Rhode Island Withholding Tax Form – There are many reasons why someone might choose to fill out a form for withholding. These factors include documentation requirements including withholding exemptions and the amount of withholding allowances. No matter what the reason is for a person to file an application, there are certain things you must keep in mind.

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR every year. If you satisfy the requirements, you may be eligible for an exemption to withholding. The exemptions you will find here are yours.

The first step for submit Form 1040 – NR is attaching Form 1042 S. For federal income tax reporting reasons, this form details the withholdings made by the withholding agency. It is crucial to enter the correct information when filling out the form. It is possible for a person to be treated differently if the correct information is not provided.

The 30% non-resident alien tax withholding tax rate is 30. You could be eligible to receive an exemption from withholding if the tax burden is higher than 30%. There are several different exclusions that are available. Some are specifically designed for spouses, whereas others are intended for use by dependents such as children.

In general, chapter 4 withholding entitles you to the possibility of a refund. Refunds can be made according to Sections 1400 through 1474. The agent who withholds the tax, or the individual who withholds the tax at source, is responsible for the refunds.

Relational status

You and your spouse’s work can be made easier by a proper marriage status withholding form. Additionally, the quantity of money that you can deposit in the bank will pleasantly surprise you. The problem is choosing the right option out of the many possibilities. There are certain things you should avoid. Making the wrong decision will result in a significant cost. If you stick to the directions and keep your eyes open for any pitfalls, you won’t have problems. If you’re lucky, you might even make new acquaintances while traveling. Today marks the anniversary of your wedding. I’m sure you’ll be capable of using this to get the elusive wedding ring. To do it right, you will need the assistance of a certified accountant. This tiny amount is worth the time and money. It is a good thing that you can access a ton of information online. TaxSlayer is a trusted tax preparation company is one of the most effective.

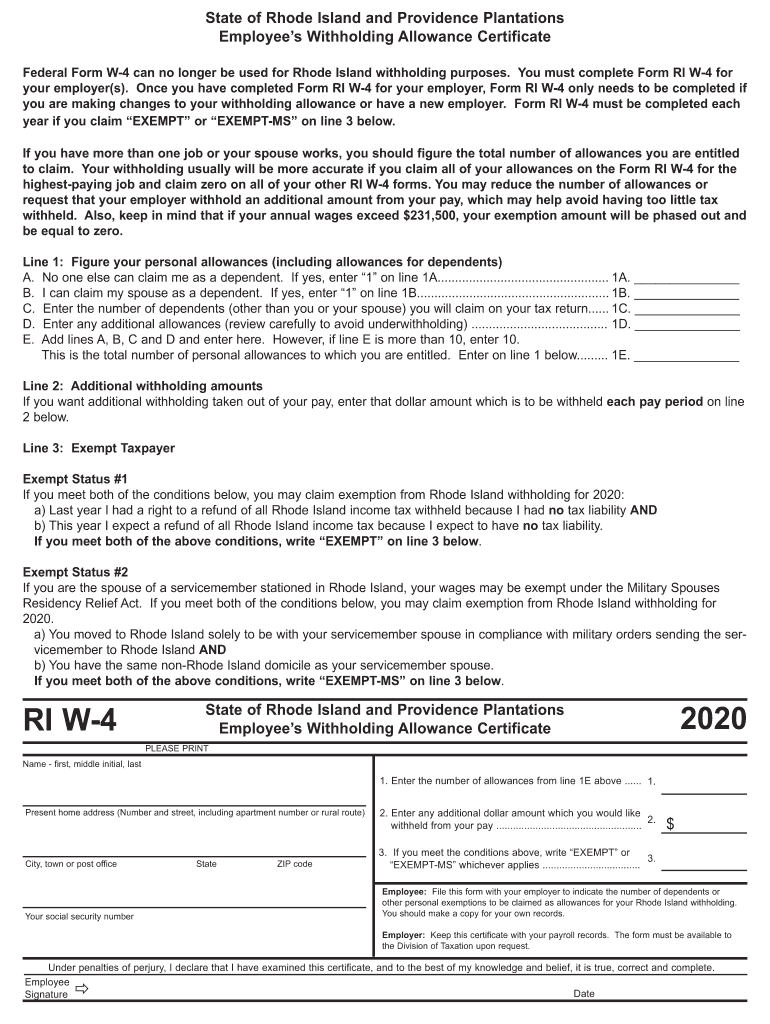

Amount of withholding allowances claimed

In submitting Form W-4 you should specify the number of withholding allowances you want to claim. This is important since it will affect the amount of tax you get from your pay checks.

The amount of allowances you receive will depend on the various aspects. For instance when you’re married, you might be eligible for an exemption for your household or head. The amount you earn will affect the amount of allowances you can receive. If you earn a higher income, you could be eligible to request an increase in your allowance.

You might be able to save money on a tax bill by deciding on the appropriate amount of tax deductions. Additionally, you may even get a refund if your annual income tax return has been completed. Be cautious regarding how you go about this.

Conduct your own research, just as you would in any other financial decision. Calculators are readily available to help you determine how much withholding allowances are required to be claimed. A professional may be an alternative.

Submission of specifications

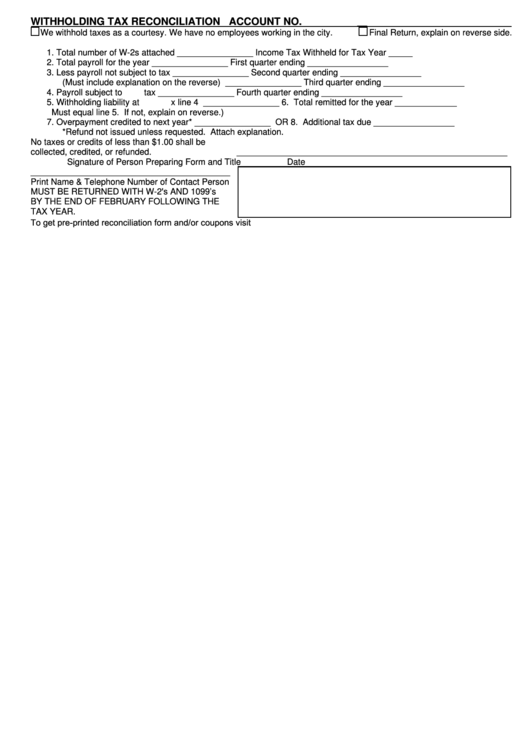

Withholding taxes from employees need to be collected and reported in the event that you’re an employer. The IRS may accept forms for certain taxes. A tax reconciliation for withholding and the quarterly tax return or the annual tax return are some examples of additional documents you could need to submit. Here are some details regarding the various forms of tax withholding forms and the deadlines for filing.

The bonuses, salary commissions, other income you get from your employees may require you to submit withholding tax returns. Additionally, if your employees receive their wages punctually, you might be eligible for reimbursement of withheld taxes. Be aware that these taxes can be considered as taxation by the county. In some situations, withholding rules can also be unique.

According to IRS regulations, you are required to electronically submit forms for withholding. When you file your national revenue tax returns, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.