Arizona Separate Withholding Form Required State Tax – There are many reasons why someone might choose to fill out a tax form. These include documentation requirements, withholding exclusions, and the requested withholding allowances. Whatever the motive someone has to fill out the Form, there are several aspects to keep in mind.

Exemptions from withholding

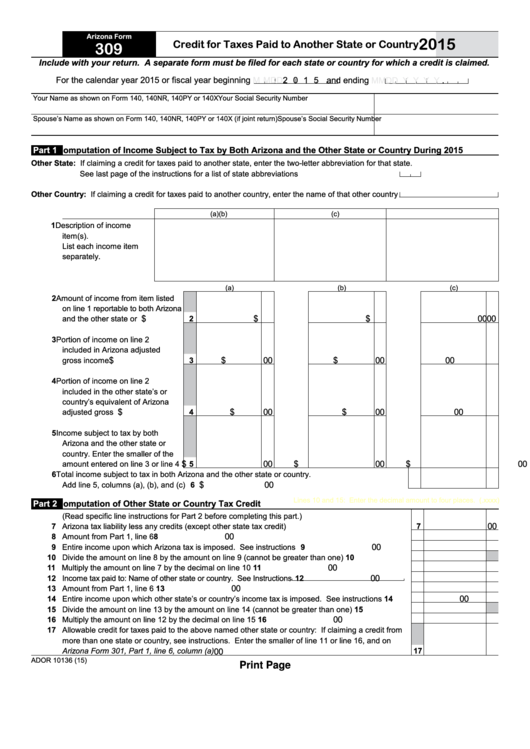

Non-resident aliens are required to submit Form1040-NR once each year to fill out Form1040-NR. If you satisfy the requirements, you could be eligible for an exemption to withholding. The exemptions listed on this page are yours.

The first step in submit Form 1040 – NR is to attach the Form 1042 S. The form outlines the withholdings made by the agency. Please ensure you are entering the correct information when filling out this form. One individual may be treated if this information is not supplied.

Non-resident aliens have to pay 30 percent withholding. The tax burden of your business should not exceed 30% to be exempt from withholding. There are a variety of exemptions. Some of them apply to spouses and dependents, such as children.

In general, chapter 4 withholding gives you the right to an amount of money. Refunds are available in accordance with Sections 1401, 1474 and 1475. Refunds are given by the tax agent. The withholding agent is the individual responsible for withholding the tax at the source.

Status of relationships

A form for a marital withholding is an excellent way to make your life easier and aid your spouse. The bank could be shocked by the amount of money that you have to deposit. It isn’t easy to determine which one of many choices is most attractive. Certain aspects should be avoided. A bad decision could cost you dearly. If you stick to it and pay attention to the directions, you shouldn’t encounter any issues. If you’re lucky, you might even make a few new pals on your travels. Today is the anniversary. I’m hoping you can leverage it to secure that dream ring. If you want to do this properly, you’ll require guidance of a certified Tax Expert. This tiny amount is worth the time and money. There is a wealth of information on the internet. TaxSlayer, a reputable tax preparation firm is among the most useful.

