Axa Tax Withholding Form 2024 – There are a variety of reasons why someone could complete an application for withholding. These factors include documentation requirements and exemptions for withholding. No matter what the reason is for the filing of an application there are certain aspects to keep in mind.

Withholding exemptions

Non-resident aliens must submit Form 1040 NR at least once each year. If you meet the requirements, you may be eligible for exemptions from the form for withholding. There are exemptions that you can access on this page.

To submit Form 1040-NR, the first step is to attach Form 1042S. To report federal income tax reasons, this form details the withholding made by the withholding agency. It is essential to fill in the correct information when filling out the form. You may have to treat one person if you don’t provide the correct information.

Nonresident aliens pay a 30% withholding tax. Tax burdens is not to exceed 30% in order to be exempt from withholding. There are a variety of exemptions available. Some of them apply to spouses or dependents, like children.

You are entitled to refunds if you have violated the rules of chapter 4. Refunds can be made under Sections 1400 to 1474. Refunds are given by the withholding agent. The withholding agent is the individual who is responsible for withholding tax at the point of origin.

Relational status

The proper marital status and withholding form will simplify your work and that of your spouse. You’ll be amazed by the amount you can deposit to the bank. It isn’t easy to choose which of many choices is the most appealing. You should be careful what you do. A bad decision could result in a costly loss. There’s no problem if you just adhere to the instructions and be attentive. If you’re lucky, you could meet some new friends on your trip. Today marks the anniversary. I’m sure you’ll take advantage of it to search for that one-of-a-kind ring. In order to complete the job correctly it is necessary to seek the assistance of a certified tax expert. The accumulation of wealth over time is more than that small amount. There are numerous websites that offer details. Reputable tax preparation firms like TaxSlayer are among the most efficient.

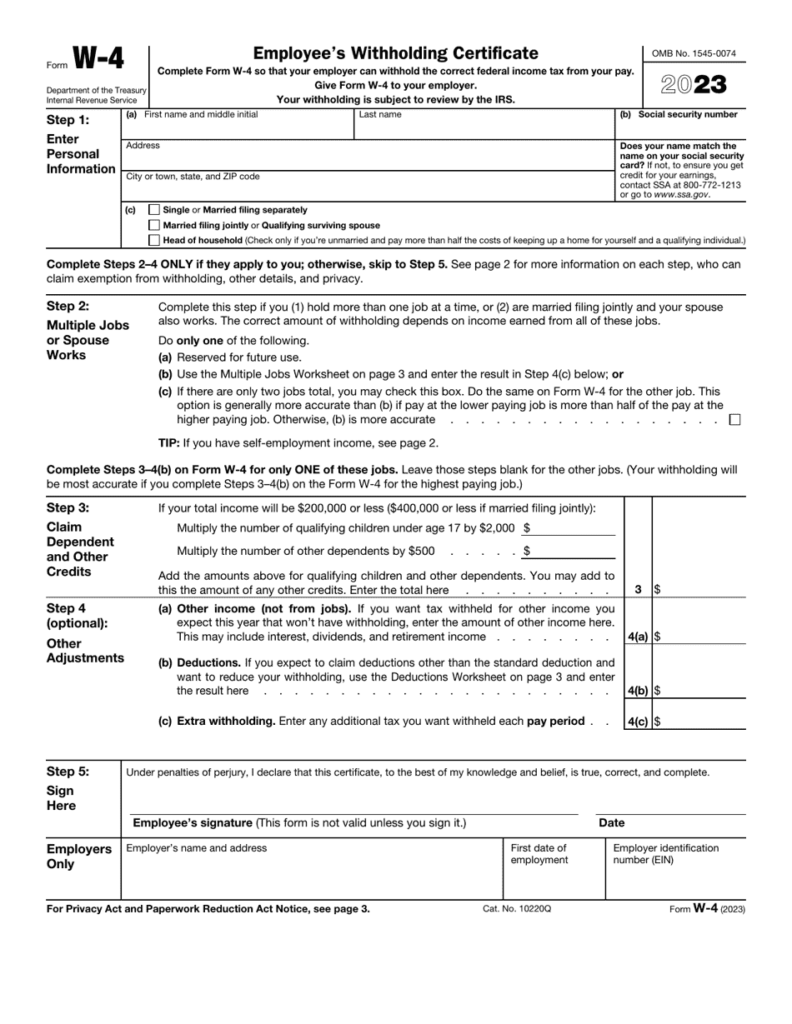

the number of claims for withholding allowances

It is important to specify the amount of withholding allowances you wish to claim on the Form W-4. This is important because the tax withheld will affect how much is taken from your paychecks.

