Change Federal Tax Withholding Form – There are a variety of explanations why somebody could decide to fill out a form for withholding. These factors include the requirements for documentation, withholding exemptions and also the amount of required withholding allowances. You must be aware of these things regardless of why you choose to fill out a form.

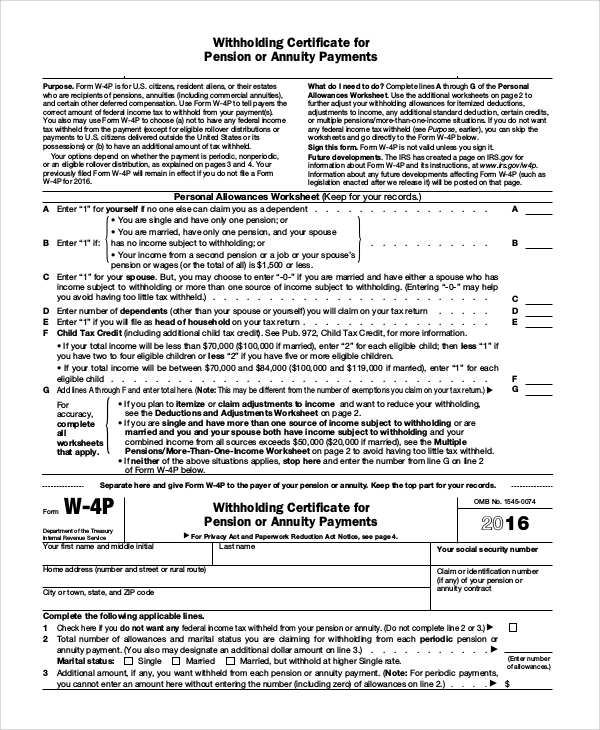

Withholding exemptions

Non-resident aliens must submit Form 1040-NR at a minimum every year. If your requirements meet, you may be eligible to request an exemption from withholding. This page will provide the exclusions.

The first step for filling out Form 1040-NR is attaching the Form 1042 S. This document lists the amount withheld by the tax authorities for federal income tax reporting purposes. Fill out the form correctly. You could be required to treat a specific person if you don’t provide this information.

The non-resident alien withholding rate is 30 percent. Non-resident aliens may be qualified for exemption. This happens when your tax burden is less than 30 percent. There are a variety of exclusions. Some are specifically for spouses, and dependents, such as children.

Generally, withholding under Chapter 4 entitles you for the right to a refund. Refunds are allowed according to Sections 1471-1474. Refunds will be made to the tax agent withholding the person who withholds the tax at the source.

Relational status

The proper marital status and withholding forms can simplify the work of you and your spouse. You’ll be amazed by the amount of money you can put in the bank. It isn’t easy to determine which of the many options you’ll choose. Certain things are best avoided. The wrong decision can cause you to pay a steep price. You won’t have any issues if you just follow the directions and be attentive. You might make some new acquaintances if you’re fortunate. Today marks the anniversary of your wedding. I’m sure you’ll use it against them to find that elusive engagement ring. You’ll need the help from a certified tax expert to finish it properly. This tiny amount is worth the lifetime of wealth. You can get a lot of information on the internet. TaxSlayer as well as other reliable tax preparation companies are some of the top.