The amount of withholding allowances claimed

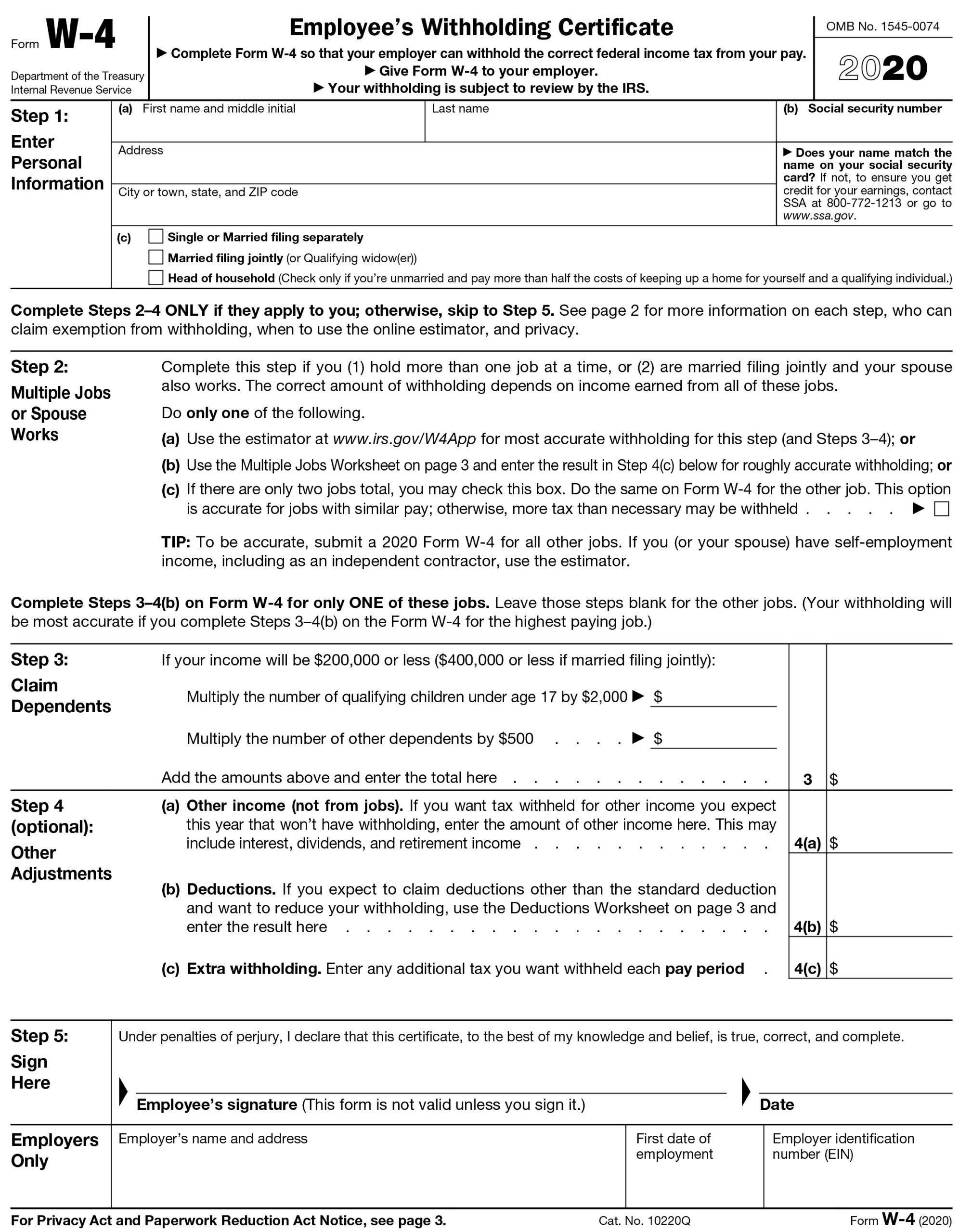

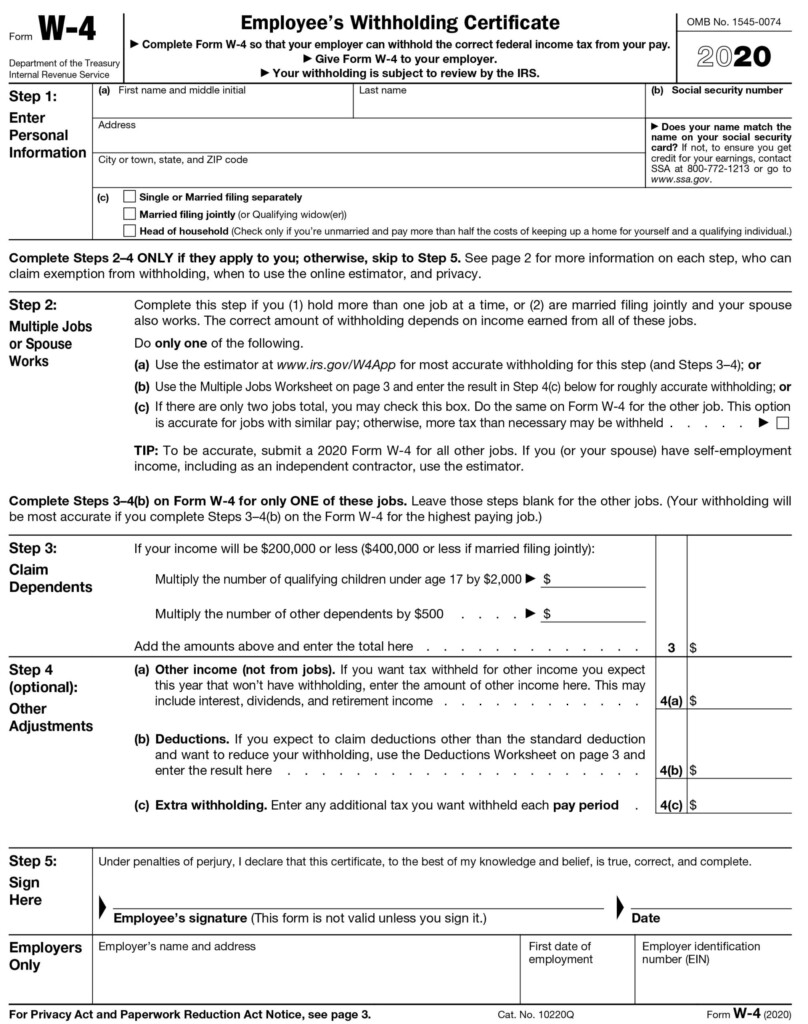

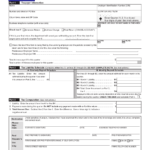

In submitting Form W-4 you should specify the number of withholding allowances you wish to claim. This is important because the amount of tax taken from your pay will be affected by the much you withhold.

