A4 Withholding Form 2024 – There are a variety of reasons why an individual could submit a form for withholding. These factors include the documents required, the exclusion of withholding, and the requested withholding allowances. No matter the reason for a person to file an application it is important to remember certain points to keep in mind.

Exemptions from withholding

Nonresident aliens are required to submit Form 1040-NR at least once per year. You could be eligible to file an exemption form for withholding tax in the event that you meet all requirements. There are exemptions accessible to you on this page.

The application of Form 1042-S to Form 1042-S is a first step to submit Form 1040-NR. This form is used to record federal income tax. It provides the details of the amount of withholding that is imposed by the tax withholding agent. Make sure that you fill in the correct information when you complete the form. It is possible for a person to be treated if the correct information is not provided.

The withholding rate for nonresident aliens is 30%. Your tax burden is not to exceed 30% to be eligible for exemption from withholding. There are a variety of exemptions offered. Some of them are intended to be used by spouses, while some are intended for use by dependents, such as children.

In general, chapter 4 withholding entitles you to the possibility of a refund. Refunds are granted according to Sections 1471-1474. Refunds are given by the tax agent. The withholding agent is the individual accountable for tax withholding at the point of origin.

Status of the relationship

The marital withholding form is a good way to simplify your life and aid your spouse. You’ll be amazed at the amount you can deposit to the bank. It can be difficult to choose which one of the options you will choose. There are certain actions you shouldn’t do. There are a lot of costs in the event of a poor choice. If you stick to it and pay attention to directions, you shouldn’t run into any problems. If you’re fortunate, you might even make some new friends on your travels. Today is the anniversary. I’m hoping that you can leverage it to secure that dream wedding ring. It’s a difficult task that requires the expertise of a tax professional. It’s worthwhile to create wealth over the course of your life. There are tons of online resources that provide information. TaxSlayer is a trusted tax preparation company.

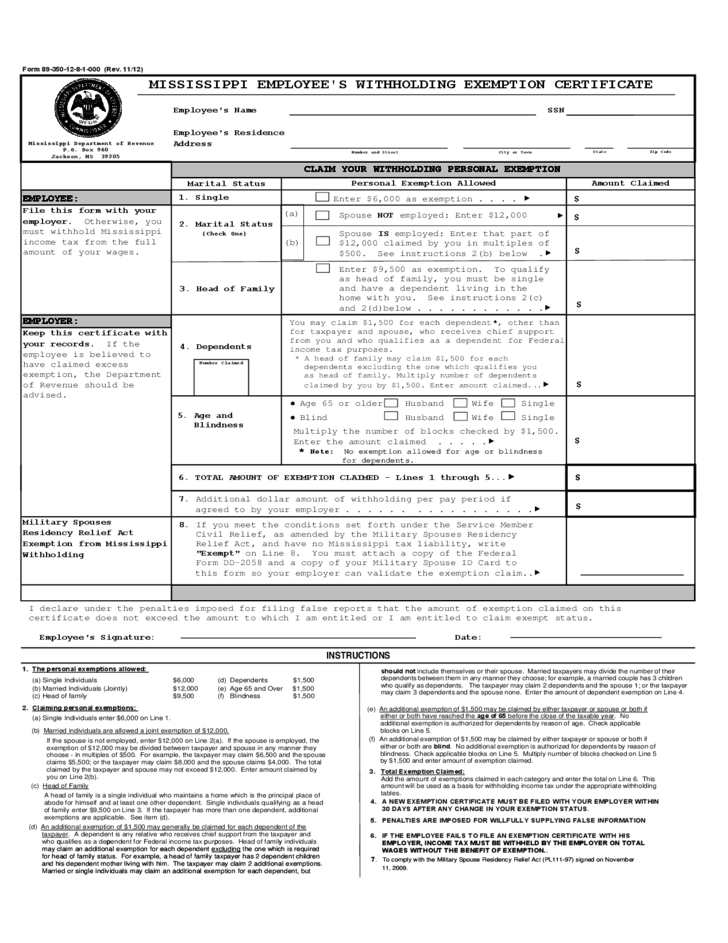

The amount of withholding allowances claimed

It is essential to state the amount of withholding allowances you would like to claim on the W-4 form. This is important as it will impact how much tax you receive from your paychecks.

There are a variety of factors that affect the amount of allowances requested.If you’re married, for instance, you could be eligible to claim an exemption for the head of household. Your income level can also affect the number of allowances accessible to you. An additional allowance could be granted if you make an excessive amount.

A tax deduction suitable for you can aid you in avoiding large tax payments. If you file your annual income tax returns, you may even be entitled to a refund. However, you must choose your strategy carefully.

It is essential to do your homework the same way you would for any financial option. Calculators are useful for determining the amount of withholding allowances that must be claimed. A better option is to consult to a professional.

Submitting specifications

Withholding taxes from employees need to be collected and reported if you are an employer. For certain taxes, you may submit paperwork to IRS. A reconciliation of withholding tax and the quarterly tax return as well as the annual tax return are all examples of additional paperwork you might need to submit. Here is more information on the various forms of withholding taxes and the deadlines to file them.

It is possible that you will need to file tax returns for withholding in order to report the income you get from employees, such as bonuses and commissions or salaries. You could also be eligible to receive reimbursement of taxes withheld if you’re employees received their wages in time. It is crucial to remember that there are a variety of taxes that are local taxes. In certain circumstances there are rules regarding withholding that can be unique.

According to IRS regulations Electronic submissions of withholding forms are required. You must include your Federal Employer ID Number when you file at your income tax return from the national tax system. If you don’t, you risk facing consequences.