Change Your New York State Withholding Form – There are many reasons that one could fill out a form for withholding. These include documents required, the exclusion of withholding and withholding allowances. There are some points to be aware of regardless of why a person files a form.

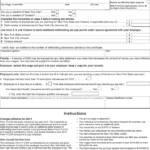

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR once a year. However, if your requirements meet, you may be eligible to request an exemption from withholding. This page lists the exclusions.

When you submit Form1040-NR, attach Form 1042S. This document is required to record federal income tax. It outlines the withholding of the withholding agent. It is important to enter the correct information when filling out the form. A person could be treated differently if this information is not entered.

The rate of withholding for non-resident aliens is 30 percent. The tax burden of your business is not to exceed 30% in order to be exempt from withholding. There are a variety of exemptions available. Some of these exclusions are only available to spouses or dependents, such as children.

Generally, you are eligible for a reimbursement in accordance with chapter 4. Refunds are allowed according to Sections 1471-1474. The refunds are given by the tax agent (the person who collects tax at the source).

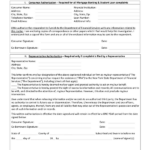

Status of the relationship

The proper marital status and withholding forms will ease the work of you and your spouse. You’ll be amazed at the amount you can deposit at the bank. The challenge is in deciding what option to choose. Undoubtedly, there are some items you must avoid. Making a mistake can have costly consequences. However, if you adhere to the instructions and keep your eyes open to any possible pitfalls You won’t face any issues. You might make some new acquaintances if lucky. After all, today marks the anniversary of your wedding. I’m hoping that they will reverse the tide to get you the perfect engagement ring. You’ll want the assistance of a tax professional certified to ensure you’re doing it right. This tiny amount is enough to last the life of your wealth. Information on the internet is easy to find. Reputable tax preparation firms like TaxSlayer are among the most efficient.