The amount of allowances you get will be contingent on the various aspects. For instance, if you are married, you could be qualified for a head or household exemption. The amount of allowances you’re eligible to claim will depend on the income you earn. If you have a high income, you could be eligible to request a higher allowance.

You may be able to reduce the amount of your tax bill by selecting the appropriate amount of tax deductions. In reality, if you submit your annual income tax return, you might even receive a refund. But it is important to pick the right method.

Like any other financial decision, you should do your homework. Calculators are a great tool to figure out how many withholding allowances should be claimed. An alternative is to speak to a professional.

Filing specifications

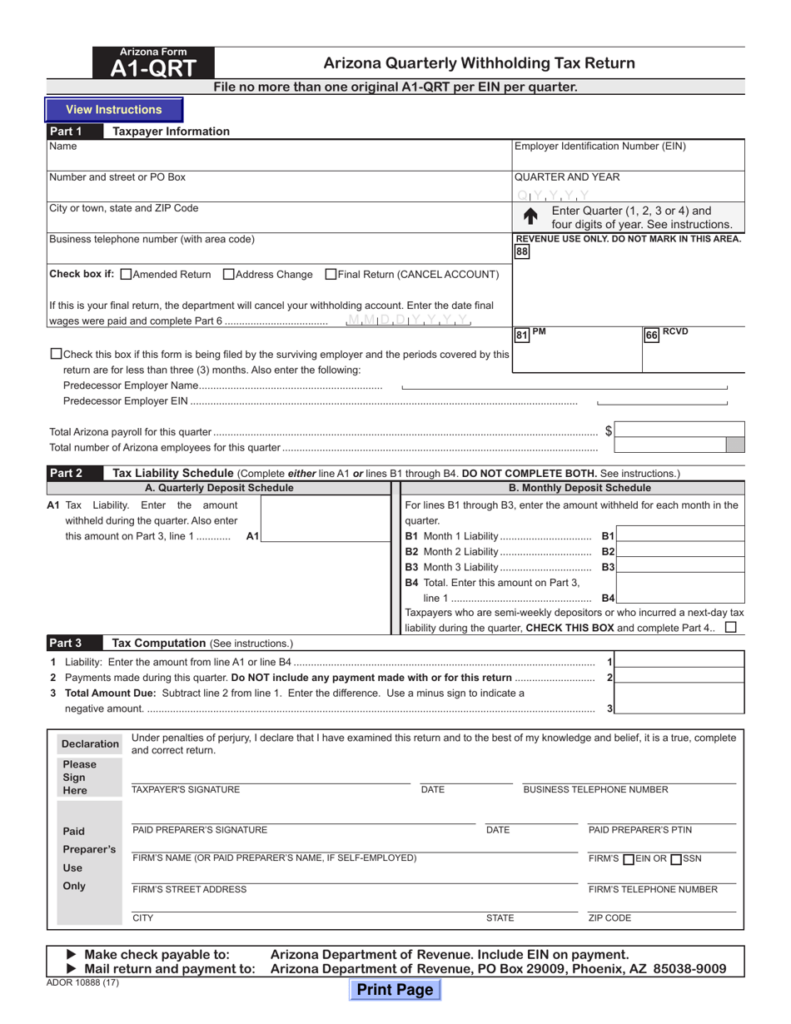

Employers must inform the IRS of any withholding tax that is being paid by employees. The IRS will accept documents to pay certain taxes. A tax return that is annually filed and quarterly tax returns, or tax withholding reconciliations are just a few examples of paperwork you might need. Here’s some details on the different forms of withholding tax categories as well as the deadlines for filling them out.

The compensation, bonuses, commissions, and other income you get from employees might require you to submit withholding tax returns. Additionally, if employees are paid punctually, you might be eligible for tax refunds for withheld taxes. Noting that certain of these taxes could be considered to be county taxes, is also crucial. Additionally, you can find specific withholding procedures that can be applied in particular circumstances.

The IRS regulations require that you electronically file withholding documents. It is mandatory to include your Federal Employer Identification Number when you file to your tax return for national income. If you don’t, you risk facing consequences.