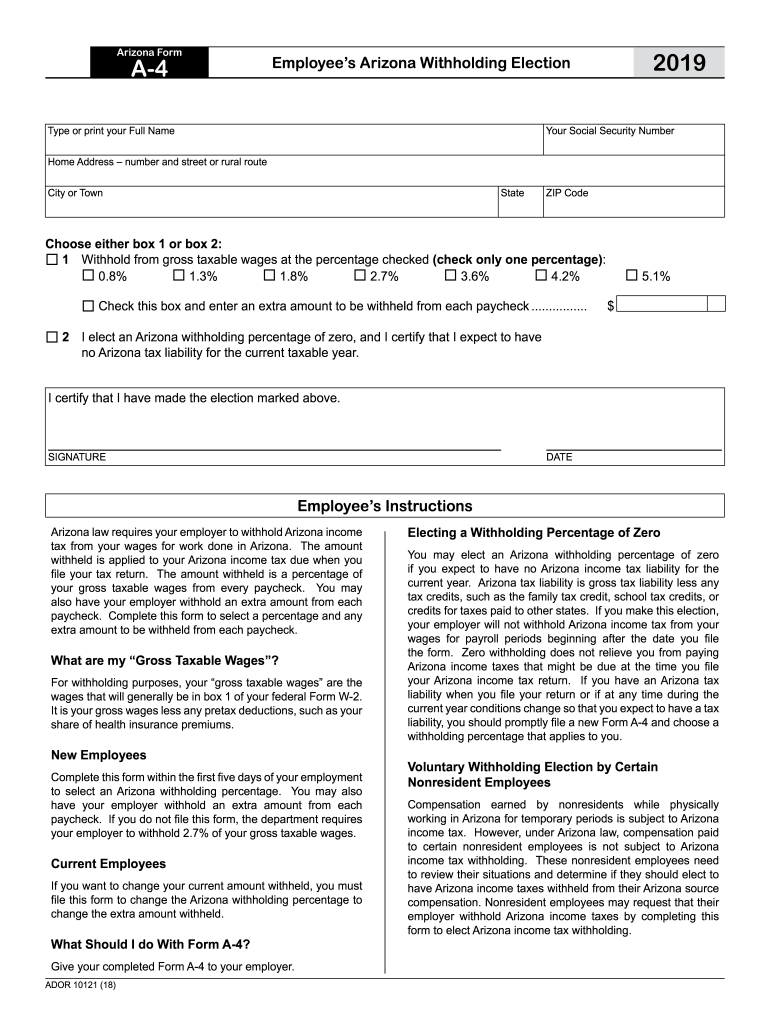

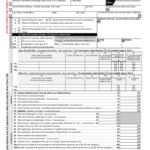

Arizona Form A4 How Much To Withhold Form – There are many reasons for a person to decide to fill out a form for withholding. This includes documentation requirements and withholding exemptions. There are certain points to be aware of regardless of the reason that a person has to fill out the form.

Withholding exemptions

Nonresident aliens are required at least once each year to fill out Form1040-NR. If you meet the requirements you may be eligible to be exempt from withholding. This page will list all exclusions.

To submit Form 1040-NR The first step is to attach Form 1042S. This form provides details about the withholding that is performed by the tax agency that handles withholding to report federal income tax for tax reporting purposes. Fill out the form correctly. You may have to treat a single person if you don’t provide the correct information.

The tax withholding rate for non-resident aliens is 30%. If the tax you pay is lower than 30 percent of your withholding, you could be eligible for an exemption from withholding. There are many exclusions. Some are specifically for spouses, or dependents, for example, children.

In general, withholding under Chapter 4 allows you to claim the right to a refund. Refunds may be granted according to Sections 1400 through 1474. The agent who withholds the tax, or the person who collects the tax at source is responsible for the refunds.

