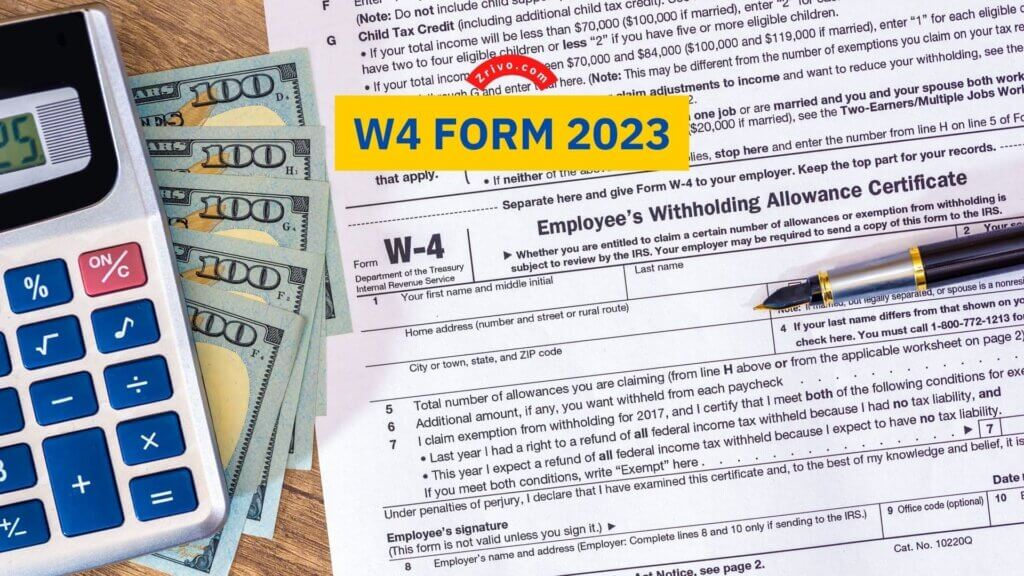

Are Their New Federal Withholding Tax Forms For 2024 – There are many reasons someone may decide to submit a withholding application. These factors include the document requirements, exclusions from withholding, and the requested withholding allowances. No matter what the reason is for a person to file documents, there are certain things you must keep in mind.

Withholding exemptions

Non-resident aliens have to submit Form 1040-NR at a minimum every year. However, if you meet the criteria, you may be eligible for an exemption form from withholding. This page you will find the exclusions for you to choose from.

When you submit Form1040-NR, attach Form 1042S. The form lists the amount withheld by the tax withholding authorities for federal tax reporting for tax reporting purposes. Be sure to enter the correct information as you complete the form. One person may be treated if this information is not entered.

Nonresident aliens pay the option of paying a 30% tax on withholding. Non-resident aliens may be eligible for an exemption. This happens when your tax burden is less than 30 percent. There are a variety of exclusions. Certain of them are applicable to spouses or dependents like children.

Generally, withholding under Chapter 4 gives you the right to the right to a refund. Refunds are granted according to Sections 1400 through 1474. The refunds are made to the withholding agent, the person who withholds the tax from the source.

Status of the relationship

Your and your spouse’s job is made simpler with a valid marriage-related status withholding document. You’ll be surprised by how much you can put in the bank. It isn’t always easy to determine which one of the many options is the most attractive. There are certain actions you should not do. Making a mistake can have costly consequences. There’s no problem if you just follow the directions and be attentive. If you’re lucky you could even meet some new friends on your travels. Today marks the day you celebrate your marriage. I’m hoping you’ll be able to utilize it against them to locate that perfect engagement ring. To do it right you’ll require the assistance of a certified accountant. The little amount is enough for a lifetime of wealth. There are numerous websites that offer details. TaxSlayer is one of the most trusted and respected tax preparation firms.

The amount of withholding allowances claimed

It is essential to state the amount of the withholding allowance you wish to claim on the form W-4. This is important because the tax amount taken from your pay will be affected by how you withhold.

You may be able to claim an exemption for your spouse when you’re married. Your income will affect the amount of allowances you can receive. You could be eligible to claim more allowances if earn a significant amount of money.

Choosing the proper amount of tax deductions might help you avoid a hefty tax payment. If you file your annual income tax return, you may even receive a refund. However, you must choose your method carefully.

Do your research, as you would in any financial decision. Calculators will help you determine the number of withholdings that need to be claimed. In addition contact a specialist.

Specifications that must be filed

If you’re an employer, you are required to pay and report withholding tax from your employees. It is possible to submit documents to the IRS for a few of these taxation. It is possible that you will require additional documentation , like a withholding tax reconciliation or a quarterly return. Here are some specifics about the various types of withholding tax forms as well as the filing deadlines.

To be eligible to receive reimbursement for withholding taxes on the pay, bonuses, commissions or any other earnings received from your employees, you may need to submit withholding tax return. It is also possible to receive reimbursement for taxes withheld if your employees received their wages on time. Be aware that certain taxes may be county taxes. Additionally, there are unique withholding practices that can be applied under particular conditions.

You have to submit electronically tax withholding forms as per IRS regulations. Your Federal Employer identification number should be included when you submit at your national tax return. If you don’t, you risk facing consequences.