Al Employee Withholding Form – There are numerous reasons that a person may decide to submit a withholding application. Withholding exemptions, documentation requirements and the amount of the allowance required are just a few of the factors. It is important to be aware of these factors regardless of the reason you decide to file a request form.

Withholding exemptions

Nonresident aliens are required once every year to file Form1040-NR. You may be eligible to submit an exemption form from withholding if you meet all the criteria. This page you will discover the exemptions that you can avail.

To submit Form 1040-NR the first step is to attach Form 1042S. This form details the withholdings that the agency makes. It is essential to fill in the correct information when filling out the form. There is a possibility for one individual to be treated in a manner that is not correct if the information is not given.

The withholding rate for nonresident aliens is 30%. You could be eligible to receive an exemption from withholding if your tax burden exceeds 30%. There are many exemptions. Certain of them are designed for spouses, while others are intended for use by dependents such as children.

In general, you’re entitled to a reimbursement in accordance with chapter 4. According to Sections 1471 through 1474, refunds can be made. The refunds are given by the agent who withholds tax (the person who withholds tax at the source).

Status of relationships

The correct marital status as well as withholding form will simplify your work and that of your spouse. In addition, the amount of money you can put at the bank can delight you. Knowing which of the several possibilities you’re likely decide is the biggest challenge. Certain, there are things you should avoid doing. It’s costly to make a wrong decision. If you stick to the guidelines and adhere to them, there won’t be any issues. If you’re fortunate you may even meet some new friends on your travels. Today is the anniversary. I hope you are able to use this against them to obtain that wedding ring you’ve been looking for. If you want to do this properly, you’ll require advice of a qualified Tax Expert. This small payment is well worth the lifetime of wealth. There are tons of online resources that can provide you with information. TaxSlayer is a trusted tax preparation company.

The amount of withholding allowances that were made

On the W-4 form you submit, you must specify the amount of withholding allowances you seeking. This is crucial because your pay will depend on the tax amount that you pay.

You could be eligible to request an exemption for your spouse when you’re married. Your income also determines how many allowances you are entitled to. You can apply for an increase in allowances if you have a large amount of income.

A tax deduction that is appropriate for your situation could aid you in avoiding large tax bills. In addition, you could even get a refund if the annual tax return is completed. Be sure to select your approach carefully.

Like any financial decision, you should conduct your homework. Calculators can help determine the amount of withholding that should be requested. Alternative options include speaking with an expert.

Specifications for filing

Employers should report the employer who withholds taxes from employees. For certain taxes you can submit paperwork to IRS. There may be additional documentation such as an withholding tax reconciliation or a quarterly return. Below are information on the different tax forms that you can use for withholding as well as the deadlines for each.

To be eligible to receive reimbursement for tax withholding on compensation, bonuses, salary or other revenue earned by your employees, you may need to submit a tax return withholding. If employees are paid in time, you could be eligible for tax refunds for withheld taxes. The fact that certain taxes are also county taxes ought to also be noted. In some situations there are rules regarding withholding that can be unique.

According to IRS rules, you are required to electronically submit forms for withholding. When you submit your national tax return make sure you provide your Federal Employer Identification number. If you don’t, you risk facing consequences.

Gallery of Al Employee Withholding Form

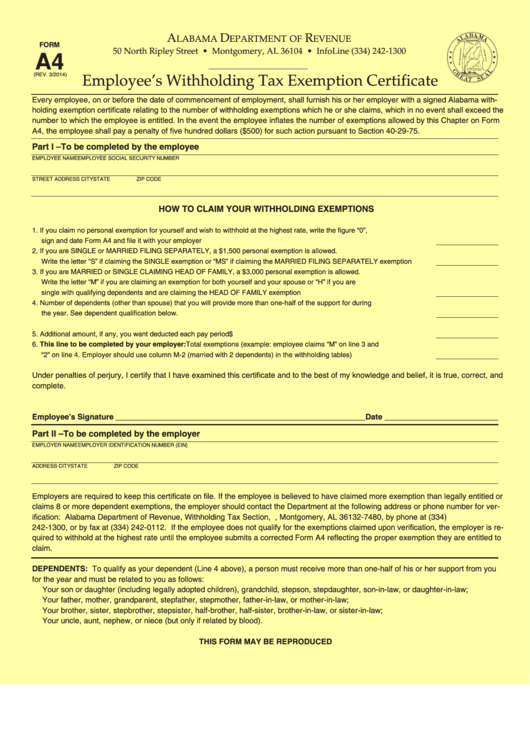

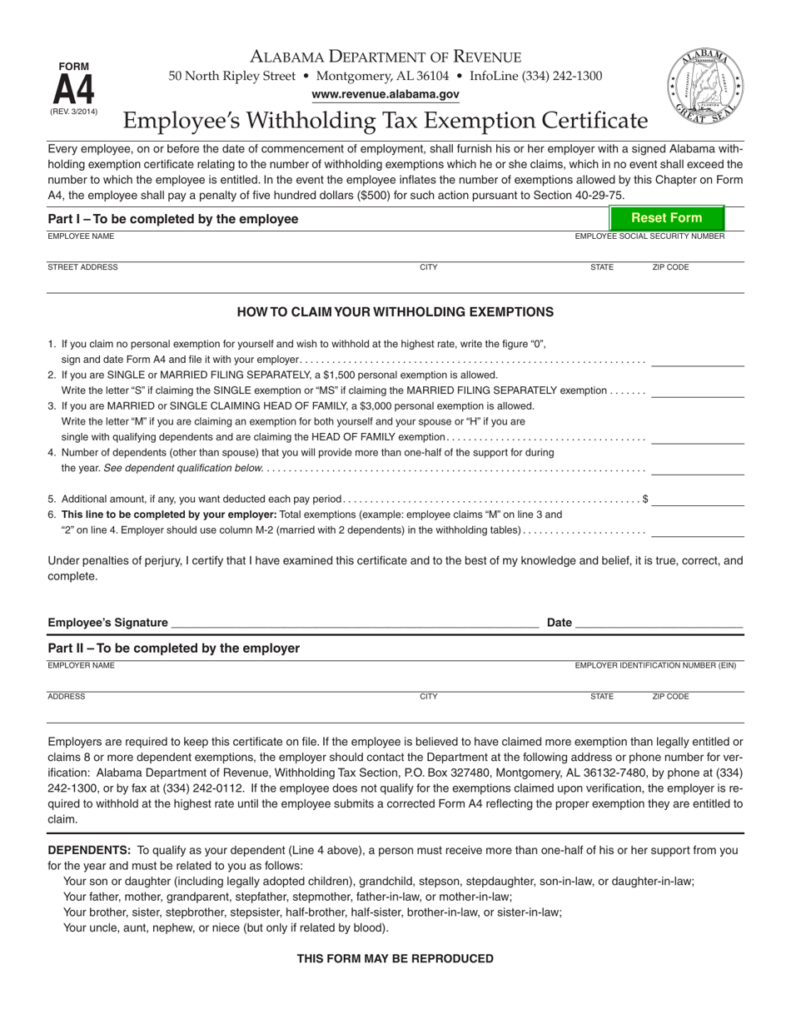

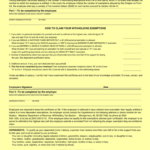

Fillable Form A4 Alabama Employee S Withholding Tax Exemption