Relational status

A proper marital status withholding will make it easier for both you and your spouse to complete your tasks. The bank may be surprised by the amount that you have to deposit. Knowing which of the many options you’re likely to pick is the tough part. Certain things are best avoided. Making the wrong decision will cost you a lot. If you stick to the guidelines and adhere to them, there won’t be any issues. If you’re lucky, you could make new acquaintances on your trip. In the end, today is the anniversary of your wedding. I hope you are capable of using this to get that elusive wedding ring. It’s a complex task that requires the expertise of a tax professional. It’s worthwhile to accumulate wealth over a lifetime. Online information is easily accessible. TaxSlayer is one of the most trusted and reputable tax preparation firms.

There are many withholding allowances that are being claimed

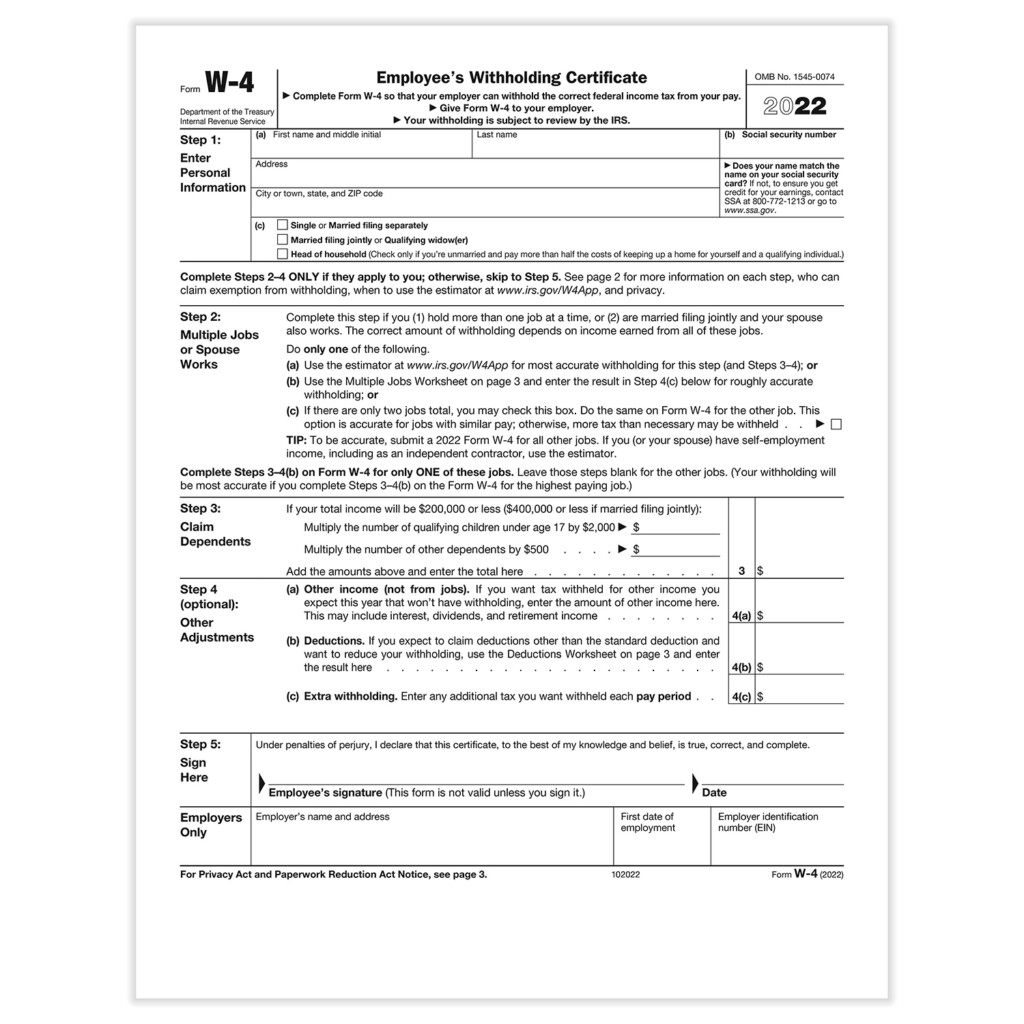

On the Form W-4 that you fill out, you need to indicate how many withholding allowances are you seeking. This is crucial since your wages could be affected by the amount of tax you have to pay.