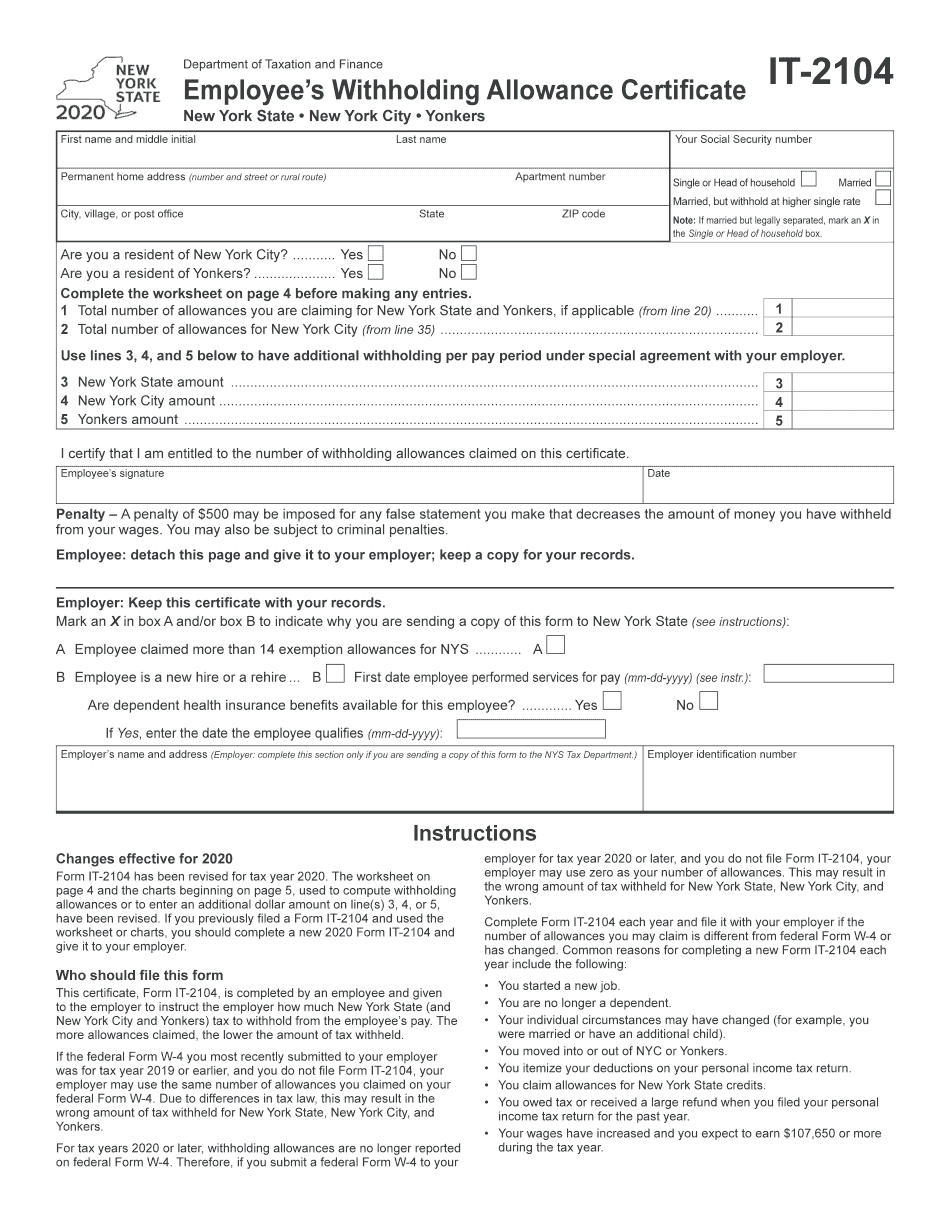

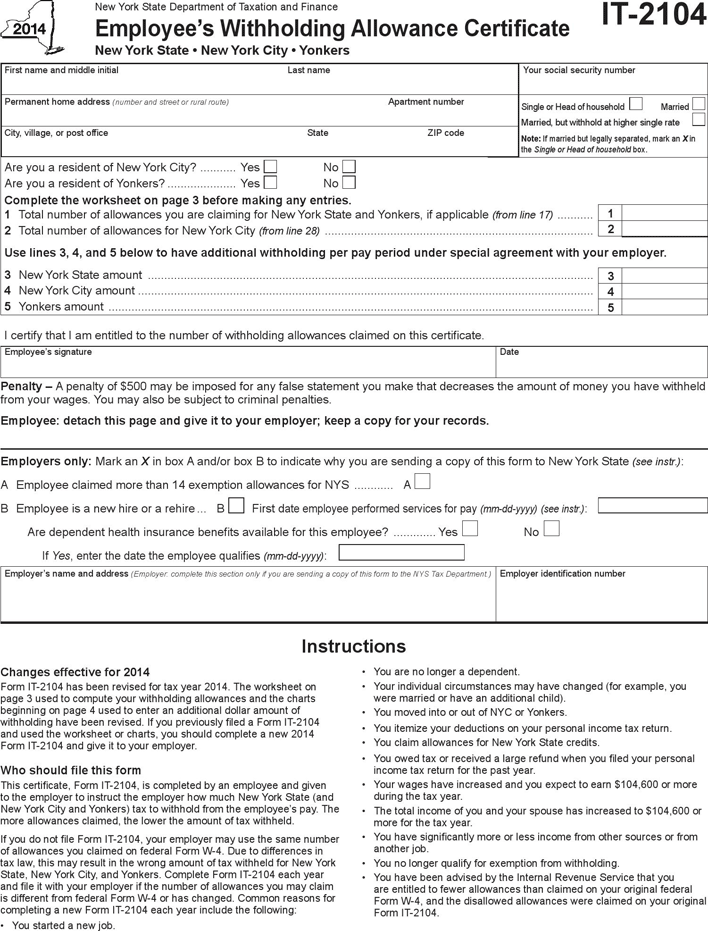

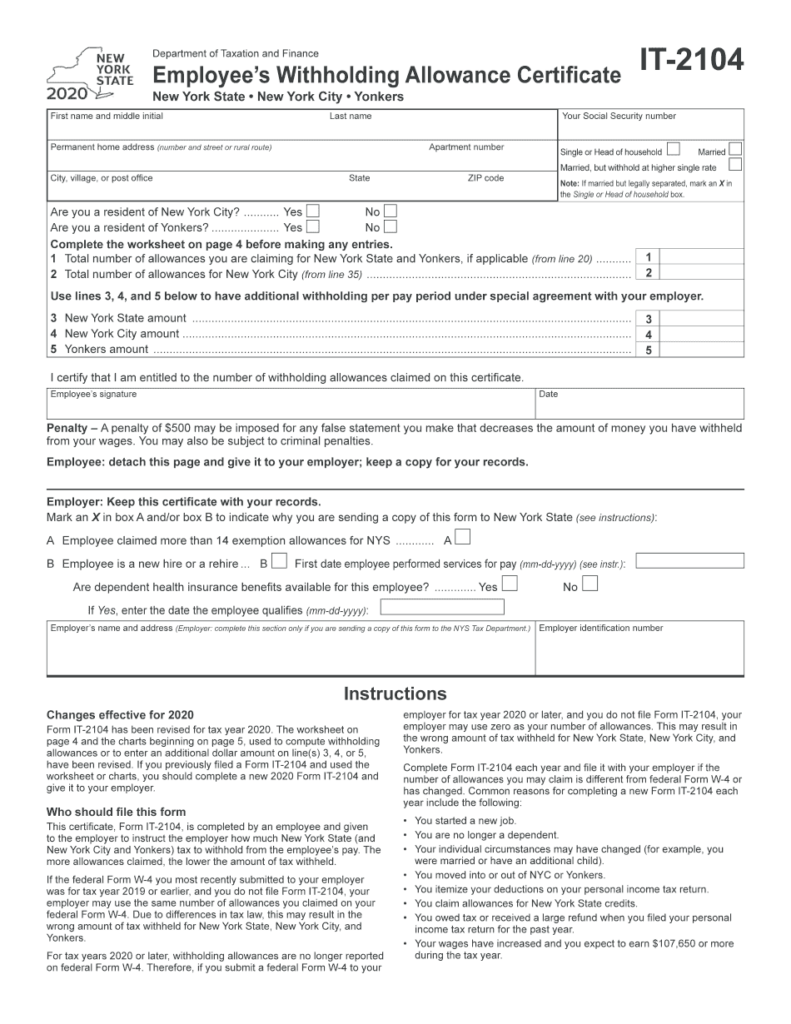

Number of claimed withholding allowances

It is important to specify the number of withholding allowances to be able to claim on the W-4 you fill out. This is vital as it will impact how much tax you receive from your pay checks.

Many factors affect the allowances requested.If you’re married, for instance, you could be able to apply for a head of household exemption. Your income level will also influence how many allowances your can receive. You can apply for more allowances if earn a significant amount of money.

A tax deduction that is appropriate for your situation could aid you in avoiding large tax payments. The possibility of a refund is feasible if you submit your tax return on income for the current year. However, be aware of your choices.

You must do your homework the same way you would for any financial option. Calculators can help you determine how much withholding allowances must be claimed. It is also possible to speak with an expert.

