California Withholding Tax Form – There are a variety of reasons one might choose to fill out withholding forms. Withholding exemptions, documentation requirements and the amount of the allowance requested are all factors. Whatever the reason one chooses to submit an application there are some aspects to consider.

Withholding exemptions

Non-resident aliens are required to submit Form 1040 NR at least once each year. If the requirements are met, you may be eligible to request an exemption from withholding. This page lists the exclusions.

To file Form 1040-NR, the first step is to attach Form 1042S. The form lists the amount that is withheld by the tax withholding authorities for federal tax reporting for tax reporting purposes. When filling out the form ensure that you have provided the accurate information. If this information is not supplied, one person may be treated.

Non-resident aliens are subject to 30 percent withholding. An exemption from withholding may be available if you have an income tax burden of less than 30 percent. There are many exemptions. Certain exclusions are only available to spouses or dependents like children.

In general, chapter 4 withholding allows you to receive a refund. Refunds are permitted under Sections 1471-1474. The refunds are given by the withholding agent (the person who is responsible for withholding tax at source).

Relationship status

The work of your spouse and you is made simpler by the proper marriage status withholding form. The bank could be shocked by the amount of money that you have to deposit. Knowing which of the several possibilities you’re most likely to decide is the biggest challenge. There are certain actions you shouldn’t do. It’s costly to make the wrong decision. But, if the directions are followed and you pay attention to the rules, you shouldn’t have any issues. If you’re lucky you might be able to make new friends during your trip. Today is your birthday. I’m hoping you’ll be able to utilize it against them to locate that perfect engagement ring. It is best to seek the advice of a tax professional certified to complete it correctly. It’s worthwhile to accumulate wealth over the course of a lifetime. Information on the internet is readily available. TaxSlayer is a trusted tax preparation company.

