Can I Claim Iowa Withholding On My Illinois Tax Form – There are numerous reasons an individual could submit the form to request withholding. The requirements for documentation, exemptions from withholding as well as the quantity of allowances for withholding required are just a few of the factors. However, if one chooses to submit an application it is important to remember a few things to keep in mind.

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once each year. If you fulfill the criteria, you may be able to submit an exemption from the withholding form. The following page lists all exclusions.

For Form 1040-NR submission the first step is attaching Form 1042S. The form is used to report the federal income tax. It outlines the withholding by the withholding agent. It is important to enter correct information when you complete the form. This information might not be given and result in one person being treated differently.

The 30% tax withholding rate for non-resident aliens is 30. It is possible to be exempted from withholding if the tax burden is greater than 30 percent. There are many exclusions. Certain are only for spouses or dependents, for example, children.

You are entitled to refunds if you have violated the rules of chapter 4. Refunds are available according to Sections 1401, 1474, and 1475. The person who is the withholding agent or the person who is responsible for withholding the tax at source is the one responsible for distributing these refunds.

relationship status

A valid marital status and withholding form will simplify the job of both you and your spouse. Additionally, the quantity of money that you can deposit at the bank could surprise you. Knowing which of the many possibilities you’re likely pick is the tough part. There are some things you shouldn’t do. It can be expensive to make the wrong choice. If you stick to it and pay attention to the instructions, you won’t run into any problems. If you’re lucky, you might even make new acquaintances while traveling. Today is your birthday. I’m hoping that you can utilize it to secure the elusive diamond. If you want to get it right you’ll require the help of a certified accountant. The little amount is worthwhile for the life-long wealth. Fortunately, you can find a ton of information online. TaxSlayer, a reputable tax preparation business, is one of the most effective.

There are numerous withholding allowances that are being claimed

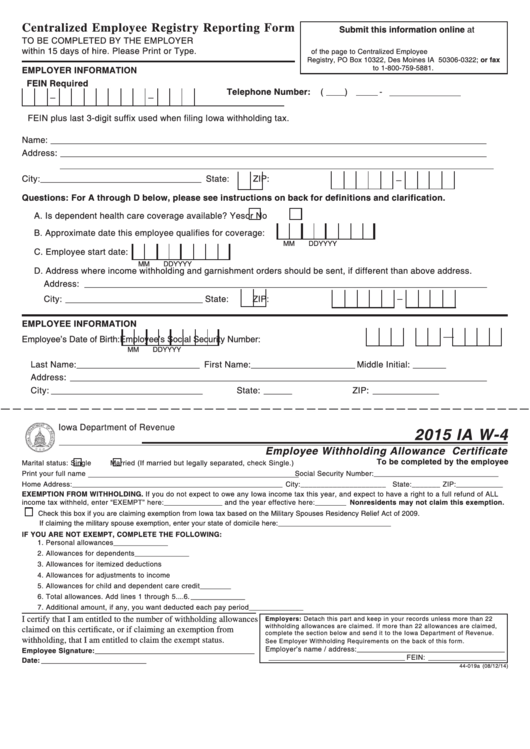

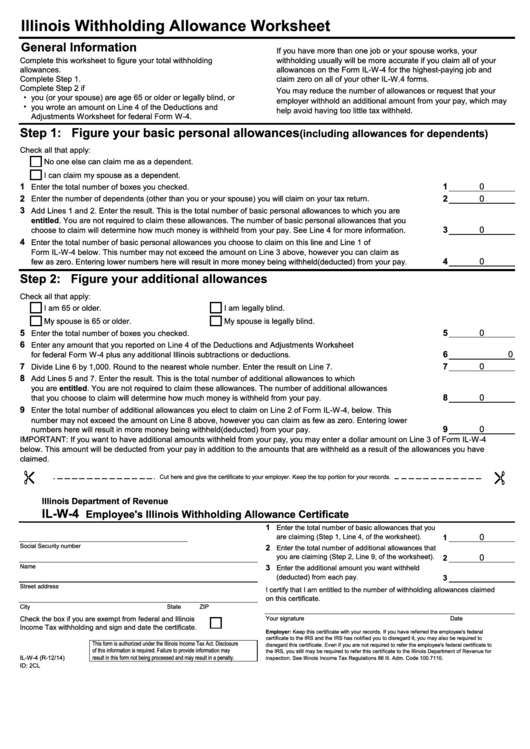

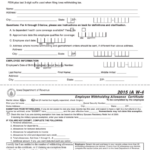

In submitting Form W-4 you must specify how many withholdings allowances you would like to claim. This is important since your wages could be affected by the amount of tax you pay.

There are a variety of factors that influence the allowance amount that you can claim. If you’re married you might be qualified for an exemption for head of household. Your income also determines the amount of allowances you’re eligible to claim. If you earn a substantial amount of money, you might be eligible for a higher allowance.

It is possible to avoid paying a large tax bill by selecting the appropriate amount of tax deductions. If you submit your annual income tax returns, you may even be eligible for a refund. But it is important to select the correct method.

Like any financial decision it is crucial to conduct your research. To figure out the amount of withholding allowances to be claimed, you can use calculators. It is also possible to speak with a specialist.

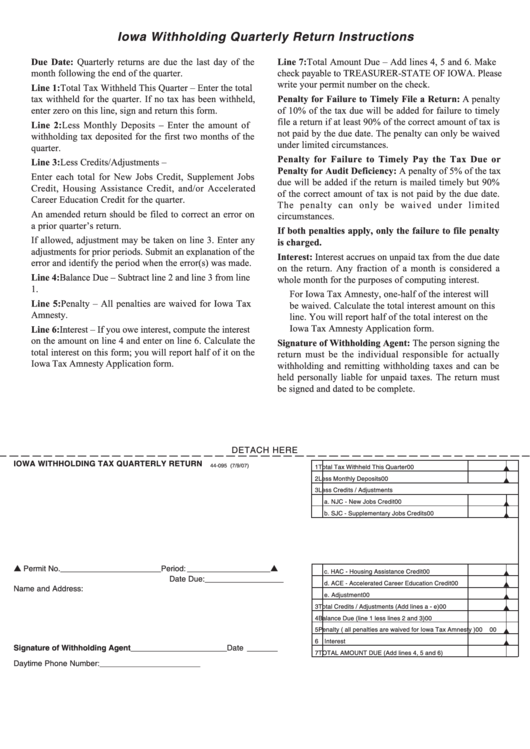

Filing specifications

Employers should report the employer who withholds taxes from employees. The IRS can accept paperwork to pay certain taxes. A tax reconciliation for withholding and an annual tax return for quarterly filing, as well as an annual tax return are examples of additional paperwork you might be required to submit. Here’s some information about the various withholding tax form categories, as well as the deadlines to filing them.

The salary, bonuses, commissions, and other income that you receive from employees might necessitate you to file tax returns withholding. Also, if your employees receive their wages punctually, you might be eligible to get tax refunds for withheld taxes. Be aware that certain taxes may be county taxes. There are specific withholding strategies that may be appropriate in particular situations.

The IRS regulations require that you electronically submit withholding documents. When you file your tax returns for the national income tax, be sure to include the Federal Employee Identification Number. If you don’t, you risk facing consequences.