There are a variety of factors that affect the allowance amount you can claim. If you’re married you might be eligible for a head-of-household exemption. The amount you are eligible for will be contingent on your income. If you earn a higher income, you could be eligible to request a higher allowance.

A tax deduction appropriate for you could aid you in avoiding large tax obligations. You could actually receive a refund if you file your annual tax return. However, you must be careful about how you approach the tax return.

Similar to any financial decision, you should do your homework. Calculators can be used to determine the amount of withholding allowances that are required to be claimed. Alternative options include speaking with a specialist.

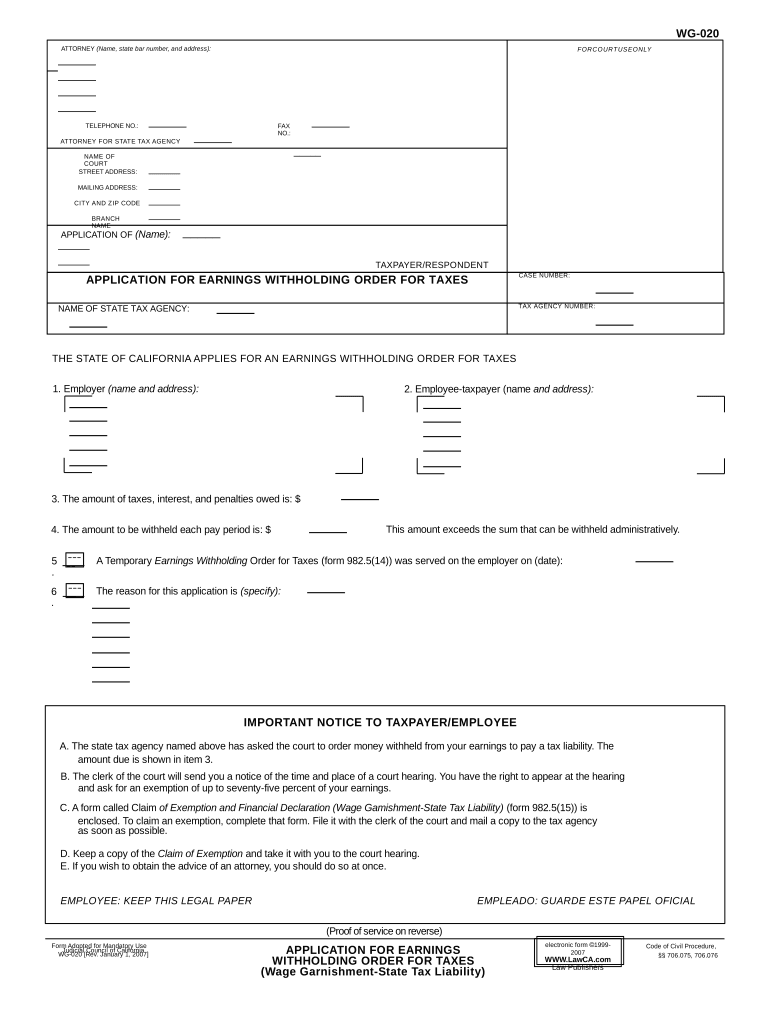

Sending specifications

Employers are required to report any withholding taxes being collected from employees. For some taxes you might need to submit documentation to the IRS. There may be additional documentation such as an withholding tax reconciliation or a quarterly tax return. Here are the details on different withholding tax forms and the deadlines for each.

The compensation, bonuses, commissions, and other income you get from employees might necessitate you to file withholding tax returns. It is also possible to get reimbursements of taxes withheld if you’re employees were paid on time. Be aware that these taxes could be considered as local taxes. You may also find unique withholding methods that are utilized in certain circumstances.

The IRS regulations require that you electronically submit withholding documents. When filing your national revenue tax returns make sure you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.