Battle Creek Withholding Forms – There are many reasons someone may decide to submit an application for withholding. These include documentation requirements, withholding exclusions, and the requested withholding allowances. You should be aware of these aspects regardless of the reason you decide to submit a request form.

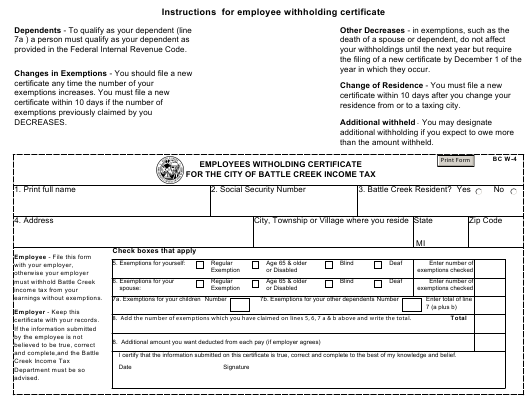

Exemptions from withholding

Non-resident aliens must submit Form 1040NR once each year. If you meet these requirements, you could be eligible to receive an exemption from the withholding forms. On this page, you’ll discover the exemptions for you to choose from.

The first step in submitting Form 1040 – NR is to attach Form 1042 S. The form contains information on the withholding that is performed by the withholding agency for federal tax reporting to be used for reporting purposes. It is important to enter the correct information when filling out the form. It is possible for one person to be treated differently if the information is not given.

The rate of withholding for non-resident aliens is 30%. Your tax burden is not to exceed 30% in order to be eligible for exemption from withholding. There are many exemptions offered. Some of these exclusions are only applicable to spouses and dependents like children.

In general, chapter 4 withholding gives you the right to the possibility of a refund. According to Sections 1471 through 1474, refunds are given. The person who is the withholding agent or the person who is responsible for withholding the tax at source, is the one responsible for distributing these refunds.

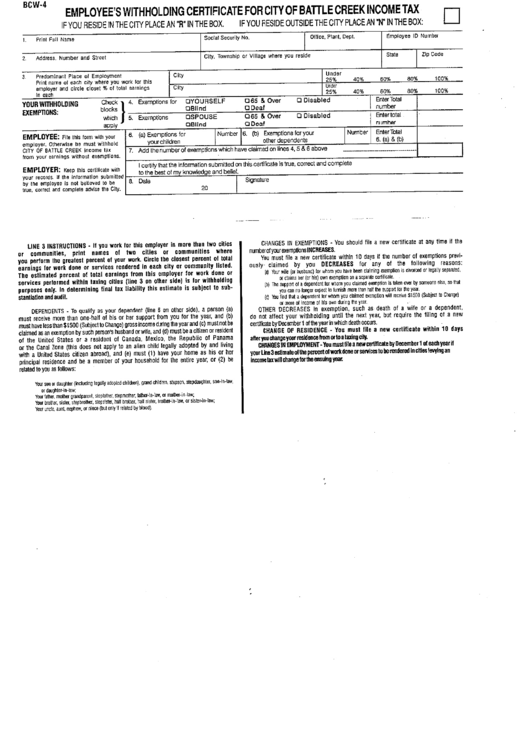

relational status

The correct marital status as well as withholding forms will ease your work and that of your spouse. You’ll be amazed by the amount that you can deposit at the bank. Knowing which of the many options you’re likely to decide is the biggest challenge. Certain, there are that you shouldn’t do. Making a mistake can have expensive negative consequences. If you stick to the instructions and be alert to any possible pitfalls You won’t face any issues. You might make some new acquaintances if you’re lucky. Today is your birthday. I’m hoping they can reverse the tide to help you get the perfect engagement ring. It’s a complex task that requires the expertise of an accountant. The accumulation of wealth over time is more than that modest payment. There are a myriad of websites that offer details. TaxSlayer and other reputable tax preparation firms are some of the most reliable.