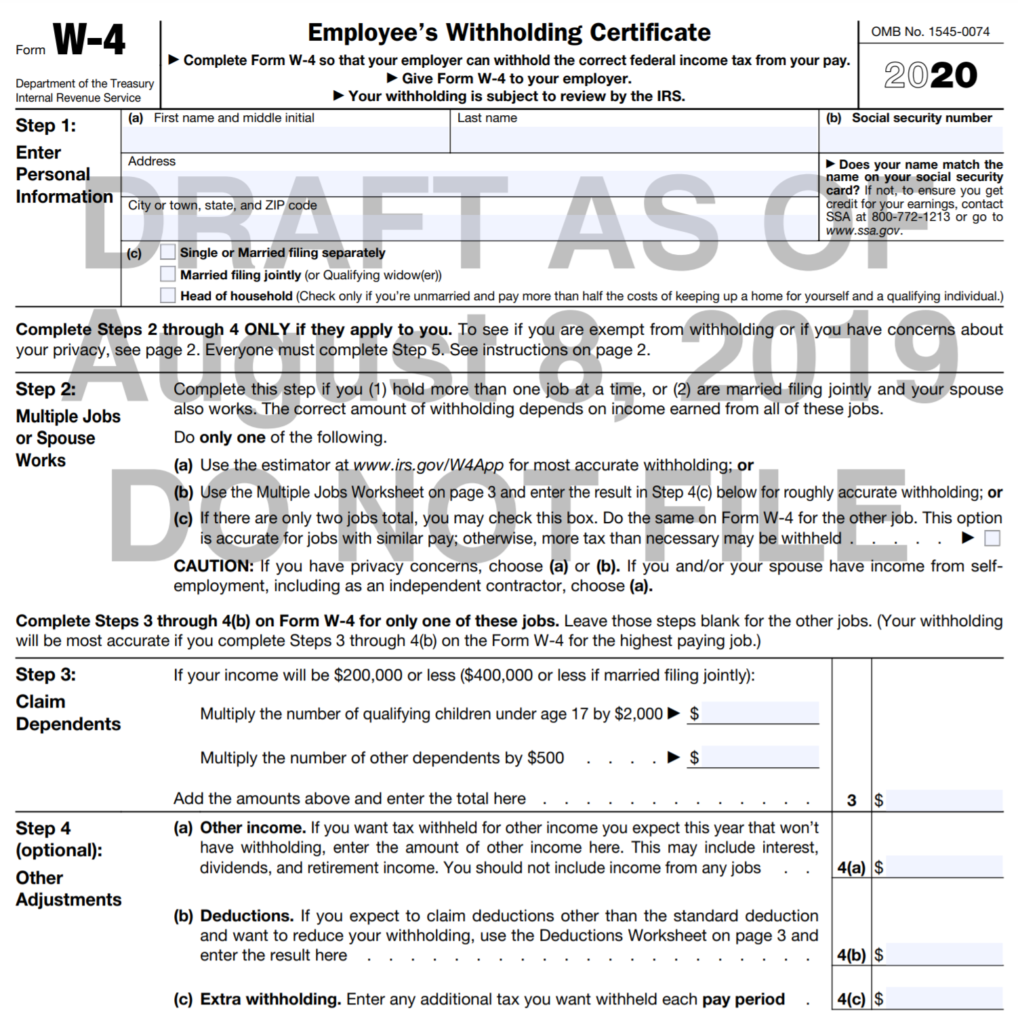

The number of withholding allowances claimed

It is important to specify the amount of withholding allowances which you wish to claim on the Form W-4. This is critical since your wages could depend on the tax amount you pay.

There are a variety of factors that influence the allowance amount you are able to apply for. If you’re married you might be qualified for an exemption for head of household. Your income level will also determine how many allowances you can receive. An additional allowance could be available if you earn a lot.

A tax deduction appropriate for you could allow you to avoid tax obligations. In reality, if you submit your annual income tax return, you may even receive a refund. It is important to be cautious regarding how you go about this.

As with every financial decision, it is important to conduct your own research. To figure out the amount of tax withholding allowances that need to be claimed, utilize calculators. Other options include talking to a specialist.

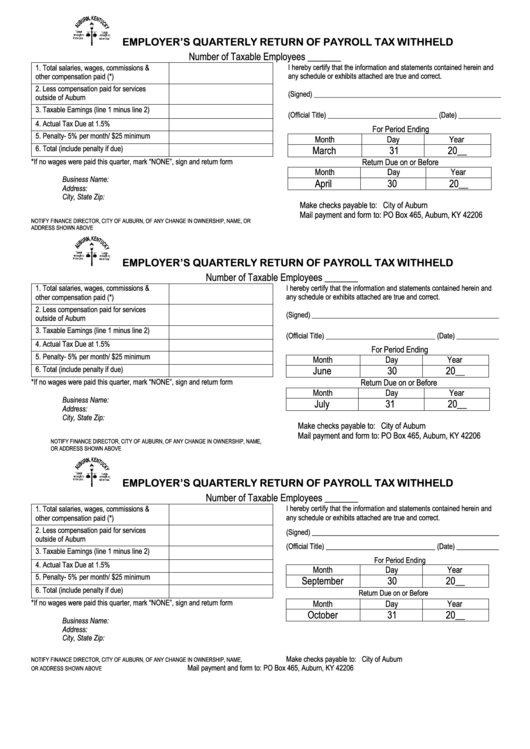

Specifications for filing

Employers are required to report the company who withholds taxes from employees. If you are taxed on a specific amount you might need to submit documentation to IRS. It is possible that you will require additional documentation , like the reconciliation of your withholding tax or a quarterly tax return. Here are some information about the various types of withholding tax forms and the filing deadlines.

Withholding tax returns may be required for income like bonuses, salary and commissions, as well as other income. You could also be eligible to get reimbursements for taxes withheld if your employees received their wages in time. The fact that some of these taxes are county taxes ought to be considered. In some situations there are rules regarding withholding that can be different.

As per IRS regulations, electronic submissions of withholding forms are required. When you file your national revenue tax return, please provide the Federal Employer Identification number. If you don’t, you risk facing consequences.