Maine State Tax Withholding Form 2024 – There are a variety of reasons why a person could choose to submit a withholding application. These factors include the document requirements, exclusions from withholding as well as the withholding allowances. Whatever the reason one chooses to submit the form there are some things to keep in mind.

Exemptions from withholding

Non-resident aliens must submit Form 1040 NR once every year. If the requirements are met, you could be eligible to apply for an exemption from withholding. This page lists all exemptions.

To complete Form 1040-NR, include Form 1042-S. This form lists the amount withheld by the tax withholding authorities for federal tax reporting to be used for reporting purposes. When filling out the form make sure you fill in the exact information. If the information you provide is not supplied, one person may be taken into custody.

The non-resident alien withholding tax is 30 percent. Nonresident aliens could be eligible for an exemption. This happens the case if your tax burden lower than 30%. There are many different exemptions. Certain are only for spouses and dependents, like children.

Generally, you are eligible to receive a refund under chapter 4. In accordance with Section 1471 through 1474, refunds are given. The agent who withholds the tax, or the person who withholds the tax at source is the one responsible for distributing these refunds.

Status of relationships

The proper marital status and withholding forms will ease the job of both you and your spouse. You’ll be amazed by the amount that you can deposit at the bank. It is difficult to decide which of the many options you’ll pick. Certain aspects should be avoided. False decisions can lead to expensive results. However, if the instructions are adhered to and you are attentive, you should not have any problems. If you’re fortunate, you might even make acquaintances while traveling. Today is the anniversary of your wedding. I’m hoping you’re in a position to leverage this against them to obtain that elusive wedding ring. For a successful approach you’ll require the aid of a qualified accountant. It’s worthwhile to create wealth over the course of your life. You can get a lot of information on the internet. Trustworthy tax preparation companies like TaxSlayer are among the most helpful.

