California Withholding Forms – There are many reasons someone might choose to fill out a form for withholding form. These factors include the documents required, the exclusion of withholding as well as the withholding allowances. Whatever the reason someone chooses to file the Form, there are several points to be aware of.

Withholding exemptions

Nonresident aliens are required to complete Form 1040-NR every year. If you fulfill the requirements, you might be eligible to submit an exemption from the withholding form. This page you’ll see the exemptions that are available to you.

To complete Form 1040-NR, add Form 1042-S. This form is used to report the federal income tax. It details the withholding by the withholding agent. When you fill out the form, ensure that you have provided the accurate information. The information you provide may not be disclosed and cause one person to be treated.

Non-resident aliens are subjected to a 30% withholding rate. An exemption from withholding may be granted if you have a a tax burden that is lower than 30 percent. There are a variety of exemptions available. Certain exclusions are only for spouses or dependents such as children.

You may be entitled to an amount of money if you do not follow the rules of chapter 4. In accordance with Section 1471 through 1474, refunds can be made. Refunds are given to the agent who withholds tax, the person who withholds the tax from the source.

Relationship status

A valid marital status and withholding forms can simplify the work of you and your spouse. You’ll be surprised by how much you can deposit to the bank. It can be difficult to determine which one of many choices is most appealing. There are certain things that you should not do. Making the wrong choice could cause you to pay a steep price. However, if you adhere to the instructions and keep your eyes open for any potential pitfalls You won’t face any issues. You might make some new acquaintances if fortunate. Today marks the anniversary. I’m sure you’ll be able to make use of it to secure that dream ring. For a successful completion of the task, you will need to seek the assistance from a qualified tax professional. It’s worth it to build wealth over the course of a lifetime. There are tons of online resources that provide information. TaxSlayer is a well-known tax preparation business is among the most helpful.

There are a lot of withholding allowances that are being made available

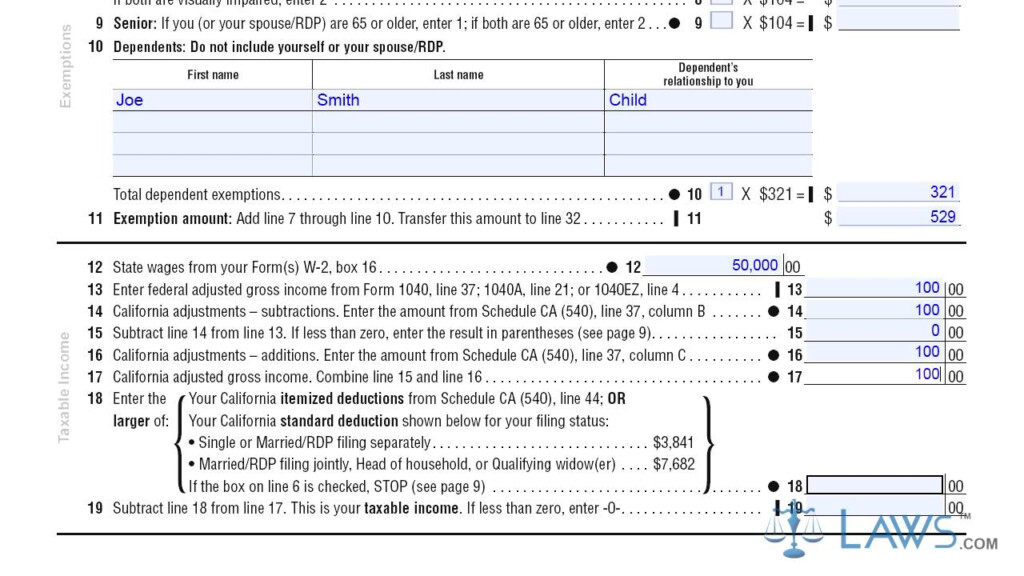

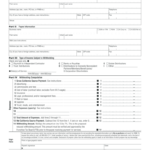

It is crucial to indicate the amount of withholding allowances which you want to claim in the Form W-4. This is essential since the tax amount taken from your paychecks will be affected by the you withhold.

