California Wage Withholding Form Examples – There stand a digit of explanations why somebody could decide to fill out a tax form. These factors include documentation requirements and withholding exemptions. There are a few things you should remember regardless of the reason a person files a form.

Withholding exemptions

Non-resident aliens are required to complete Form 1040-NR every year. If you meet these conditions, you could be able to claim an exemption from the withholding form. On this page, you will discover the exemptions that you can avail.

To submit Form 1040-NR, add Form 1042-S. The document is required to report federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. When filling out the form ensure that you provide the correct details. If the information you provide is not supplied, one person may be diagnosed with a medical condition.

Non-resident aliens have to pay 30 percent withholding. Your tax burden should not exceed 30% in order to be exempt from withholding. There are many different exemptions. Some of them are only for spouses or dependents such as children.

Generally, you are eligible to receive a refund under chapter 4. Refunds can be claimed according to Sections 1401, 1474, and 1475. The refunds are made to the agent who withholds tax that is the person who collects taxes from the source.

Status of the relationship

The proper marital status and withholding form will simplify the job of both you and your spouse. You’ll be amazed by the amount that you can deposit at the bank. The challenge is picking the right bank among the numerous options. You must be cautious in what you do. False decisions can lead to expensive results. But if you adhere to the guidelines and keep your eyes open to any possible pitfalls You won’t face any issues. If you’re fortunate you may even meet some new friends on your travels. In the end, today is the anniversary of your wedding. I’m hoping you’re able to use this against them to obtain the elusive wedding ring. To do this properly, you’ll require assistance of a certified Tax Expert. This tiny amount is worth the time and money. There are numerous online resources that can provide you with information. TaxSlayer and other trusted tax preparation firms are a few of the top.

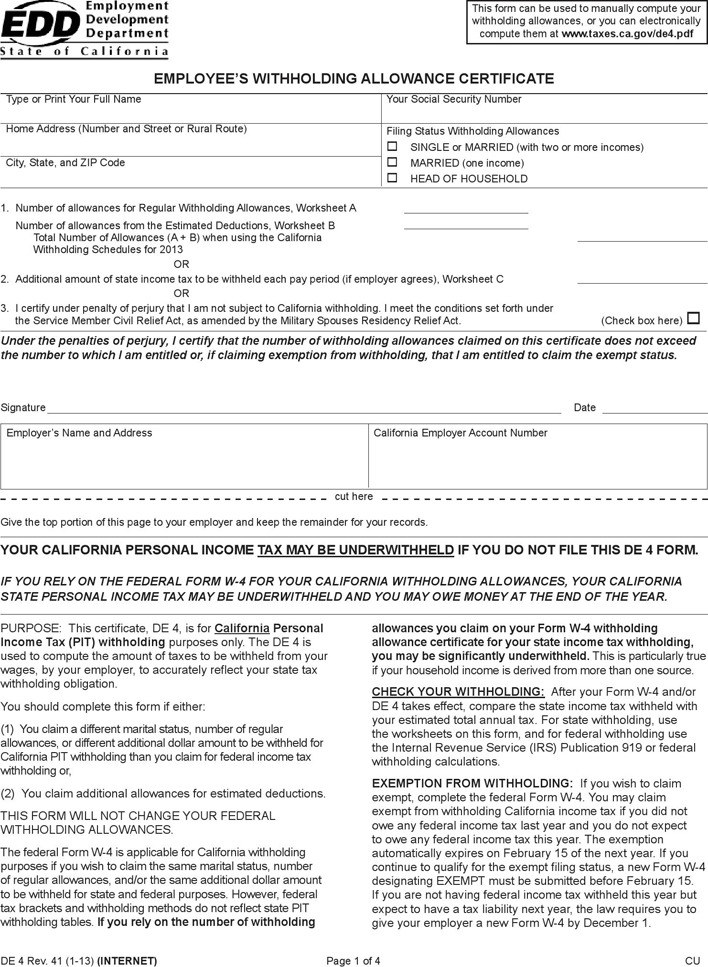

the number of claims for withholding allowances

In submitting Form W-4 you must specify how many withholding allowances you wish to claim. This is important since your wages could be affected by the amount of tax you pay.