There are many factors that influence the allowance amount that you can claim. If you’re married, you might be qualified for an exemption for head of household. Additionally, you can claim additional allowances, based on how much you earn. If you earn a substantial amount of income, you may be eligible for a higher allowance.

It could save you lots of money by choosing the correct amount of tax deductions. If you submit your annual income tax returns, you may even be qualified for a tax refund. It is important to be cautious about how you approach this.

Just like with any financial decision you make it is essential to conduct your research. Calculators can be utilized to determine how many withholding allowances are required to be requested. Another option is to talk with a professional.

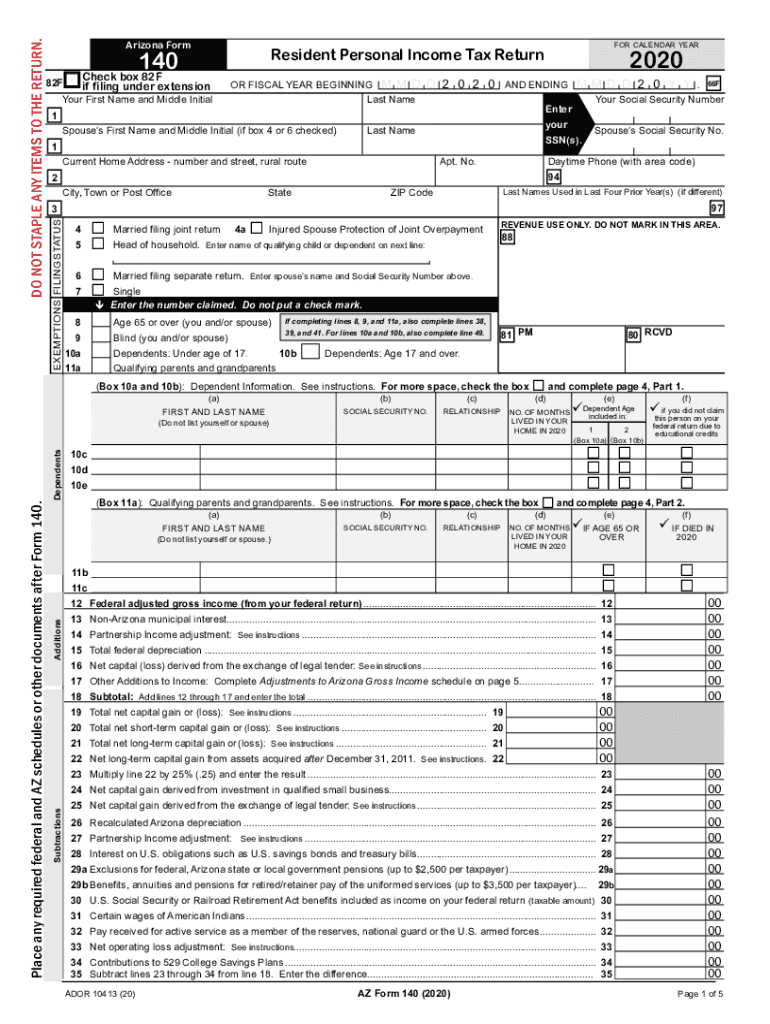

Specifications for filing

If you are an employer, you must pay and report withholding tax on your employees. The IRS will accept documents for some of these taxes. A tax reconciliation for withholding and a quarterly tax return, or the annual tax return are examples of additional documents you could have to file. Below are information on the different withholding tax forms and the deadlines for each.

The salary, bonuses commissions, other income that you receive from your employees could require you to submit withholding tax returns. If you pay your employees on time, you may be eligible for the refund of taxes that you withheld. Be aware that these taxes could be considered as taxation by the county. There are also unique withholding procedures that can be utilized in certain circumstances.

In accordance with IRS regulations the IRS regulations, electronic filings of tax withholding forms are required. If you are filing your tax returns for the national income tax ensure that you provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.