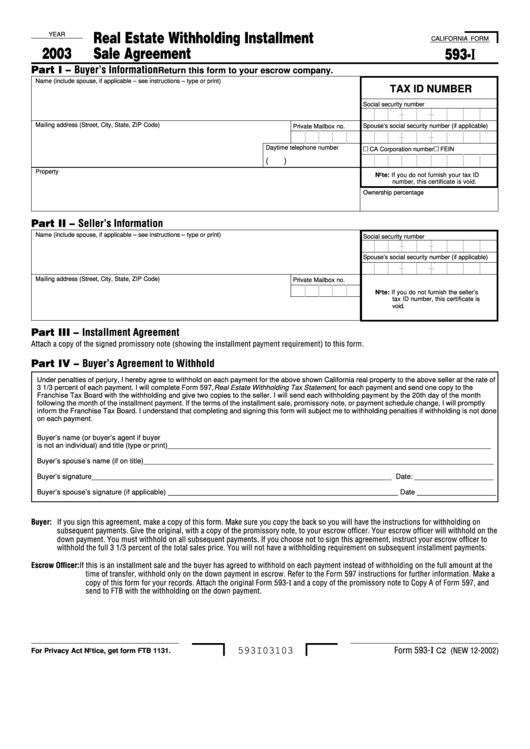

Calcualtion Form Percentage For State Of Ca Withholding – There are a variety of reasons someone may choose to fill out withholding forms. The reasons include the need for documentation as well as exemptions from withholding, as well as the amount of withholding allowances. No matter the reason someone chooses to file an Application there are some aspects to keep in mind.

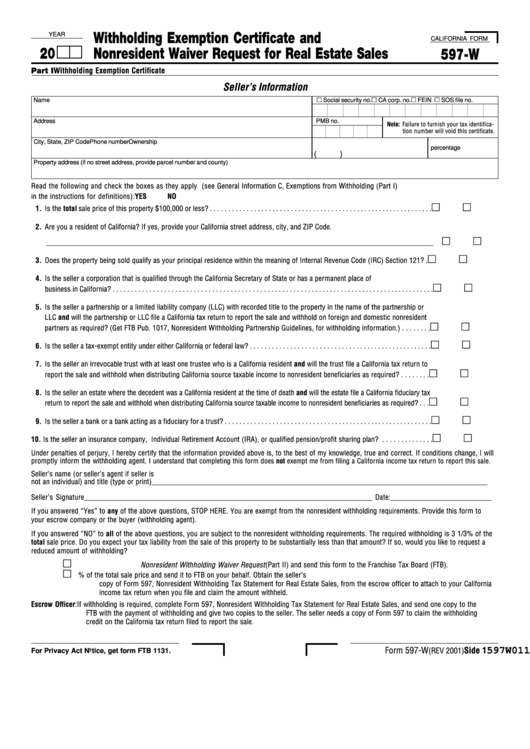

Exemptions from withholding

Non-resident aliens are required to file Form 1040–NR at least once per calendar year. However, if your requirements are met, you may be eligible to apply for an exemption from withholding. The exemptions you will find here are yours.

The first step for submit Form 1040 – NR is to attach the Form 1042 S. This form details the withholdings that the agency makes. Make sure you enter the correct information when filling out this form. There is a possibility for one individual to be treated in a manner that is not correct if the correct information is not provided.

The non-resident alien withholding tax is 30 percent. You could be eligible to receive an exemption from withholding tax if your tax burden is higher than 30%. There are a variety of exclusions. Certain are only for spouses and dependents, like children.

In general, the withholding section of chapter 4 gives you the right to a refund. Refunds are granted according to sections 1401, 1474, and 1475. Refunds are provided by the agent who withholds tax. The withholding agent is the individual who is responsible for withholding tax at the source.

Relational status

A marital withholding form is an excellent way to make your life easier and aid your spouse. It will also surprise you with the amount of money you can put in the bank. It isn’t easy to determine which one of the many options is most attractive. There are some things to avoid. Making the wrong decision will result in a significant cost. If the rules are adhered to and you are attentive you shouldn’t face any issues. It is possible to make new acquaintances if fortunate. Today is the anniversary date of your wedding. I’m hoping that you can leverage it to secure that dream engagement ring. If you want to get it right you’ll require the aid of a qualified accountant. It’s worth it to build wealth over the course of your life. There is a wealth of information online. TaxSlayer is among the most trusted and reputable tax preparation companies.

There are a lot of withholding allowances being claimed

It is important to specify the amount of the withholding allowance you wish to claim on the W-4 form. This is important because it affects how much tax you will receive from your pay checks.

Many factors affect the amount you are eligible for allowances. You may also be eligible for higher allowances, based on how much you earn. You may be eligible for more allowances if earn a significant amount of money.

It is possible to avoid paying a large tax bill by selecting the correct amount of tax deductions. If you submit your annual tax returns and you are eligible for a refund. But, you should be cautious about your approach.

In any financial decision, you should be aware of the facts. Calculators are readily available to help you determine how much withholding allowances you can claim. If you prefer contact a specialist.

Specifications that must be filed

Withholding tax from your employees have to be collected and reported in the event that you’re an employer. You may submit documentation to the IRS for a few of these taxes. A reconciliation of withholding tax, an annual tax return for quarterly filing, as well as an annual tax return are examples of other paperwork you may be required to submit. Here’s some details on the different forms of withholding tax categories and the deadlines for filling them out.

Withholding tax returns may be required to prove income like bonuses, salary or commissions as well as other earnings. You could also be eligible to get reimbursements of taxes withheld if you’re employees were paid in time. Be aware that these taxes can also be considered county taxes. Additionally, you can find specific withholding rules that can be utilized in certain situations.

You must electronically submit withholding forms in accordance with IRS regulations. Your Federal Employer Identification Number must be listed on your national revenue tax return. If you don’t, you risk facing consequences.