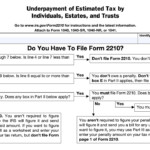

Form 2210: Line D Withholding – There are numerous reasons that a person may decide to submit a withholding application. This is due to the requirement for documentation, exemptions to withholding and also the amount of the required withholding allowances. However, if one chooses to submit an application it is important to remember a few aspects to consider.

Exemptions from withholding

Non-resident aliens must submit Form 1040NR once each year. If you fulfill the requirements, you might be eligible for an exemption from withholding form. This page will provide all exemptions.

The application of Form 1042-S to Form 1042-S is a first step to submit Form 1040-NR. The form is used to declare the federal income tax. It provides the details of the withholding of the withholding agent. Fill out the form correctly. This information may not be provided and could result in one individual being treated.

The 30% tax withholding rate for non-resident aliens is 30 percent. If your tax burden is less than 30 percent of your withholding, you may qualify for an exemption from withholding. There are numerous exemptions. Some are only for spouses or dependents like children.

You can claim a refund if you violate the terms of chapter 4. Refunds may be granted under Sections 1400 to 1474. The person who is the withholding agent or the individual who collects the tax at source is responsible for making these refunds.

Relationship status

A form for a marital withholding is an excellent way to make your life easier and help your spouse. The bank might be shocked by the amount that you deposit. It can be difficult to determine which one of the many options is the most appealing. There are some things you should avoid doing. It will be costly to make a wrong decision. If you stick to it and follow the directions, you shouldn’t encounter any issues. It is possible to make new friends if you are lucky. Today is the anniversary of your marriage. I hope you will take advantage of it to locate that perfect engagement ring. You’ll want the assistance of a certified tax expert to finish it properly. The accumulation of wealth over time is more than that tiny amount. There are a myriad of online resources that can provide you with information. Reputable tax preparation firms like TaxSlayer are among the most helpful.

There are a lot of withholding allowances that are being requested

In submitting Form W-4 you must specify how many withholding allowances you wish to claim. This is essential because the amount of tax withdrawn from your paycheck will be affected by the much you withhold.

You could be eligible to claim an exemption for the head of your household in the event that you are married. Your income also determines the amount of allowances you’re entitled to. If you have a higher income it could be possible to receive higher amounts.

You could save lots of money by determining the right amount of tax deductions. It is possible to receive an income tax refund when you file your annual income tax return. But, you should be careful about how you approach the tax return.

As with any financial decision, you must do your research. Calculators can be used for determining how many withholding allowances are required to be requested. A better option is to consult to a professional.

Formulating specifications

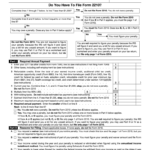

Employers must collect withholding taxes from their employees and then report the tax. The IRS may accept forms to pay certain taxes. You may also need additional forms that you could require for example, the quarterly tax return or withholding reconciliation. Here’s some information about the various withholding tax form categories and the deadlines for filing them.

The salary, bonuses, commissions, and other income that you receive from employees might require you to file tax returns withholding. In addition, if you paid your employees on time, you could be eligible to receive reimbursement for taxes that you withheld. Remember that these taxes can be considered as local taxes. Furthermore, there are special withholding practices that can be implemented in specific situations.

The IRS regulations require you to electronically submit your withholding documentation. Your Federal Employer Identification Number must be listed when you submit to your national tax return. If you don’t, you risk facing consequences.