Az Withholding Form 2024 – There are many reasons someone may choose to fill out forms for withholding. The reasons include the need for documentation including withholding exemptions and the quantity of requested withholding allowances. It doesn’t matter what motive someone has to fill out a Form, there are several aspects to keep in mind.

Withholding exemptions

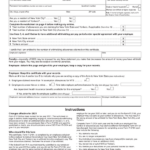

Non-resident aliens must submit Form 1040-NR once a year. If you meet the criteria, you may be qualified for exemption from withholding. The exclusions are that you can access on this page.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The document is required to declare federal income tax. It outlines the amount of withholding that is imposed by the tax withholding agent. Make sure you fill out the form correctly. It is possible for one person to be treated if the information is not given.

The withholding rate for nonresident aliens is 30%. If the tax you pay is lower than 30% of your withholding, you may be eligible to be exempt from withholding. There are many exclusions. Certain of them are designed for spouses, whereas others are meant for use by dependents, such as children.

Generally, withholding under Chapter 4 entitles you for an amount of money back. Refunds can be made under Sections 1400 to 1474. Refunds are provided by the agent who withholds tax. This is the person accountable for tax withholding at the source.

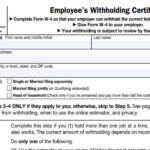

Relational status

The proper marital status and withholding forms can simplify the job of both you and your spouse. You’ll be amazed at how much you can deposit at the bank. The problem is deciding which of the numerous options to choose. There are some things you should not do. It will be costly to make a wrong decision. There’s no problem when you adhere to the instructions and be attentive. If you’re lucky, you may even make new acquaintances while traveling. Today is the day you celebrate your marriage. I hope you will take advantage of it to search for that one-of-a-kind engagement ring. It will be a complicated task that requires the expertise of a tax professional. The tiny amount is worthwhile for the life-long wealth. Information on the internet is easy to find. TaxSlayer is a well-known tax preparation business is one of the most helpful.

