Az State Withholding Tax Forms – There are a variety of reasons one might decide to complete a form for withholding form. Documentation requirements, withholding exemptions and the amount of the allowance required are just a few of the factors. There are certain things you should remember regardless of why the person fills out the form.

Exemptions from withholding

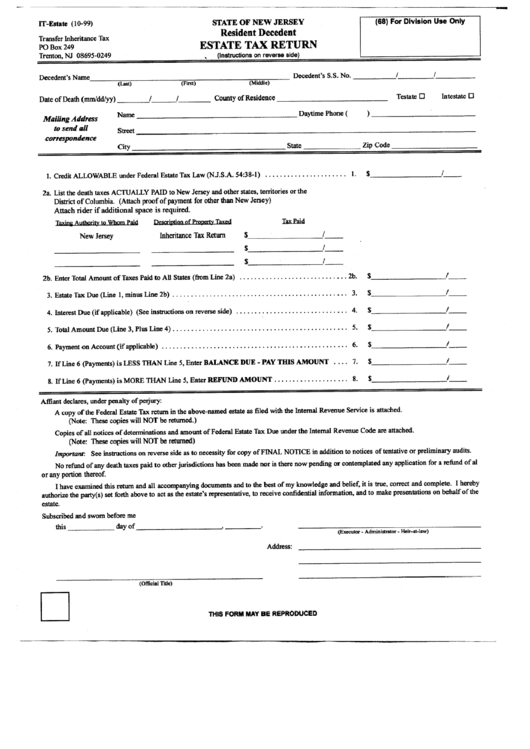

Nonresident aliens need to submit Form 1040–NR once a calendar year. However, if you meet the criteria, you may be able to submit an exemption from withholding form. This page lists all exemptions.

To submit Form 1040-NR The first step is attaching Form 1042S. To report federal income tax purposes, this form outlines the withholding process of the agency responsible for withholding. It is crucial to enter the correct information when filling out the form. It is possible for one person to be treated differently if the information is not given.

Nonresident aliens have a 30% withholding tax. Exemption from withholding could be granted if you have a the tax burden less than 30 percent. There are a variety of exemptions that are available. Some of these exclusions are only available to spouses or dependents, such as children.

Generally, a refund is offered for the chapter 4 withholding. Refunds can be claimed in accordance with Sections 1401, 1474, and 1475. Refunds are to be given by the agents who withhold taxes, which is the person who is responsible for withholding taxes at the source.

Relational status

A valid marital status and withholding form will simplify the work of you and your spouse. Additionally, the quantity of money you can put at the bank could delight you. The problem is deciding which one of the many options to select. There are certain items you must avoid. Making a mistake can have costly consequences. You won’t have any issues when you adhere to the instructions and pay attention. If you’re lucky, you may be able to make new friends during your trip. Today marks the anniversary of your wedding. I’m hoping you’re capable of using this against them in order to acquire that elusive wedding ring. If you want to get it right you’ll need the help of a certified accountant. The tiny amount is worthwhile for the lifetime of wealth. You can get a lot of information on the internet. TaxSlayer is a trusted tax preparation business, is one of the most effective.

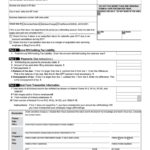

The number of withholding allowances claimed

When filling out the form W-4 you submit, you must declare how many withholding allowances are you asking for. This is important because the tax amount withdrawn from your paychecks will be affected by the much you withhold.

Many factors affect the amount of allowances requested.If you’re married, for instance, you might be eligible to claim a head of household exemption. Your income will determine how many allowances you are eligible for. You can apply for more allowances if earn a significant amount of money.

A tax deduction that is appropriate for your situation could allow you to avoid tax payments. You could actually receive the amount you owe if you submit your annual tax return. But it is important to select the correct method.

Like any other financial decision, you should do your homework. Calculators can be used to figure out the amount of withholding allowances that are required to be requested. Another option is to talk with a specialist.