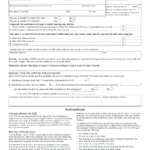

filing specifications

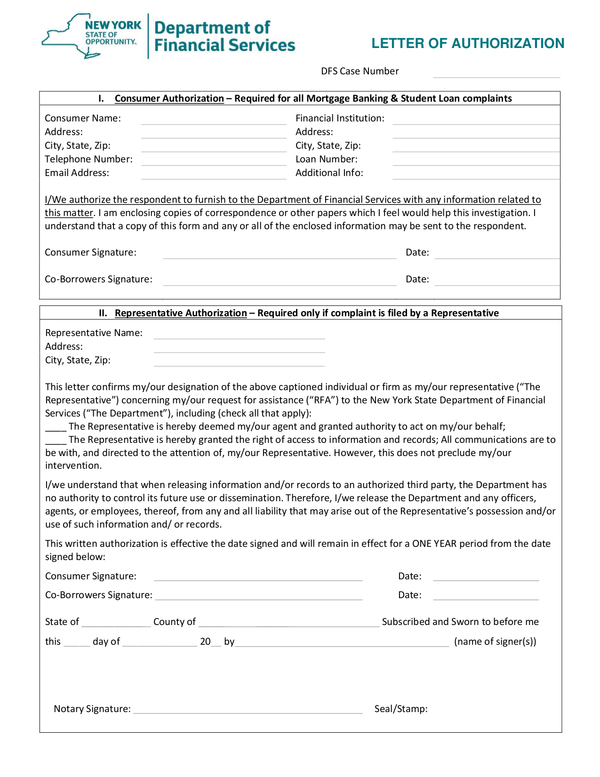

Employers should report the employer who withholds taxes from their employees. For some taxes you can submit paperwork to the IRS. You might also need additional documentation , like the reconciliation of your withholding tax or a quarterly return. Below are details on the various forms of withholding taxes and the deadlines to file them.

Withholding tax returns may be required for income such as bonuses, salary, commissions and other income. You could also be eligible to receive reimbursement for taxes withheld if your employees were paid in time. Be aware that these taxes may be considered to be county taxes. In addition, there are specific tax withholding procedures that can be implemented in specific circumstances.

The IRS regulations require you to electronically file withholding documents. The Federal Employer identification number should be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.