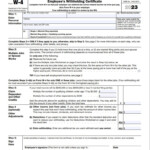

Number of withholding allowances claimed

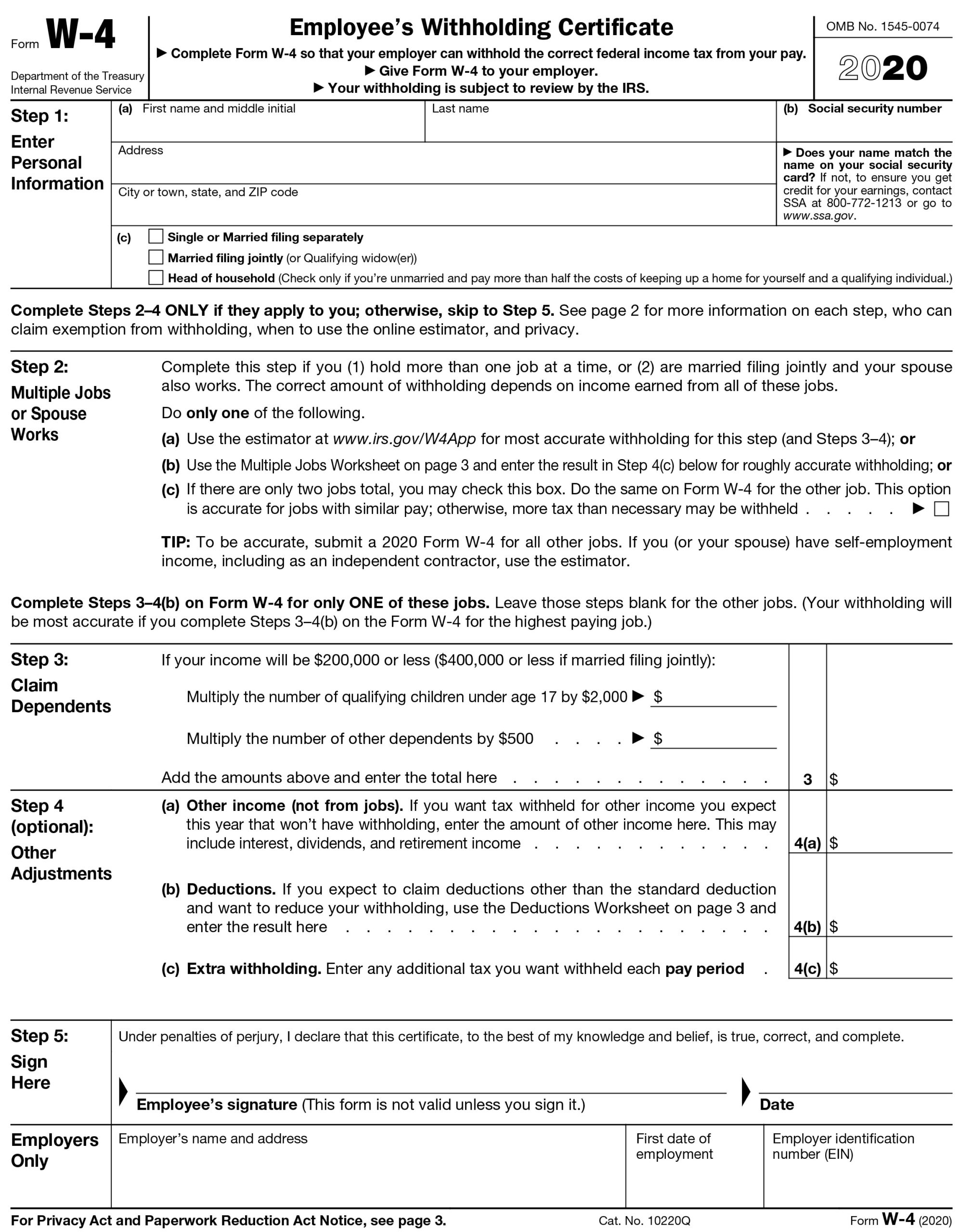

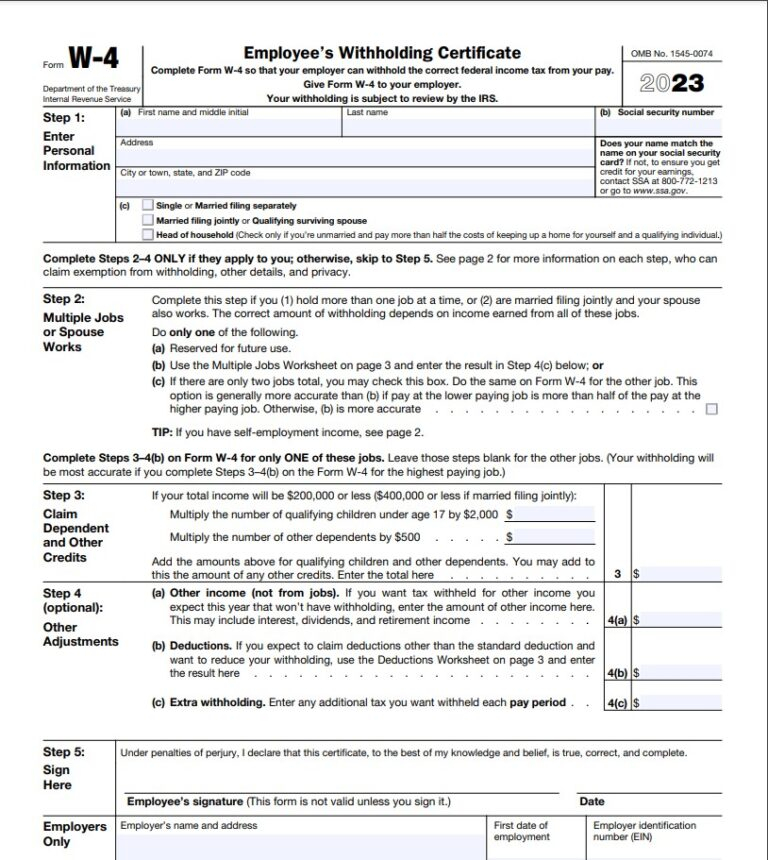

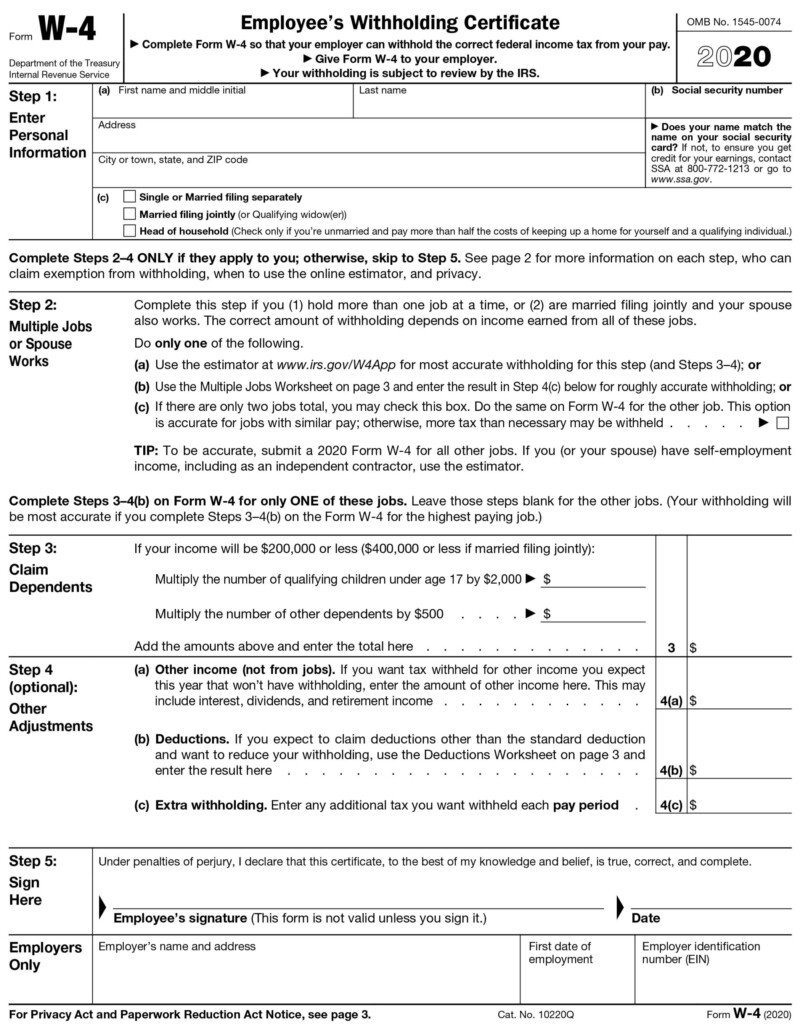

The W-4 form must be filled out with the number of withholding allowances you want to take advantage of. This is crucial since the withholdings will effect on the amount of tax that is taken out of your pay checks.

The amount of allowances you get will be contingent on the various aspects. For instance If you’re married, you might be qualified for an exemption for the head of household or for the household. Your income can affect the number of allowances offered to you. If you have a higher income, you might be eligible to receive a higher allowance.

Making the right choice of tax deductions can allow you to avoid a significant tax bill. A refund could be possible if you submit your tax return on income for the current year. However, you must be cautious about your approach.

Like any financial decision, you should do your research. Calculators can help you determine how much withholding allowances are required to be claimed. You can also speak to a specialist.

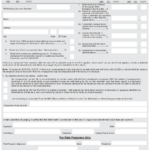