You may be eligible to request an exemption for your spouse in the event that you are married. The amount you earn will also impact how many allowances you are entitled to. You can apply for a greater allowance if you earn a significant amount of money.

The proper amount of tax deductions could aid you in avoiding a substantial tax bill. If you complete your yearly income tax return, you may even be eligible for a tax refund. But be sure to choose your approach carefully.

Do your research, as you would with any financial decision. Calculators are a great tool to figure out how many withholding allowances should be claimed. If you prefer, you may speak with a specialist.

Formulating specifications

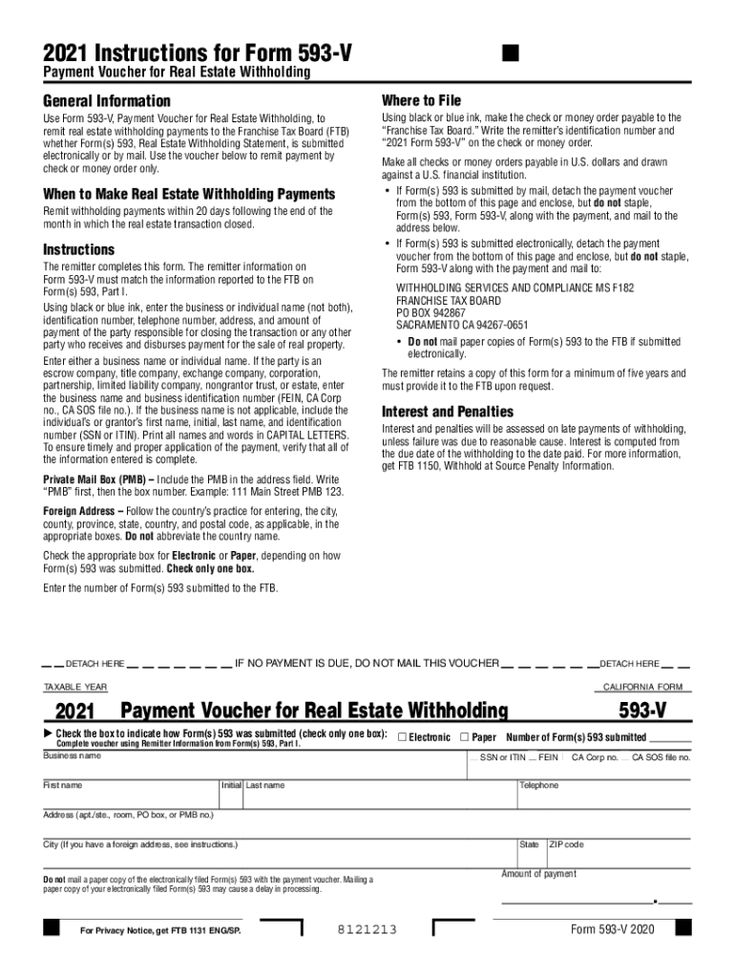

Employers are required to report any withholding taxes being paid by employees. You can submit paperwork to the IRS for some of these taxes. A reconciliation of withholding tax or a quarterly tax return, or the annual tax return are all examples of other paperwork you may have to file. Below is information about the various forms of withholding tax and the deadlines for filing them.

You may have to file withholding tax returns for the income you receive from employees, such as bonuses and commissions or salaries. If you make sure that your employees are paid on time, you may be eligible for the reimbursement of taxes withheld. Be aware that certain taxes may be county taxes, is also crucial. In addition, there are specific tax withholding procedures that can be implemented in specific situations.

In accordance with IRS rules, you must electronically submit withholding forms. You must include your Federal Employer ID Number when you point to your tax return for national income. If you don’t, you risk facing consequences.