Arizona Department Of Revenue Withholding Tax Forms – There stand a digit of reasons for a person to decide to fill out a tax form. These factors include the documentation requirements, withholding exclusions, and the requested withholding allowances. You should be aware of these factors regardless of the reason you decide to fill out a form.

Exemptions from withholding

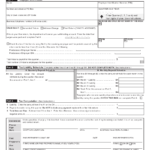

Non-resident aliens must submit Form 1040–NR every calendar year. If the requirements are met, you could be eligible to apply for an exemption from withholding. This page will provide the exclusions.

Attaching Form 1042-S is the first step to file Form 1040-NR. For federal income tax reporting reasons, this form outlines the withholding made by the withholding agency. Be sure to enter the correct information when filling out this form. It is possible that you will have to treat a single person for not providing this information.

Non-resident aliens have to pay the 30% tax withholding rate. Non-resident aliens may be eligible for an exemption. This applies when your tax burden is lower than 30%. There are a variety of exemptions offered. Certain of them apply to spouses and dependents such as children.

The majority of the time, a refund is accessible for Chapter 4 withholding. Refunds are permitted under Sections 1471-1474. Refunds will be made to the agent who withholds tax the person who withholds the tax at the source.

relational status

A proper marital status withholding can help both of you to accomplish your job. You’ll be amazed at the amount that you can deposit at the bank. The challenge is in deciding what option to choose. There are certain things that you shouldn’t do. It will be expensive to make the wrong decision. It’s not a problem if you just adhere to the instructions and be attentive. If you’re lucky you could even meet a few new pals on your travels. In the end, today is the date of your wedding anniversary. I’m hoping that you can use it against them to get that elusive wedding ring. It’s a complex job that requires the experience of a tax professional. A lifetime of wealth is worth the tiny amount. There is a wealth of details online. TaxSlayer and other trusted tax preparation companies are some of the most reliable.

Amount of withholding allowances claimed

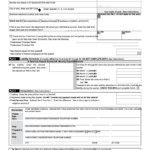

On the W-4 form you fill out, you need to declare the amount of withholding allowances you asking for. This is important since the tax amount withdrawn from your paycheck will be affected by the you withhold.

You may be able to claim an exemption for the head of your household if you are married. Your income level can also impact how many allowances are available to you. If you earn a substantial amount of income, you may get a bigger allowance.

A tax deduction appropriate for you could help you avoid large tax payments. In reality, if you file your annual income tax return, you may even get a refund. However, be cautious about your approach.

It is essential to do your homework the same way you would with any financial decision. Calculators are a great tool to determine how many withholding allowances you should claim. A specialist could be a good option.