Specifications that must be filed

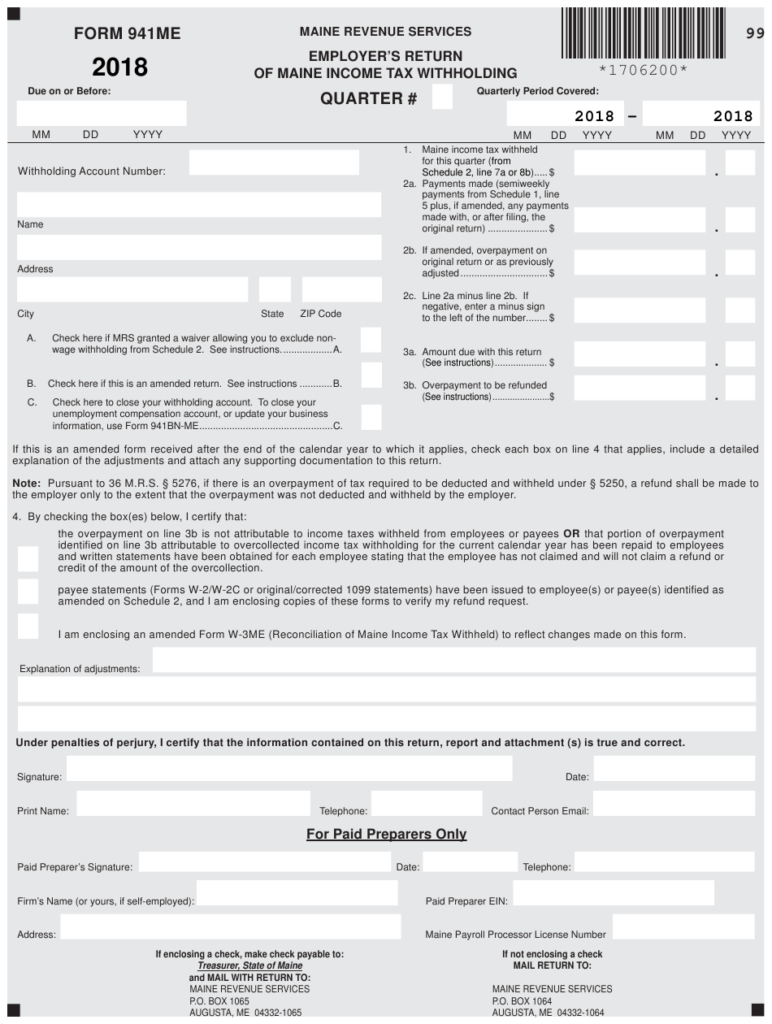

Withholding tax from your employees must be collected and reported if you’re an employer. The IRS may accept forms for certain taxes. Other documents you might be required to file include the reconciliation of your withholding tax, quarterly tax returns, as well as an annual tax return. Here’s some details on the different tax forms for withholding categories, as well as the deadlines to the submission of these forms.

To be qualified for reimbursement of withholding tax on the salary, bonus, commissions or other revenue earned by your employees it is possible to submit withholding tax return. You could also be eligible to be reimbursed of taxes withheld if you’re employees were paid promptly. Be aware that certain taxes may be taxation by county is important. Additionally, you can find specific withholding procedures that can be applied in particular circumstances.

In accordance with IRS regulations, you must electronically file withholding forms. You must provide your Federal Employer ID Number when you submit at your income tax return from the national tax system. If you don’t, you risk facing consequences.