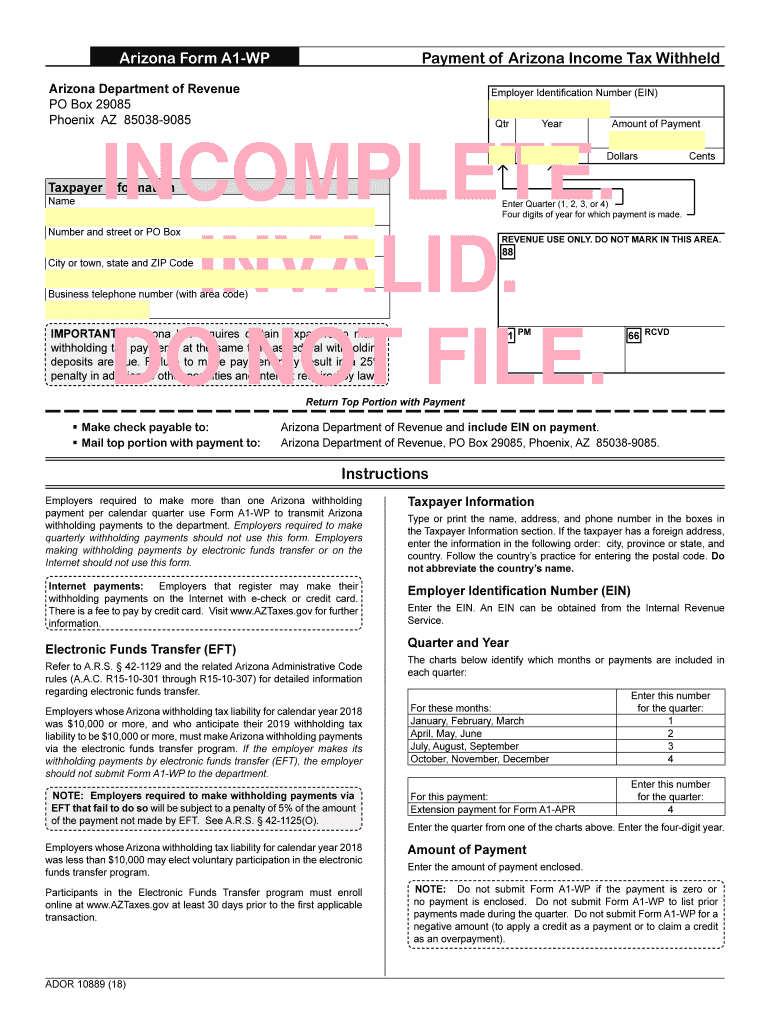

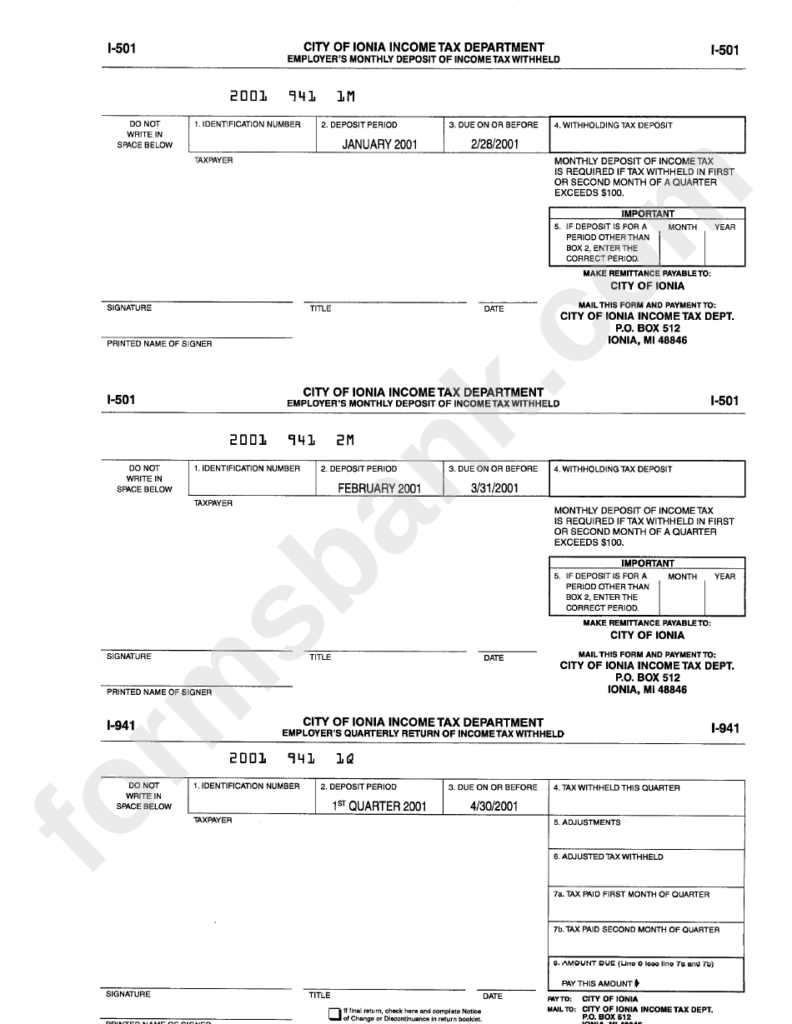

filing specifications

If you are an employer, you must collect and report withholding taxes on your employees. The IRS can accept paperwork for certain taxes. There are additional forms you may require like a quarterly tax return or withholding reconciliation. Here is some information on the different tax forms for withholding categories and the deadlines for the submission of these forms.

In order to be eligible to receive reimbursement for withholding tax on the pay, bonuses, commissions or other revenue received from your employees, you may need to submit a tax return withholding. If you pay your employees on time, you may be eligible to receive reimbursement of any withheld taxes. It is important to note that certain taxes are county taxes ought to be considered. There are specific tax withholding strategies that could be appropriate in particular situations.

According to IRS rules, you are required to electronically file withholding forms. You must include your Federal Employer Identification Number when you file to your tax return for national income. If you don’t, you risk facing consequences.