Ca Tax Withholding Form – There are numerous reasons that a person could choose to submit a withholding application. This includes documentation requirements including withholding exemptions and the quantity of requested withholding allowances. No matter what the reason is for the filing of an application it is important to remember certain points you must keep in mind.

Exemptions from withholding

Non-resident aliens must submit Form 1040–NR at least once per calendar year. You could be eligible to apply for an exemption for withholding, when you meet the requirements. On this page, you will find the exclusions available to you.

To complete Form 1040-NR, include Form 1042-S. For federal income tax reporting purposes, this form outlines the withholding made by the tax agency that handles withholding. Make sure you fill out the form correctly. A person could be treated if this information is not provided.

The rate of withholding for non-resident aliens is 30 percent. If the tax you pay is less than 30 percent of your withholding you may qualify to be exempt from withholding. There are numerous exemptions. Certain are only for spouses and dependents, like children.

In general, refunds are accessible for Chapter 4 withholding. Refunds are allowed according to Sections 1471-1474. These refunds are made by the agent who withholds tax (the person who is responsible for withholding tax at source).

Status of relationships

A marriage certificate and withholding form will help you and your spouse make the most of your time. Additionally, the quantity of money you may deposit at the bank can be awestruck. The difficulty lies in choosing the right option among the numerous choices. Certain things are best avoided. It’s costly to make the wrong decision. If the rules are adhered to and you are attentive you shouldn’t face any problems. If you’re fortunate you may even meet acquaintances while traveling. Today is the anniversary date of your wedding. I’m sure you’ll take advantage of it to locate that perfect ring. To do this properly, you’ll require the advice of a qualified Tax Expert. It’s worthwhile to create wealth over a lifetime. It is a good thing that you can access plenty of information on the internet. TaxSlayer is one of the most trusted and reputable tax preparation companies.

There are a lot of withholding allowances that are being made available

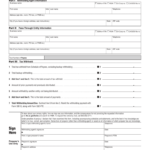

On the W-4 form you submit, you must indicate the amount of withholding allowances you seeking. This is essential since the withholdings can have an effect on the amount of tax that is deducted from your pay checks.

There are a variety of factors that affect the allowances requested.If you’re married as an example, you might be able to apply for an exemption for head of household. The amount of allowances you can claim will depend on the income you earn. If you have a high income, you may be eligible for an increase in your allowance.

You might be able to save money on a tax bill by choosing the correct amount of tax deductions. Additionally, you may even get a refund if your annual income tax return is completed. Be sure to select your method carefully.

You must do your homework the same way you would for any financial decision. Calculators can aid you in determining the amount of withholding allowances must be claimed. An alternative is to speak with a professional.