The number of withholding allowances requested

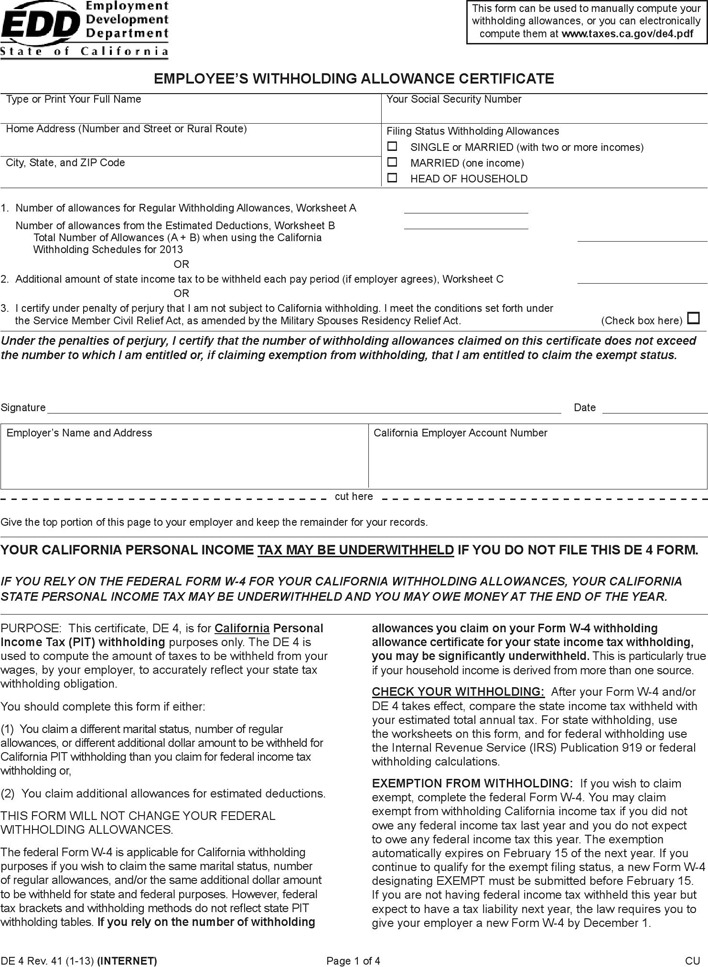

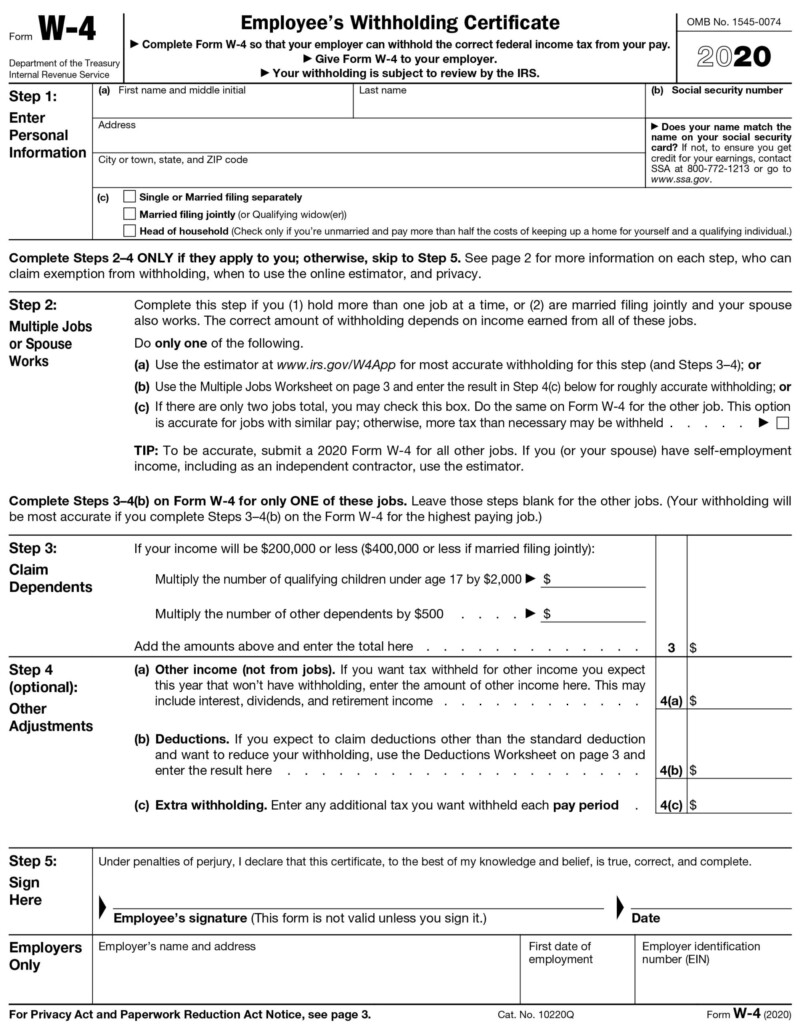

It is crucial to indicate the amount of the withholding allowance you want to claim in the Form W-4. This is critical as your paychecks may depend on the tax amount that you pay.

You may be able to claim an exemption for your spouse in the event that you are married. Your income level can also impact how many allowances are accessible to you. If you have high income, you might be eligible to receive higher amounts.

You could save lots of money by choosing the correct amount of tax deductions. If you file the annual tax return for income You could be entitled to a refund. But be sure to choose your method carefully.

Conduct your own research, just as you would in any financial decision. Calculators are available to help you determine how much withholding allowances are required to be claimed. A specialist might be a viable option.

Specifications for filing

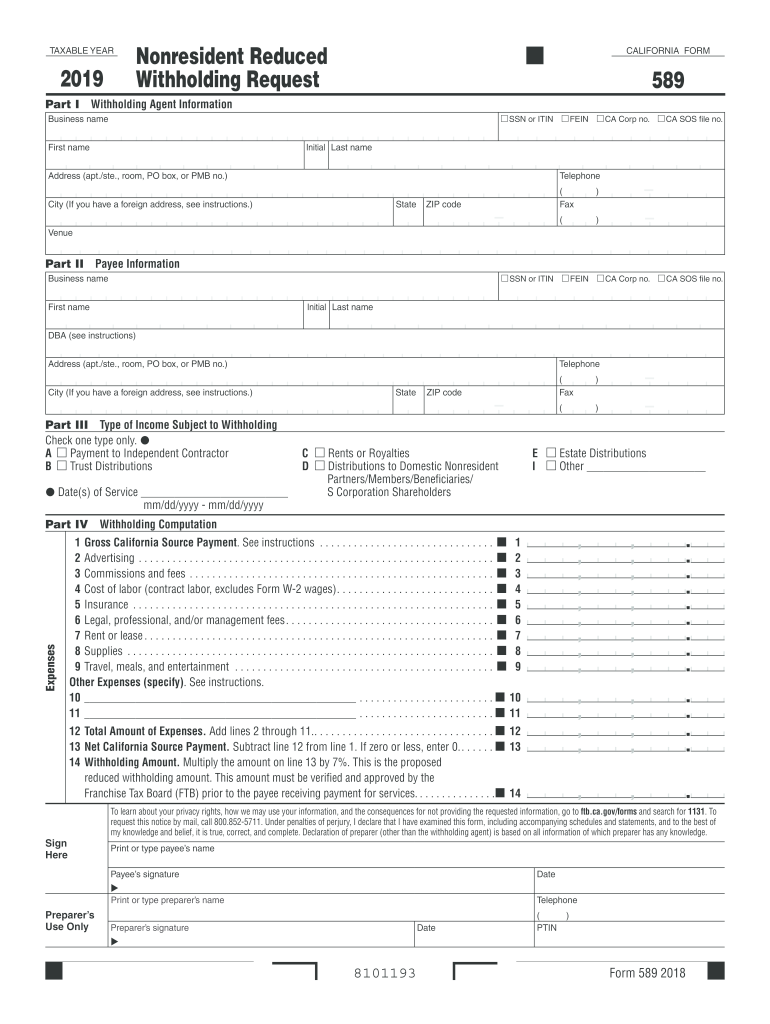

Employers are required to report any withholding taxes that are being collected from employees. If you are taxed on a specific amount you might need to submit documentation to IRS. You may also need additional forms that you may require for example, a quarterly tax return or withholding reconciliation. Below are information on the various tax forms for withholding and their deadlines.

Tax returns withholding may be required for certain incomes such as bonuses, salary and commissions, as well as other income. It is also possible to be reimbursed of taxes withheld if you’re employees were paid in time. It is important to remember that certain taxes could be considered to be local taxes. Additionally, you can find specific withholding rules that can be applied in particular circumstances.

According to IRS regulations, you must electronically file withholding forms. Your Federal Employer identification number should be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.