Alabama Withholding Tax Form A-1 – There are numerous reasons that a person might decide to file an application for withholding. The requirements for documentation, exemptions from withholding and the amount of withholding allowances requested are all factors. No matter the reason someone chooses to file the Form, there are several things to remember.

Withholding exemptions

Non-resident aliens are required to submit Form 1040-NR at least once per year. If you meet the requirements you may be eligible to be exempt from withholding. The following page lists all exclusions.

The first step in filling out Form 1040-NR is attaching Form 1042 S. To report federal income tax reasons, this form provides the withholding process of the tax agency that handles withholding. Make sure that you fill in the correct information when you fill in the form. You may have to treat one person for not providing this information.

The rate of withholding for non-resident aliens is 30%. It is possible to get an exemption from withholding tax if your tax burden is greater than 30 percent. There are many exclusions. Certain exclusions are only applicable to spouses and dependents such as children.

Generally, a refund is accessible for Chapter 4 withholding. As per Sections 1471 to 1474, refunds are given. These refunds must be made by the agents who withhold taxes, which is the person who collects taxes at source.

Relational status

A proper marital status withholding can make it simpler for you and your spouse to accomplish your job. You’ll be surprised by how much you can deposit to the bank. The trick is to decide which one of the many options to select. There are certain aspects to be aware of. Unwise decisions could lead to costly consequences. If you stick to it and pay attention to the instructions, you won’t run into any problems. If you’re lucky you might meet some new friends on your journey. Today marks the anniversary of your wedding. I’m hoping they turn it against you to get you the perfect engagement ring. It’s a complex job that requires the experience of a tax professional. The little amount is enough for a lifetime of wealth. You can find plenty of information on the internet. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

There are many withholding allowances being claimed

You must specify how many withholding allowances you want to claim on the Form W-4 you fill out. This is critical since your wages could be affected by the amount of tax you have to pay.

There are many variables that influence the allowance amount you can request. If you’re married you might be eligible for a head-of-household exemption. Your income can impact how many allowances are available to you. You may be eligible for an increase in allowances if you have a large amount of income.

You may be able to save money on a tax bill by selecting the right amount of tax deductions. Even better, you might be eligible for a refund when your tax return for income is filed. But , you have to choose your strategy carefully.

Do your research as you would with any financial decision. Calculators can help determine the amount of withholding that should be claimed. An expert may be an alternative.

Specifications for filing

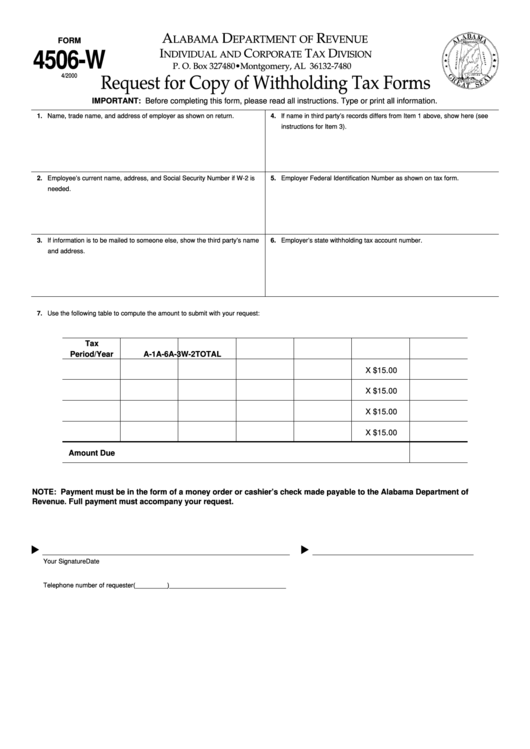

Withholding taxes on your employees must be collected and reported when you are an employer. The IRS may accept forms for certain taxes. An annual tax return and quarterly tax returns, or tax withholding reconciliations are just a few examples of paperwork you might require. Here are some details regarding the various forms of withholding tax forms along with the filing deadlines.

Withholding tax returns may be required for certain incomes such as bonuses, salary, commissions and other income. You could also be eligible to receive reimbursement for taxes withheld if your employees received their wages promptly. Noting that certain of these taxes could be considered to be taxes imposed by the county, is vital. There are also unique withholding methods that are applicable in certain circumstances.

The IRS regulations require you to electronically submit withholding documents. You must include your Federal Employer ID Number when you file your national income tax return. If you don’t, you risk facing consequences.