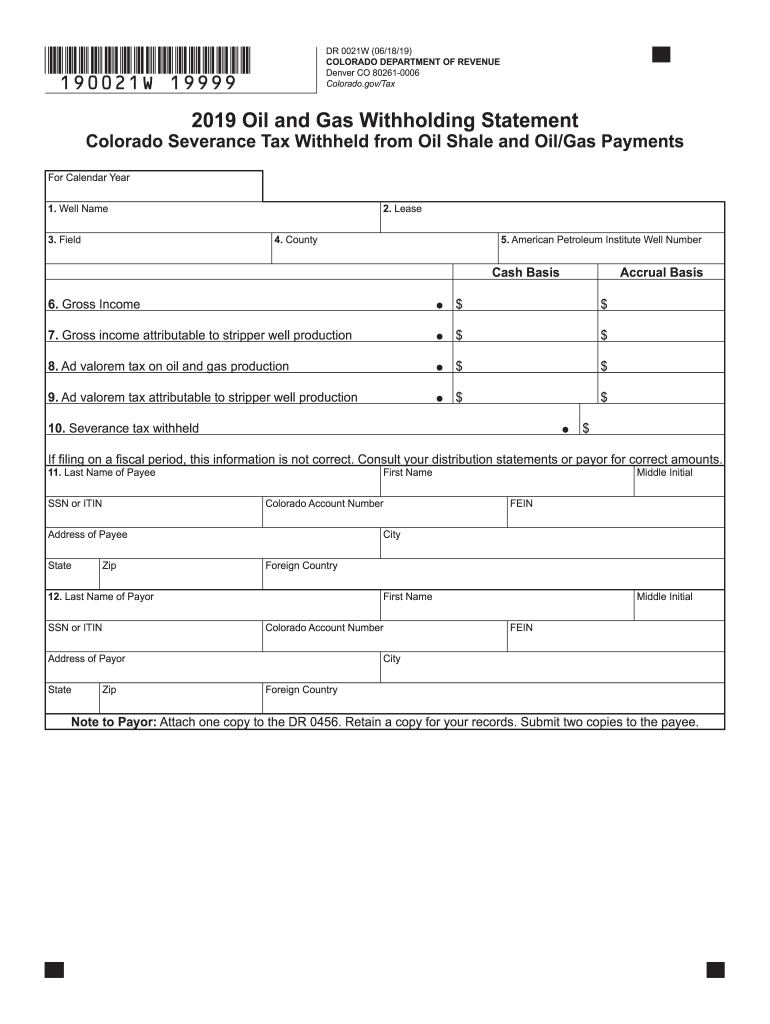

If you are an employer, you must collect and report withholding taxes from your employees. You may submit documentation to the IRS for some of these taxes. You might also need additional documentation such as a withholding tax reconciliation or a quarterly tax return. Here’s some details about the different tax forms and when they must be submitted.

Employees may need the submission of withholding tax return forms to get their bonuses, salary and commissions. Additionally, if you paid your employees promptly, you could be eligible for reimbursement of taxes that you withheld. Be aware that certain taxes could be considered to be local taxes. There are also unique withholding methods which can be utilized under certain conditions.

The IRS regulations require that you electronically submit withholding documents. You must provide your Federal Employer Identification Number when you file at your income tax return from the national tax system. If you don’t, you risk facing consequences.