The number of withholding allowances claimed

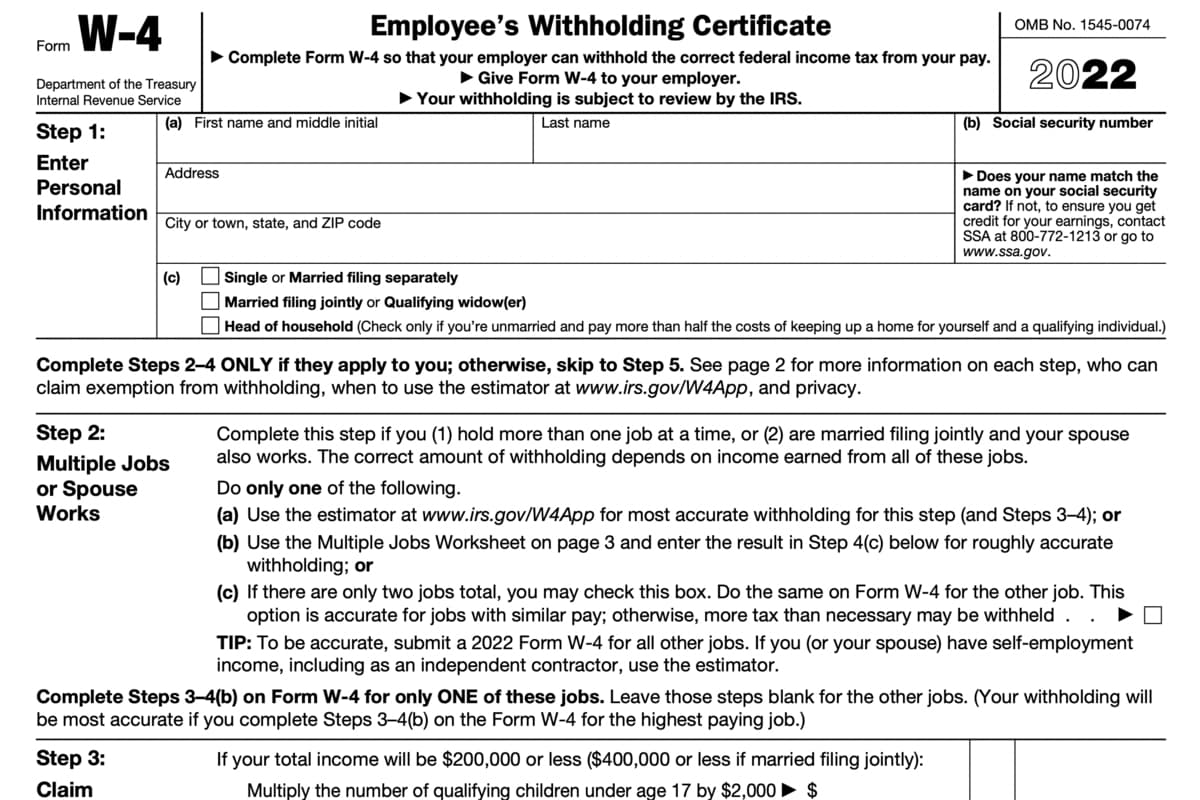

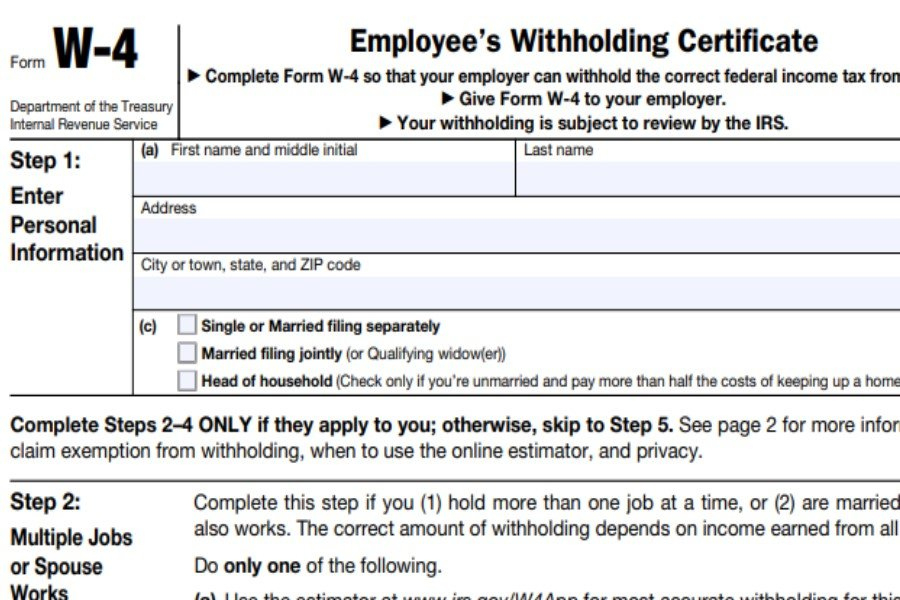

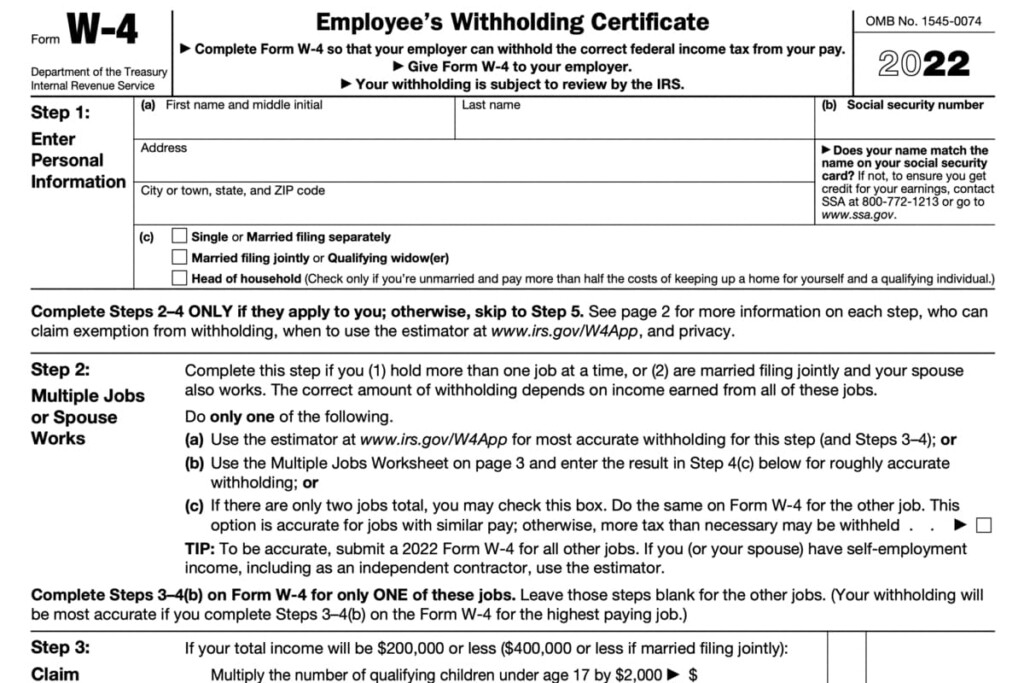

It is crucial to indicate the amount of withholding allowances which you want to claim in the form W-4. This is crucial since the tax withheld can affect the amount taken out of your paycheck.

The amount of allowances that you are entitled to will be determined by various factors. For example If you’re married, you could be eligible for an exemption for your household or head. Your income level also affects how many allowances you are qualified to receive. If you earn a higher income, you can request an increased allowance.

You could save a lot of money by determining the right amount of tax deductions. If you submit the annual tax return for income and you are entitled to a refund. But, you should be careful about how you approach the tax return.

Research as you would with any other financial decision. Calculators are a great tool to determine the amount of withholding allowances are required to be claimed. It is also possible to speak with a specialist.

Filing requirements

Employers must report the employer who withholds tax from their employees. If you are unable to collect these taxes, you may provide documentation to the IRS. You may also need additional forms that you might need for example, the quarterly tax return or withholding reconciliation. Here’s a brief overview of the different tax forms, and the time when they should be filed.

You may have to file tax returns withholding to claim the earnings you earn from employees, such as bonuses or commissions. You may also have to file for salary. If you pay your employees on time, then you may be eligible for the refund of taxes that you withheld. Be aware that certain taxes could be considered to be local taxes. You may also find unique withholding methods that are used in specific situations.

Electronic submission of withholding forms is required under IRS regulations. It is mandatory to include your Federal Employer ID Number when you file to your tax return for national income. If you don’t, you risk facing consequences.