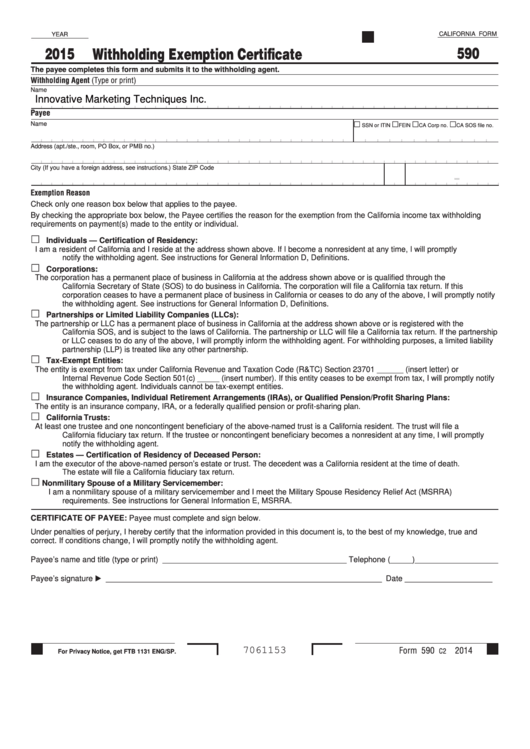

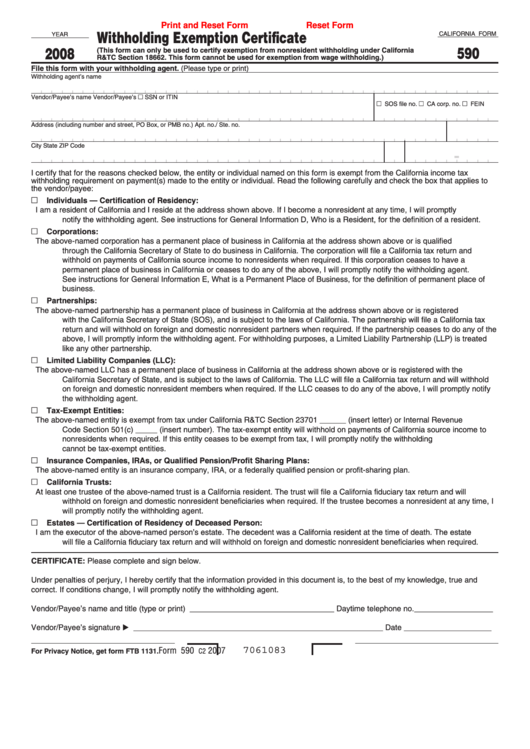

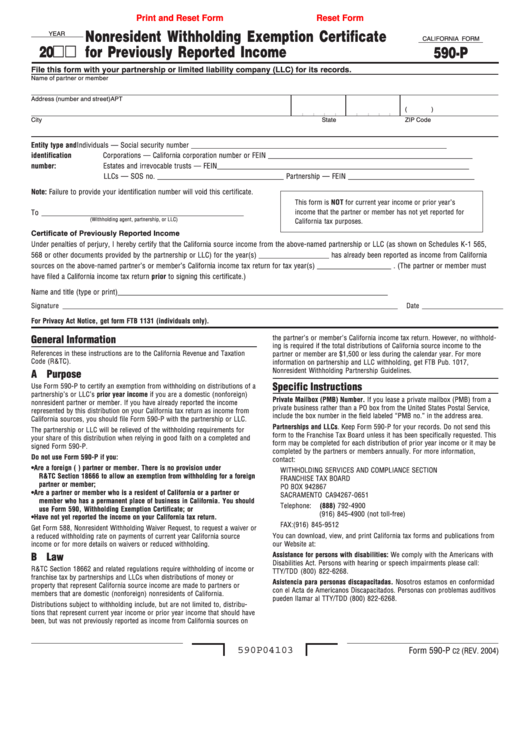

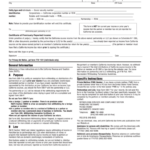

Ca Withholding Form 590 – There are many reasons one might choose to fill out withholding forms. This is due to the requirement for documentation, exemptions from withholding, as well as the amount of withholding allowances. No matter why one chooses to submit a form there are some aspects to consider.

Exemptions from withholding

Nonresident aliens are required once every year to file Form1040-NR. However, if you satisfy the criteria, you may be able to submit an exemption from the withholding form. You will discover the exclusions available on this page.

To submit Form 1040-NR, attach Form 1042-S. This form lists the amount that is withheld by the tax withholding authorities for federal tax reporting to be used for reporting purposes. Complete the form in a timely manner. If this information is not supplied, one person may be treated.

Nonresident aliens pay 30 percent withholding tax. If your tax burden is lower than 30 percent of your withholding, you may qualify to receive an exemption from withholding. There are many exclusions. Some of these exclusions are only for spouses or dependents like children.

In general, the withholding section of chapter 4 allows you to receive the possibility of a refund. In accordance with Section 1471 through 1474, refunds are granted. The refunds are made by the agents who withhold taxes, which is the person who withholds taxes at the source.

Status of relationships

A proper marital status withholding can make it simpler for you and your spouse to accomplish your job. You’ll also be surprised by with the amount of money you can put in the bank. The problem is deciding which one of the many options to pick. Be cautious about with what you choose to do. Making the wrong decision will cost you dearly. If you adhere to the rules and follow the directions, you shouldn’t run into any problems. If you’re lucky, you could be able to make new friends during your journey. Today is the day you celebrate your wedding. I’m sure you’ll be capable of using this against them to obtain the elusive wedding ring. It’s a difficult job that requires the knowledge of an accountant. It’s worth it to build wealth over a lifetime. Online information is easy to find. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

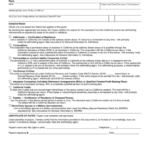

The amount of withholding allowances claimed

In submitting Form W-4 you should specify the number of withholding allowances you want to claim. This is important because the tax withheld will impact the amount of tax taken from your paycheck.

There are many variables that influence the allowance amount that you can claim. If you’re married, you may be eligible for a head-of-household exemption. The amount of allowances you are eligible for will be contingent on your income. If you earn a high amount, you might be eligible to receive higher amounts.

It could save you a lot of money by choosing the correct amount of tax deductions. Refunds could be feasible if you submit your income tax return for the current year. You need to be careful when it comes to preparing this.

Just like with any financial decision, it is important to do your homework. Calculators can be utilized to determine how many withholding allowances must be made. Alternative options include speaking with a specialist.

Specifications for filing

Employers are required to take withholding tax from their employees and report it. If you are taxed on a specific amount you can submit paperwork to the IRS. There are other forms you might need like an annual tax return, or a withholding reconciliation. Below is information about the different types of withholding tax and the deadlines to file them.

The compensation, bonuses commissions, bonuses, and other income you get from your employees may necessitate you to file withholding tax returns. Additionally, if you paid your employees promptly, you could be eligible for reimbursement of taxes that you withheld. Be aware that certain taxes could be considered to be county taxes, is also important. In addition, there are specific tax withholding procedures that can be used in certain circumstances.

The IRS regulations require you to electronically submit withholding documents. Your Federal Employer Identification number must be listed when you point your national tax return. If you don’t, you risk facing consequences.