Filing specifications

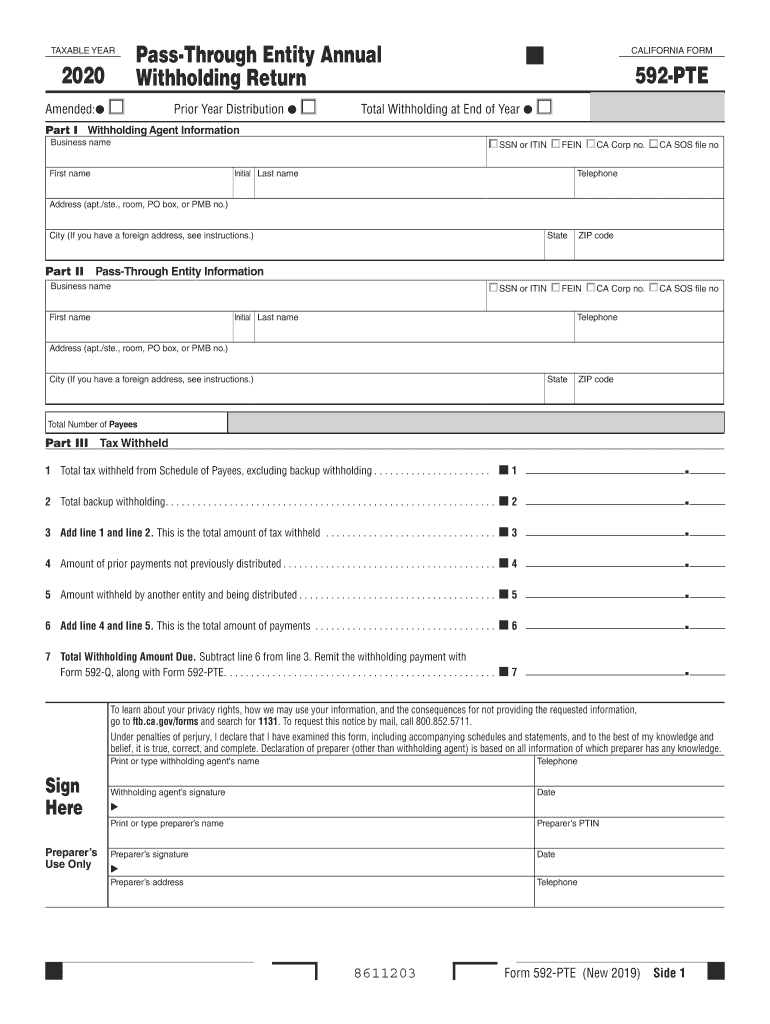

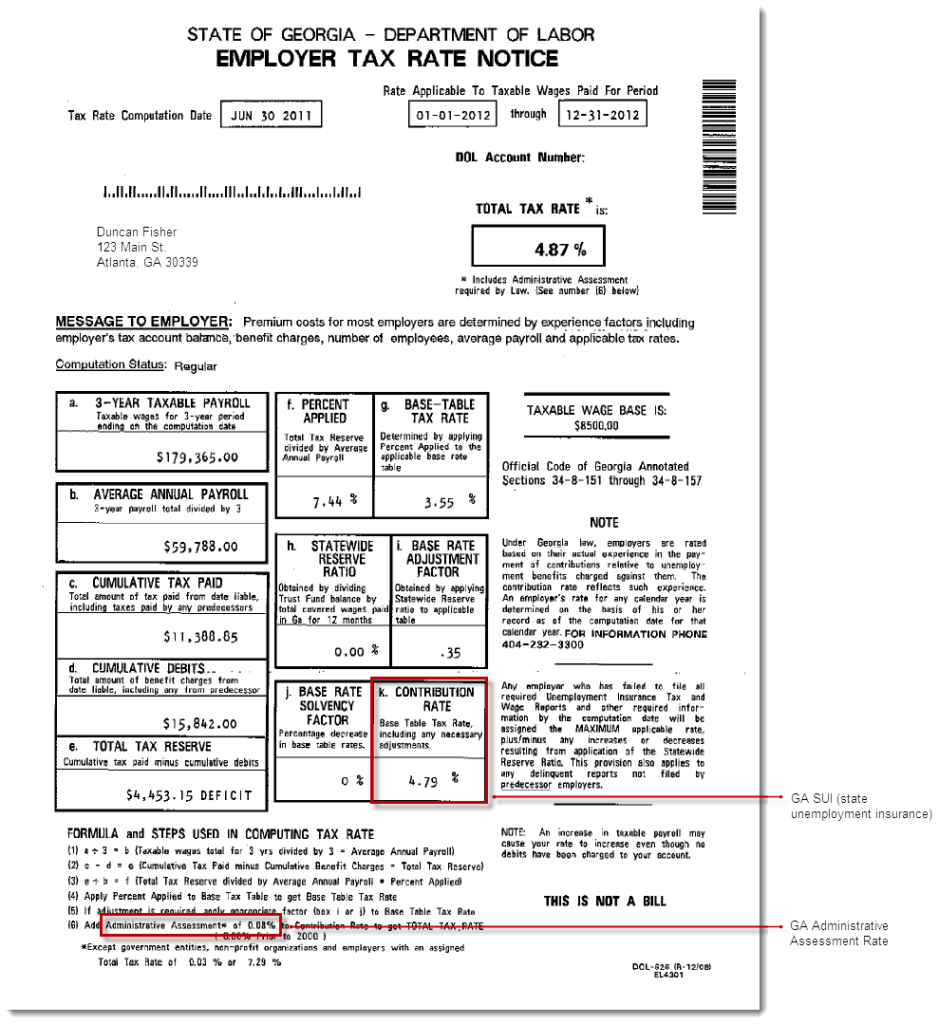

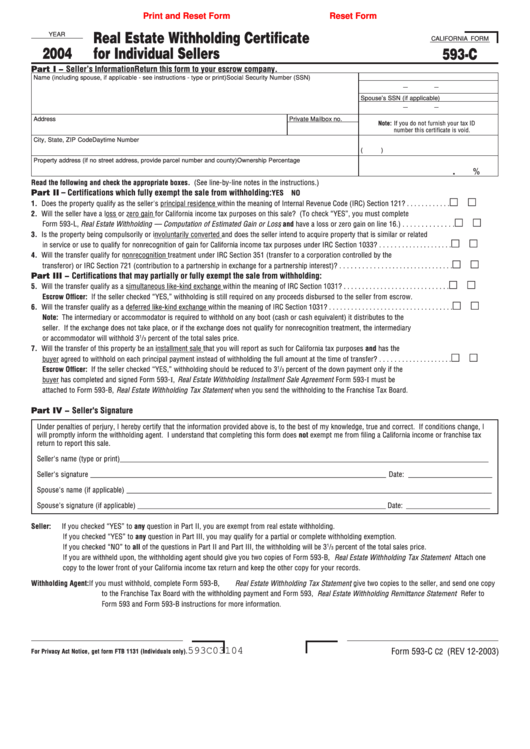

If you are an employer, you have to be able to collect and report withholding taxes from your employees. You may submit documentation to the IRS for a few of these taxation. Other documents you might be required to file include a withholding tax reconciliation as well as quarterly tax returns and the annual tax return. Here are some details regarding the various forms of tax forms for withholding as well as the deadlines for filing.

The salary, bonuses commissions, bonuses, and other income you get from your employees could require you to submit tax returns withholding. Additionally, if you pay your employees on time you may be eligible for reimbursement for any taxes that were withheld. It is important to note that there are a variety of taxes that are local taxes. There are certain withholding strategies that may be appropriate in particular situations.

The IRS regulations require you to electronically submit your withholding documentation. The Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.