Sending specifications

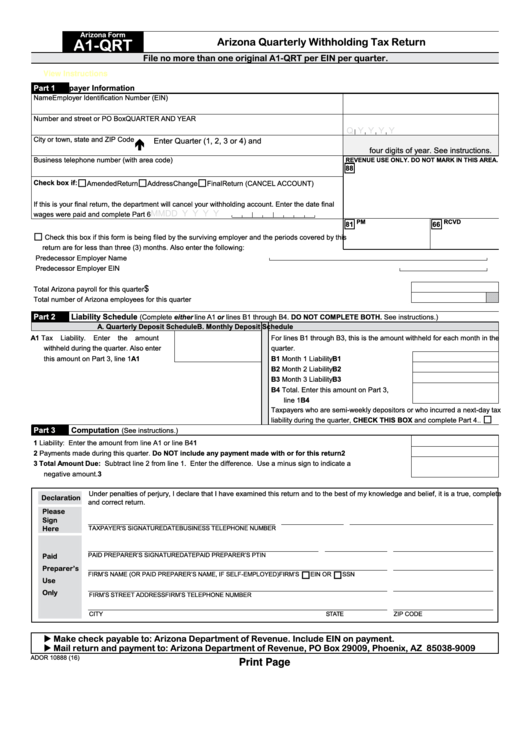

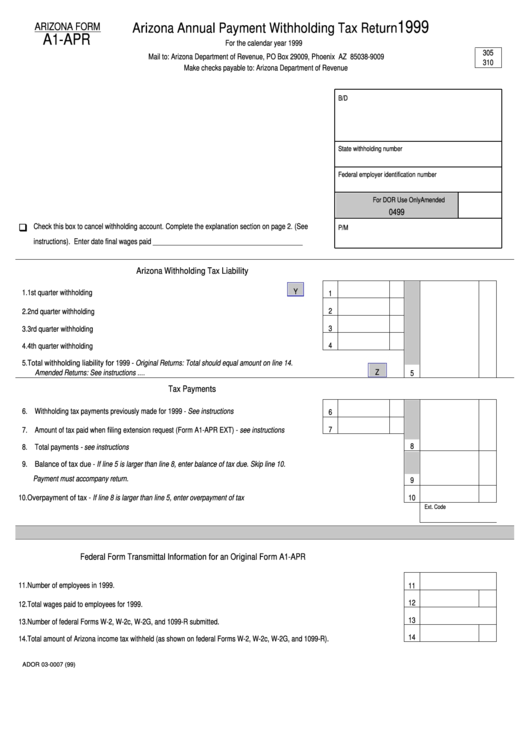

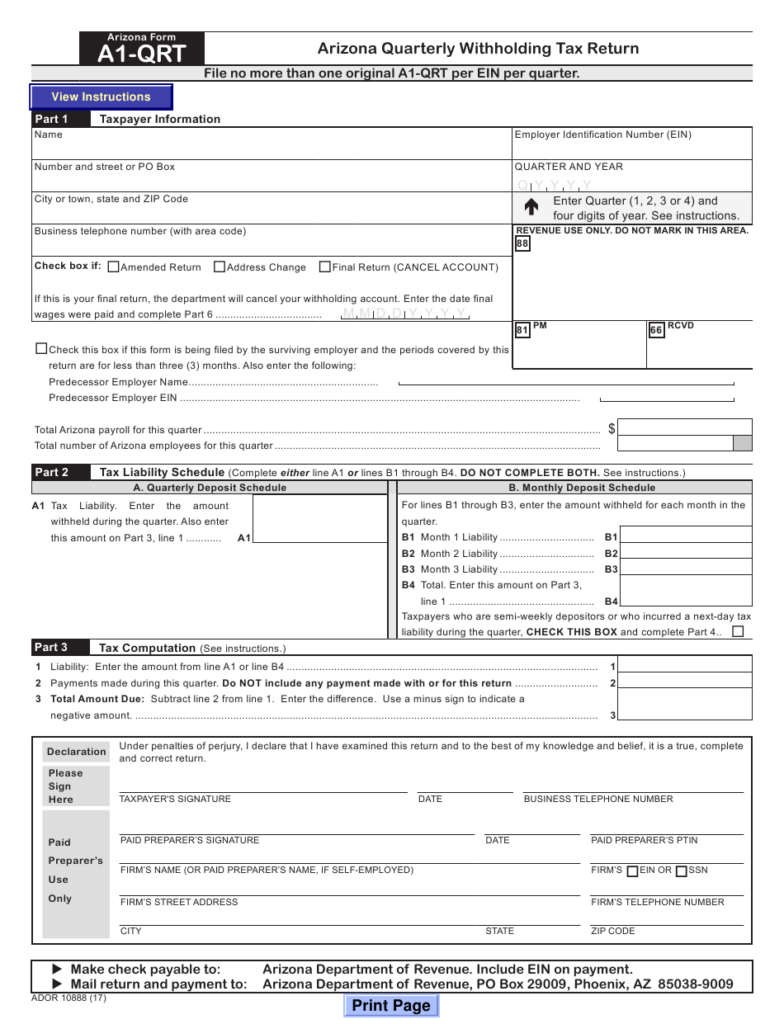

If you’re an employer, you are required to be able to collect and report withholding taxes on your employees. In the case of a small amount of these taxes, you can submit paperwork to IRS. There may be additional documents, such as the reconciliation of your withholding tax or a quarterly return. Here is more information on the different forms of withholding taxes and the deadlines to file them.

The bonuses, salary, commissions, and other income you get from your employees could necessitate you to file tax returns withholding. It is also possible to get reimbursements for tax withholding if your employees received their wages promptly. It is important to note that some of these taxes are local taxes. There are specific tax withholding strategies that could be appropriate in particular circumstances.

You must electronically submit withholding forms in accordance with IRS regulations. When you file your national revenue tax return be sure to include the Federal Employer Identification number. If you don’t, you risk facing consequences.