A number of factors can determine the amount that you can claim for allowances. Your income can determine the amount of allowances accessible to you. You can apply for an increase in allowances if you have a large amount of income.

A tax deduction suitable for you can help you avoid large tax bills. Additionally, you may be eligible for a refund when your annual income tax return has been completed. You need to be careful when it comes to preparing this.

Conduct your own research, just as you would in any financial decision. Calculators will help you determine the amount of withholding that should be claimed. If you prefer contact an expert.

Filing specifications

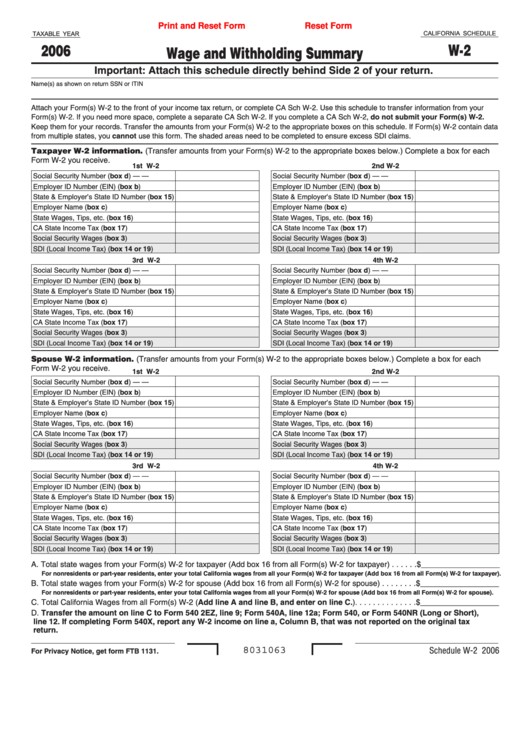

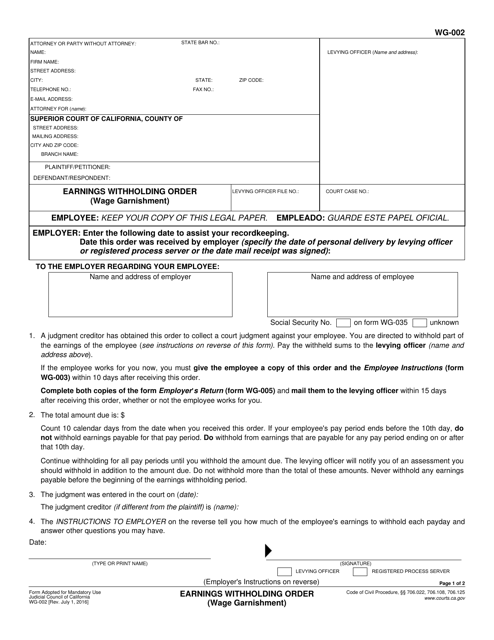

Withholding tax from your employees have to be reported and collected in the event that you are an employer. The IRS will accept documents to pay certain taxes. Other documents you might need to submit include a withholding tax reconciliation as well as quarterly tax returns and an annual tax return. Here’s a brief overview of the different tax forms and the time when they should be submitted.

To be eligible to receive reimbursement for withholding taxes on the compensation, bonuses, salary or other revenue earned by your employees, you may need to submit a tax return withholding. If you also pay your employees on-time you may be eligible to be reimbursed for any taxes taken out of your paycheck. Be aware that certain taxes may be county taxes. Additionally, there are unique methods of withholding that are used in certain conditions.

You are required to electronically submit withholding forms in accordance with IRS regulations. You must provide your Federal Employer Identification Number when you file to your tax return for national income. If you don’t, you risk facing consequences.