The number of withholding allowances claimed

When filling out the form W-4 you fill out, you need to declare how many withholding allowances are you asking for. This is vital since it will affect the amount of tax you get from your paychecks.

You may be able to claim an exemption for your spouse if you are married. Your income also determines how much allowances you’re qualified to receive. An additional allowance could be granted if you make a lot.

It could save you thousands of dollars by choosing the correct amount of tax deductions. It is possible to receive the amount you owe if you submit the annual tax return. Be cautious when it comes to preparing this.

As with every financial decision, it is important to do your research. Calculators can help determine how many withholding amounts should be demanded. As an alternative contact an expert.

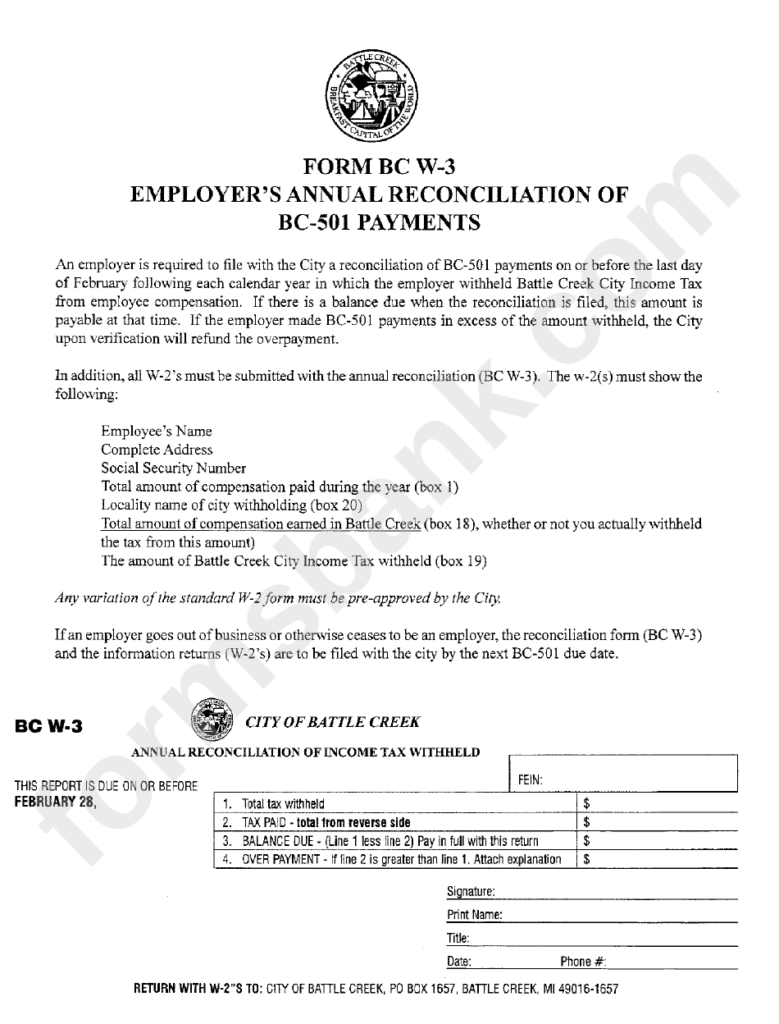

Formulating specifications

If you’re an employer, you must be able to collect and report withholding taxes from your employees. The IRS will accept documents for some of these taxes. There are additional forms you might need, such as an annual tax return, or a withholding reconciliation. Here’s a brief overview of the different tax forms and the time when they should be filed.

In order to be eligible to receive reimbursement for withholding tax on the salary, bonus, commissions or other income that your employees receive it is possible to submit a tax return withholding. You could also be eligible to get reimbursements for tax withholding if your employees received their wages on time. It is important to note that some of these taxes may be taxes imposed by the county, is vital. There are also unique withholding techniques that can be used in certain circumstances.

You must electronically submit withholding forms according to IRS regulations. When you file your tax returns for the national income tax, be sure to provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.